Information exhibits the Bitcoin sentiment had turned fairly bearish simply earlier than the asset’s worth had rebounded up from the $27,100 degree.

Bitcoin Recovers Shortly After FUD Takes Over Market

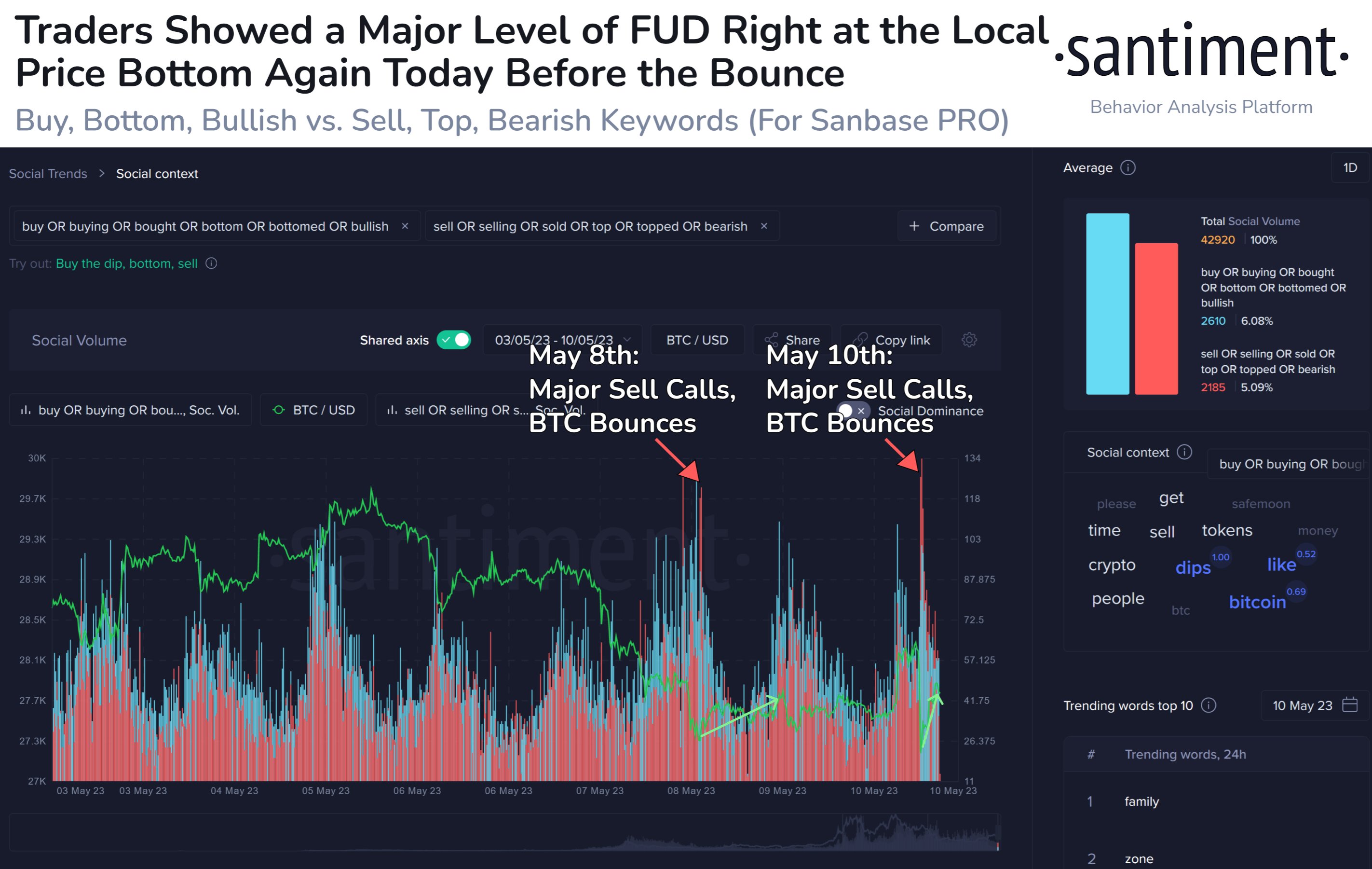

In accordance with information from the on-chain analytics agency Santiment, traders confirmed excessive ranges of concern across the time of the native backside throughout the previous day. The related indicator right here is the “social volume,” which measures the full variety of social media textual content paperwork that point out a given subject like cryptocurrency or Bitcoin.

These social media textual content paperwork embrace a wide range of sources, like Reddit, Twitter, Telegram, and different boards. The social quantity solely tracks what number of such paperwork point out the time period at the very least as soon as. So which means even when a put up incorporates the key phrase a number of instances, its contribution to the social quantity will nonetheless be just one unit.

The importance of the social quantity is that it tells us concerning the quantity of dialogue that sure subjects are getting from social media contributors in the intervening time.

Within the context of the present subject, social media is used to know the diploma of the bearish and bullish sentiments available in the market. Here’s a chart that exhibits the development in these social volumes for Bitcoin over the past week:

Seems to be just like the bearish sentiment has seen a pointy surge lately | Supply: Santiment on Twitter

To separate the social quantity for discussions that indicate a bullish mentality, phrases similar to “purchase, backside, bullish” have been chosen, whereas key phrases like “promote, high, bearish” are those chosen for pinpointing a bearish sentiment.

As displayed within the above graph, the Bitcoin social quantity for the bearish sentiment appears to have noticed a big spike throughout the previous day. This surge within the indicator had come after BTC had plunged from above $28,000 to round $27,100.

This means that the BTC traders had turned very fearful throughout this panic selloff. The same degree of bearish sentiment was additionally noticed solely a few days again, because the chart highlights.

The flip in market mentality again then had additionally come following a decline (this time from the $29,000 mark to the low $27,000 ranges), and apparently, it had coincided with the native backside within the worth.

The spike this time has additionally occurred concurrently with the attainable native backside formation at $27,100, as the worth of the cryptocurrency has recovered a bit bit since then.

Traditionally, every time the market has held an opinion too unbalanced in any explicit course, the worth has tended to maneuver reverse to this opinion of the lots. Due to this, in instances when the market has seen giant quantities of greed, a neighborhood high has typically grow to be extra possible.

Naturally, the identical goes for native bottoms as properly, since they’ve often fashioned when FUD has taken over the minds of the traders. The current spike seems to have been an instance of this sample, and to date, it appears like the newest bearish sentiment spike may additionally be the identical.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,500, down 5% within the final week.

BTC appears to have been shifting sideways in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Santiment.internet