Practically 20 altcoins have doubled in 2023 … can Bitcoin break long-term resistance? … elementary bullish tailwinds … the Fed may wreck all the pieces tomorrow

Up to now in 2023, 9 of the highest 100 cryptocurrencies have doubled in worth.

If we broaden our evaluation to the highest 200 cryptos, almost 20 have doubled.

Final week alone, Bitcoin popped 9%… Cardano climbed 10%… Polygon tacked on 20%… and two smaller altcoins, Threshold and Aptos, soared greater than 100%.

Once more, that’s all from simply final week.

Pulling again, it’s Tuesday, so in line with current custom, let’s test in on the crypto sector with the assistance of our knowledgeable Luke Lango.

From Luke’s Crypto Investor Community weekend replace:

…It’s not even the tip of January and already, about 15% of the highest 200 cryptos have risen greater than 100% this 12 months.

Does that sound like a brand new increase cycle to you?

It actually does to us…

Whereas our “Growth Cycle 2023” prediction for cryptos might have appeared outlandish and misplaced a month in the past, it’s now beginning to appear to be a consensus perception.

As Bitcoin goes, so goes the sector

For newer Digest readers, Luke is our hypergrowth funding knowledgeable, and few sectors supply larger potential for hypergrowth than cryptocurrencies.

Earlier than the 2022 bear market, altcoins had been some most profitable investments of the prior 5 years – some rising, actually, 1000’s of %.

Luke’s Crypto Investor Network publication focuses on these cutting-edge altcoins, however Bitcoin stays the barometer of the crypto sector. Basically, its development units the momentum course for the broader altcoin world.

So, to get a way for the place the sector is heading, our evaluation should start with Bitcoin.

On that notice, let’s return to Luke:

At this level, just about each technical purchase sign has been triggered.

Maybe most potently, Bitcoin has crossed above its 30-week shifting common (MA) for the primary time on this bear market cycle.

Each time BTC has crossed above its 30-week MA, BTC proceeded to soar by at the very least 100% over the following few months.

Supply: Bloomberg

Now, although “100% features” may be in Bitcoin’s future, how the crypto handles a key upcoming resistance degree will affect how rapidly it will get there.

Bitcoin stands on the cusp of the $24,000 to $24,500 degree, which is a crucial technical vary

Common Digest readers will acknowledge it from final Wednesday’s Digest. That’s once we analyzed Bitcoin by way of a “Stage Evaluation” lens (you’ll be able to read that issue here).

In brief, it seems that Bitcoin needs to interrupt out of its Stage-1 sideways consolidation stage into its Stage-2 development stage.

Nevertheless, for that to occur, the crypto must push north by way of its Stage-1 resistance line with heavy quantity.

As you’ll be able to see beneath, that degree is roughly $24,000 to $24,500 (ballpark 4%-5% greater than Bitcoin’s worth as I write Tuesday morning).

Supply: StockCharts.com

Luke believes the macro fundamentals assist a breakout

Again to his Crypto Investor Community replace:

The elemental drivers of this rally look very strong, too.

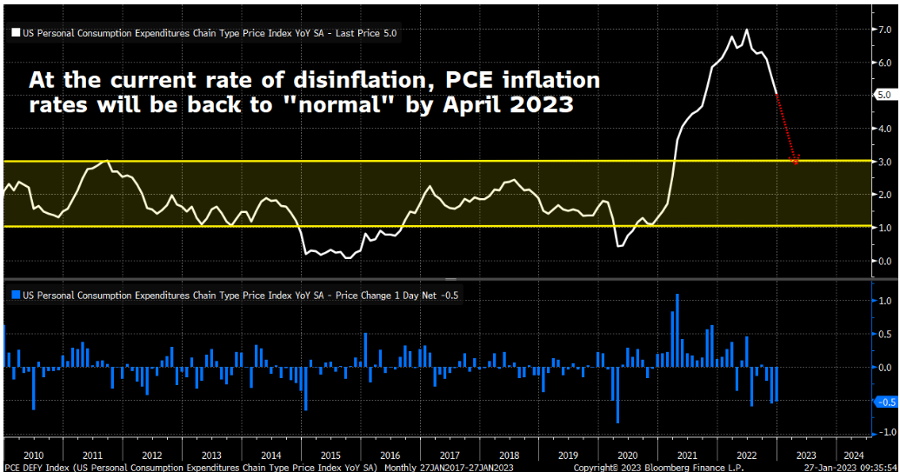

On the macro entrance, we acquired extra information [last] week that inflation is falling aside, with PCE and core PCE inflation cooling off quickly in December. These inflation charges are on monitor to get again to “regular” ranges by the spring.

