The inventory and crypto market seem to haven’t but gained over buyers, regardless of a bullish pivot seen in January 2023 after final 12 months’s devastating sell-off that worn out trillions of {dollars} in worth.

That is in keeping with a word from Financial institution of America, which highlighted the truth that cash held in money market funds has reached a record high of $4.8 trillion as rates of interest stay at multi-year highs. Most cash market funds are yielding about 4%.

Ready On the Sidelines

Buyers are cautious relating to shares, as evidenced by year-to-date fund flows, which have been robust for fastened revenue and rising market equities however weak for US shares. Funding grade and high-yield debt have seen the strongest inflows since September 2021, averaging $7.7 billion over the previous month. In the meantime, rising market debt and fairness has seen its strongest inflows since March 2021, with $7.1 billion over the previous month.

It seems that buyers are additionally pulling cash out of US know-how and healthcare shares. Financial institution of America has known as this development “capitulation.” The outflow development from these two sectors over the previous month is the worst since January of 2019.

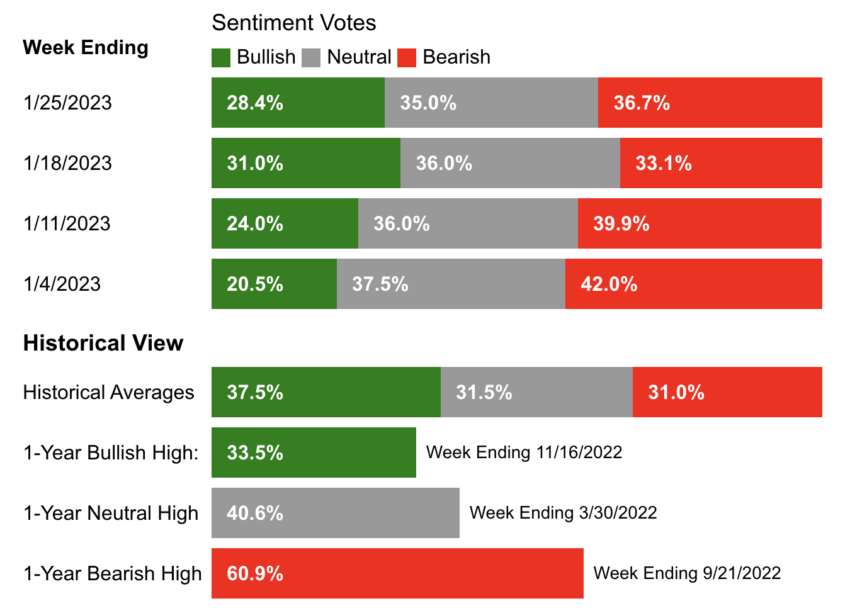

The weekly AAII Investor Sentiment Survey additionally signifies that buyers are bearish in the direction of shares. Certainly, bearish respondents outweighed bullish respondents by 36.7% to twenty-eight.4%.

