On-chain knowledge exhibits the Bitcoin Interexchange Stream Pulse is about to see a development reversal, right here’s what it might imply for the crypto’s value.

Bitcoin Interexchange Stream Pulse Is Crossing Over Its 90-Day MA

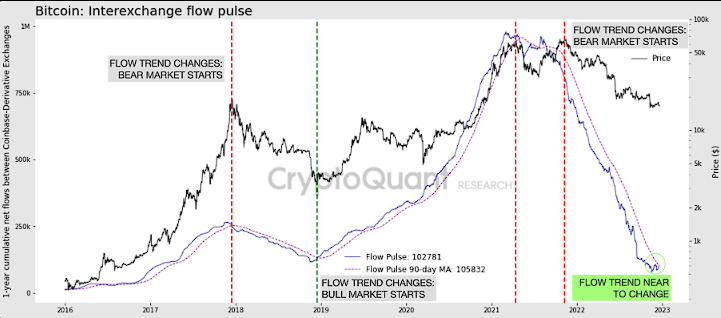

As per CryptoQuant’s on-chain year-end dashboard launch, the development shifts on this metric have traditionally occurred with section adjustments available in the market. The “Interexchange Stream Pulse” is an indicator that measures the 1-year cumulative internet flows between Coinbase and derivative exchanges.

When the worth of this metric rises, it means buyers are transferring extra cash from spot to by-product exchanges proper now, and are therefore keen to take up extra danger. Then again, low values counsel not a lot capital is flowing into the by-product exchanges for the time being.

Now, here’s a chart that exhibits the development within the Bitcoin Interexchange Stream Pulse, in addition to its 90-day shifting common (MA), over the previous few years:

Seems like the worth of the metric could also be starting to show round | Supply: CryptoQuant

As you may see within the above graph, a sample appears to have traditionally adopted with the Bitcoin Interexchange Stream Pulse throughout bull-bear traits within the value of the crypto. Every time the coin has noticed a bullish interval, the indicator has seen a relentless climb and has stayed above its 90-day MA.

The rationale behind that is that buyers are usually keen to take extra danger throughout bull markets, and therefore ship more and more giant quantities to by-product exchanges for establishing leverage positions.

Nonetheless, every time the metric has reversed its route and crossed under the 90-day MA, a prime formation has taken place within the value of BTC, and the bullish development has ended. Within the bear markets which have adopted such intervals, the Interexchange Stream Pulse has often continued to go down and has remained under its 3-month common. As soon as once more, why this occurs is straightforward; bear markets are when the typical holder is unwilling to take any dangers, and therefore capital move into derivatives dries up.

This development within the indicator continues till the turning level as soon as once more takes place, the place the value kinds its backside and the metric begins shifting again up the other means (crossing above its 90-day MA within the course of).

Within the present bear market as nicely, the Bitcoin Interexchange Stream Pulse has persistently moved down whereas staying below its 90-day MA. Most lately, nevertheless, the decline appears to have stopped, and now the indicator is retesting its long-term common.

If the historic sample is something to go by, a profitable crossover and reversal within the Interexchange Stream Pulse’s trajectory right here would imply the bear bottom is in for the present cycle, and a sluggish transition in the direction of a bull market might comply with.

BTC Value

On the time of writing, Bitcoin’s value floats round $16,600, down 1% within the final week.

The worth of the crypto appears to have declined over the past couple of days | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, CryptoQuant.com