Share

Bitcoin (BTC) is at present caught in a bearish storm that began in the beginning of this month. Following 4 months of constant beneficial properties this yr, bitcoin started Might on a bearish word. Nevertheless, key historic knowledge suggests the asset is likely to be on the verge of a bull run in the long run.

Philip Swift, the founding father of BTC knowledge useful resource LookIntoBitcoin, and habits analytics platform Santiment, lately highlighted this looming bull run. Each entities cited historic knowledge from vital indicators, together with however not restricted to the BTC RHODL Ratio Indicator and the provision of BTC on exchanges.

The BTC RHODL Ratio

Swift created the RHODL Ratio to investigate bitcoin’s worth primarily based on investor habits. The indicator appears at lately moved cash and compares them to cash that haven’t been moved for some time (between one and two years). This helps market watchers decide if traders are into BTC for fast earnings or holding onto it for the long run.

The RHODL Ratio is heading to the upside, which implies extra market individuals are utilizing BTC for short-term earnings. The indicator started its upswing in late 2022 amid the FTX-induced downtrend. Swift famous then that the upswing signaled a looming worth enhance. Notably, BTC has been up 65% since then.

In a current tweet, Swift disclosed that the indicator suggests the potential emergence of a brand new bull run. In keeping with him, historic knowledge signifies that the metric is repeating the same sample to what was noticed in 2020 when he created the indicator. This led to the bull run that resulted in bitcoin’s all-time excessive.

1/ After I created the #bitcoin RHODL Ratio indicator in 2020, one factor that struck me was the way it confirmed a brand new bull run forming…when the ratio worth of youthful cash started to extend.

Which is the place we’re proper now

Do not panic about small worth pullbacks. Zoom out. pic.twitter.com/1qEmLYQOLf

— Philip Swift (@PositiveCrypto) May 16, 2023

A continuation of the rally

Furthermore, in a separate analysis, Santiment highlighted metrics that sign an impending worth upswing for the BTC market. The evaluation cited bitcoin’s on-chain transaction quantity, provide on exchanges, whale accumulation, and short-term merchants’ profitability.

Santiment identified that BTC traders are more and more capitulating their holdings. The asset is experiencing a slew of unfavorable spikes in its on-chain transaction quantity, indicating worry and panic promoting amongst traders. The evaluation famous that that is bullish for long-term holders, who would scoop up the cash pumped into the market.

As well as, bitcoin’s provide on exchanges was noticed to have dropped to a multi-year low, at present at 5.73%. The final time the ratio of BTC provide on exchanges went beneath 6% was in 2017. A major transaction involving $3.35 billion value of BTC contributed primarily to this drop after the tokens have been moved from Binance to a brand new address on Might 5.

Santiment additionally disclosed that whales (holding between 1,000 and 10,000 BTC) are on an accumulation spree. Furthermore, short-term merchants are experiencing unfavorable returns, whereas long-term merchants stay worthwhile. The evaluation revealed that these metrics sign a continuation of the run that started earlier this yr.

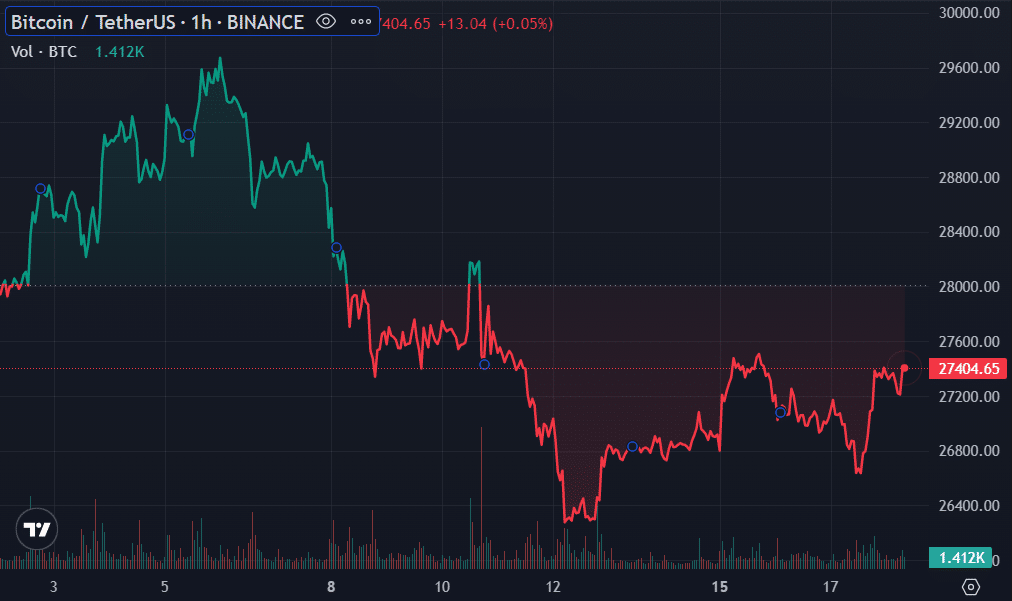

In the meantime, BTC is altering arms at $27,418 on the reporting time. A bullish begin to the day noticed the asset surge to $27,485 earlier than going through delicate opposition. BTC continues to be 2% up up to now 24 hours, because it appears to recoup the earlier week’s losses.