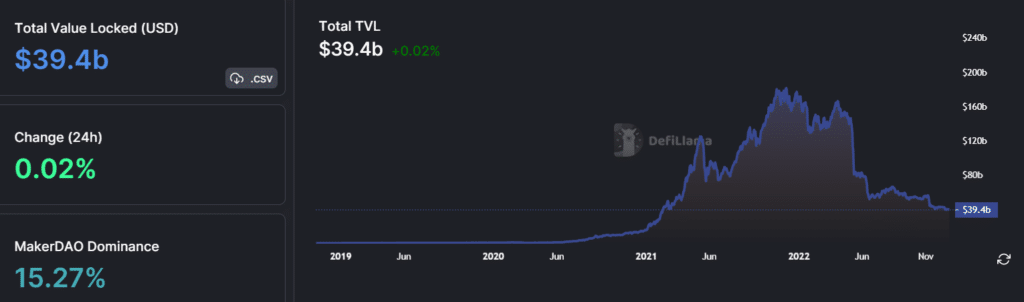

In response to information supplied by DeFi Llama, the whole worth locked (TVL) in decentralized finance (DeFi) protocols has plunged together with the chilly crypto winter. Your entire DeFi TVL has dropped by 78.1% since December 2021 — from an all-time excessive (ATH) of $181.2 billion to roughly $39.4 billion on the time of writing.

Fairly equally, Binance Smart Chain’s (BSC) TVL has considerably dropped, reaching 19-month lows. On the time of writing, BSC’s complete worth is locked round $4.08 billion, down by 0.14% previously 24 hours, per the tracker’s information.

As the information signifies, the whole worth locked on BSC dropped by practically 81.3% since Could 2021 — from an ATH of $21.85 billion to as little as $4.7 billion. The final time BSC noticed the $4.09 billion mark was March 27, 2021.

The biggest shareholder of BSC’s TVL is the favored decentralized alternate (DEX), PancakeSwap, with a share of over 53% — value $2.16 billion, down by 14.3% previously 30 days and accessible on Ethereum and Aptos as properly.

Moreover, the most important shareholder of the DeFi TVL is MakerDAO (decentralized autonomous group) — the creator of the decentralized stablecoin on the Ethereum (ETH) blockchain, DAI.

MakerDAO has 15.27% dominance of the entire DeFi ecosystem — with a TVL of $6.02 billion, down by 9.3% previously 30 days — and is obtainable on the ETH blockchain solely, in line with information supplied by DeFi Llama.

In response to a Chainalysis report final week, the buying and selling quantity within the DeFi ecosystem spiked with FTX’s collapse final month.

The examine added that buyers are shifting to non-custodial wallets as an alternative of centralized exchanges or custodial crypto wallets.