Additionally on the inflation entrance, short-term client inflation expectations dropped once more in January, whereas pure gasoline costs plunged beneath $3 this week.

Inflation is collapsing.

Supply: Bloomberg

In the meantime, the financial system seems to be positioned to avert a recession.

Mastercard (MA) and Visa (V) reported earnings [last] week. Each cost card giants stated that client spending was impressively resilient within the final three months of 2022 and is selecting up steam right here in January.

The patron is 70% of the financial system. In the event that they’re nonetheless chugging alongside, the financial system will, too.

Maybe most essential of all, Luke factors towards the S&P’s technical breakout.

As we famous in yesterday’s Digest, the S&P has lastly damaged above its long-term down-sloping trendline. This didn’t occur as soon as in 2022.

Again to Luke for why that is so bullish for crypto:

This seems to be like a traditional technical breakout from a bear market. And that’s bullish for cryptos as a result of shares and cryptos have not too long ago developed a strongly optimistic correlation.

The one huge overhang that is still

With Bitcoin and the broader altcoin sector surging in 2023, mixed with a elementary image that’s firming up, why hasn’t Luke beneficial new altcoin investments?

As a result of there’s one very giant elephant within the room that holds the facility to make or break this budding rally…

The Fed.

Tomorrow, the Fed pronounces its newest coverage choice, and we hear from Chairman Jerome Powell.

It’s widely-expected that the Fed will elevate charges solely 25 foundation factors, however what’s unclear is Powell’s tone and forward-looking feedback in his press convention.

And given the potential for curveballs, Luke needs to sit down this one out – for now.

Again to his replace:

We don’t wish to front-run this occasion within the crypto world.

Powell will both gentle a fireplace beneath the crypto markets by saying the Fed’s job is sort of performed, or he’ll trigger an enormous crash by saying the Fed must preserve mountain climbing for lots longer.

We wish to situation new Buy Alerts after that occasion.

Why?

As a result of whereas we can’t predict what Powell will say, we are able to predict with affordable confidence that inflation is cooling quick sufficient to permit the Fed to pause its rate-hike marketing campaign by the summer season, on the newest, no matter what Powell says on Wednesday.

Due to this fact, if Powell lights a fireplace beneath threat belongings on Wednesday, we’ll be part of the rally as a result of it would final for some time longer.

If Powell causes a crash, we’ll buy the dip as a result of we’re assured cryptos will rebound.

Both method, it merely makes essentially the most sense to us to attend for Powell to do no matter he’s going to do subsequent Wednesday, after which both be part of the rally or purchase the dip.

Whereas we don’t understand how tomorrow will play out with the Fed, let’s finish with a couple of extra causes for crypto optimism

The on-chain analytics platform CryptoQuant publishes a “Revenue and Loss (PnL) Index.”

The index makes an attempt to normalize cycle high and backside indicators utilizing mixed information from three different on-chain metrics. When it’s worth climbs above its one-year shifting common, that triggers a long-term “purchase” sign.

And that simply occurred.

The PnL Index simply issued a “definitive purchase sign” for Bitcoin. Notably, that is the primary such sign since early 2019.

But it surely’s not the one bullish indicator that’s triggering at this time.

Right here’s one other from Coin Telegraph:

CryptoQuant will not be alone in eyeing uncommon recoveries in on-chain information, a few of which had been absent all through Bitcoin’s journey to all-time highs following the March 2020 COVID-19 market crash.

Amongst them is Bitcoin’s relative energy index (RSI), which has now bounced from its lowest ranges ever.

PlanB, the creator of the stock-to-flow household of Bitcoin worth forecasting fashions, famous that the final rebound from macro lows in RSI occurred on the finish of Bitcoin’s earlier bear market in early 2019.

Backside line: Inexperienced shoots are popping up within the crypto world at this time, however the Fed holds the facility to mow them down tomorrow.

Alternatively, if Powell sounds extra dovish than anticipated, maintain onto your hats – crypto might be off to the races.

We’ll preserve you up to date.

Have an excellent night,

Jeff Remsburg