On-chain information reveals the Bitcoin miner promoting energy has plunged not too long ago, an indication that may very well be constructive for the crypto’s worth.

Bitcoin Miner Promoting Energy Has Plummeted In Latest Days

As identified by an analyst in a CryptoQuant post, there was much less promoting stress from the miners not too long ago. There are two related indicators right here, the miner provide and the miner outflow. The primary of those, the miner supply, is solely a measure of the whole quantity of Bitcoin at the moment sitting within the wallets of miners.

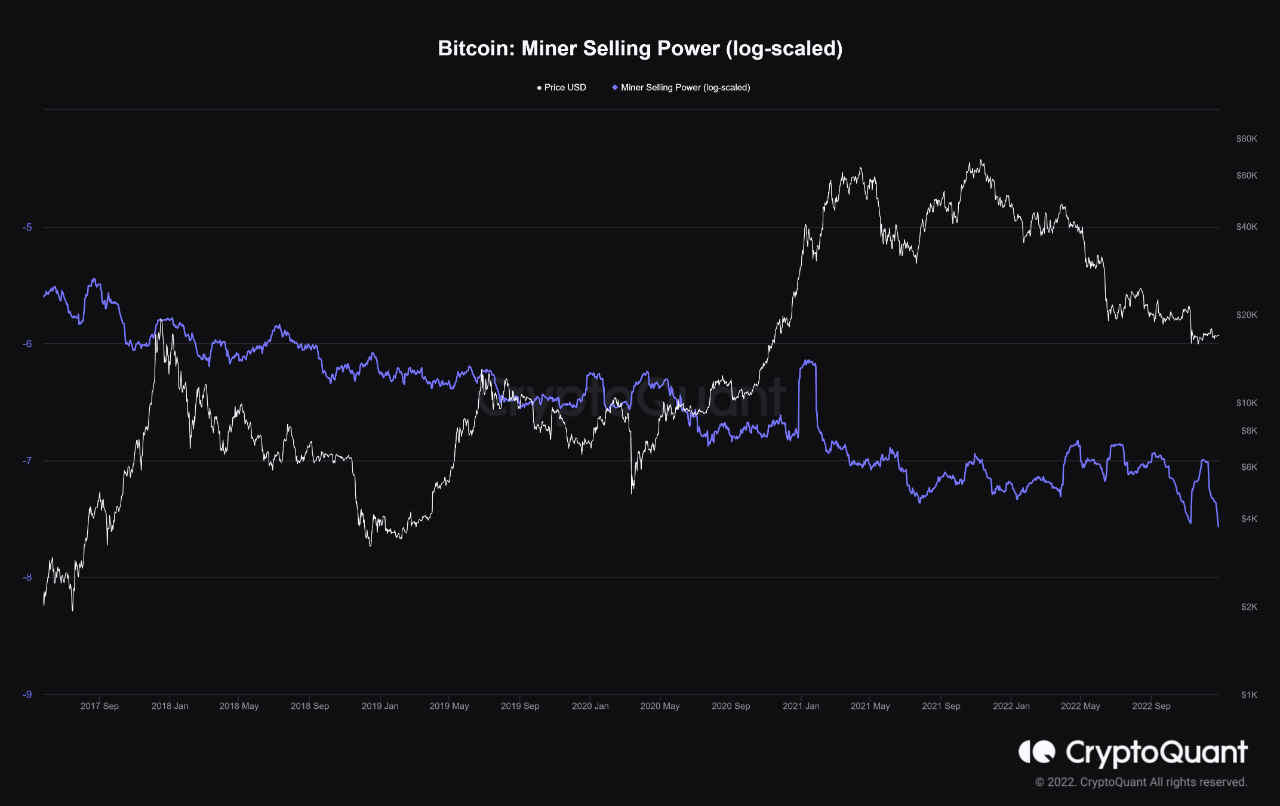

The opposite one, the miner outflow, is a metric that retains observe of the whole variety of cash that miners are transferring out of their provide in the mean time. Now, the “miner promoting energy” is outlined as this miner outflow divided by the miner provide (30-day shifting common, log-scaled).

When the worth of this indicator is excessive, it means miners are transferring out massive quantities in comparison with their complete provide proper now. Since miners often take out their BTC for dumping functions, this pattern could be bearish for the worth of the crypto. Alternatively, low values recommend miners are spending comparatively little quantities at the moment.

The under chart reveals the pattern within the Bitcoin miner promoting energy over the previous few years:

The worth of the metric appears to have taken a plunge in current days | Supply: CryptoQuant

Because the above graph shows, at any time when the Bitcoin miner promoting energy has reached excessive values and set a neighborhood peak, the worth of the crypto has seen some downtrend. This pattern is sensible as highs within the metric recommend elevated promoting stress from these chain validators.

Not too long ago, the indicator once more confirmed such a formation, and BTC reacted with a decline this time as properly, as its worth went from greater than $18,000 to the present $16,000 stage. Nonetheless, since this current peak, the miner promoting energy has been quickly taking place and has now set a brand new low.

This muted promoting stress from miners could not essentially be bullish by itself, nevertheless it does imply that if Bitcoin reveals any bullish momentum now, miners wouldn’t present any impedance to it in the intervening time.

An fascinating long-term pattern to note within the miner promoting energy chart is that the metric has been on an general downtrend within the final 5 years or so. Which means that over time, miners have been promoting lesser and lesser BTC in comparison with their reserves, suggesting that they’ve been accumulating and rising their provide as a substitute.

BTC Value

On the time of writing, Bitcoin’s price floats round $16,800, up 1% within the final week.

BTC continues to show boring worth motion | Supply: BTCUSD on TradingView

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, CryptoQuant.com