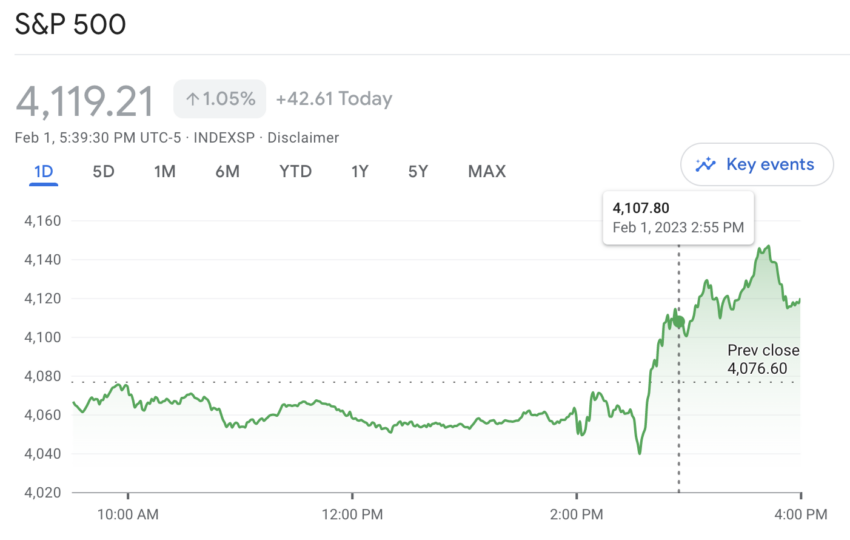

Nonetheless, Financial institution of America’s Michael Hartnett sees a superb purpose for this bearishness. Whereas he admits that the “ache commerce” for the inventory market stays greater, he recommends buyers pull again from the S&P 500 as soon as it reaches the $4,100 to $4,200 vary.

Apparently, the S&P 500 hit a excessive of $4,150 on Wednesday, Feb. 1, following a statement from Federal Reserve Chair Jerome Powell, hinting that the disinflationary development within the financial system has commenced.

Hartnett anticipates {that a} laborious touchdown will happen in 2023 and one other tightening of economic circumstances this spring could also be required to tip the US financial system, which is at present rising at over 7% in nominal phrases, right into a recession.

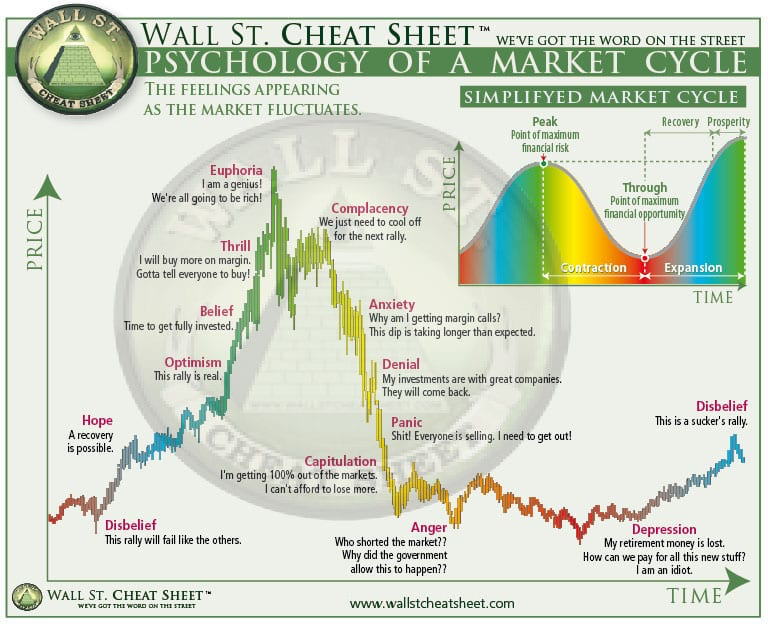

Crypto Buyers In Disbelief

The disbelief stage within the psychology of a market cycle refers to a interval during which buyers are skeptical of the market’s upward trend and stay cautious, even because the market continues to point out optimistic positive factors. This will occur after a interval of great market volatility or a bear market, throughout which buyers might have suffered vital losses.

Throughout this stage, buyers could also be cautious of leaping again into the market and as a substitute favor to stay on the sidelines, holding onto their money or investing in much less dangerous belongings. They might additionally watch for additional affirmation of the market’s upward development earlier than making funding selections.

This stage is usually characterised by a scarcity of market members and low buying and selling volumes, as many buyers stay skeptical of the market’s path and are hesitant to speculate. This will additionally end in a scarcity of momentum out there, as there will not be sufficient shopping for strain to drive costs greater.

Nonetheless, because the market continues to point out optimistic positive factors, investor confidence may gradually return, and extra members might start to enter the market. This may help to extend market momentum and drive costs greater, as buyers grow to be extra comfy with the market’s path and are extra prepared to speculate.

If a part of the money held in cash market funds have been to circulation into the crypto market, it might have a big impression. Though Bitcoin has loved a formidable upward value motion, posting year-to-date positive factors of greater than 45%, the potential inflow of money might drive up demand, leading to potentially higher prices.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned within the story to get an official assertion in regards to the latest developments, but it surely has but to listen to again.