The on-chain information for the stablecoin redemptions throughout the latest value plunge might recommend there aren’t many Bitcoin holders promoting anymore.

Stablecoin Redeem Rely Has Remained Low Not too long ago

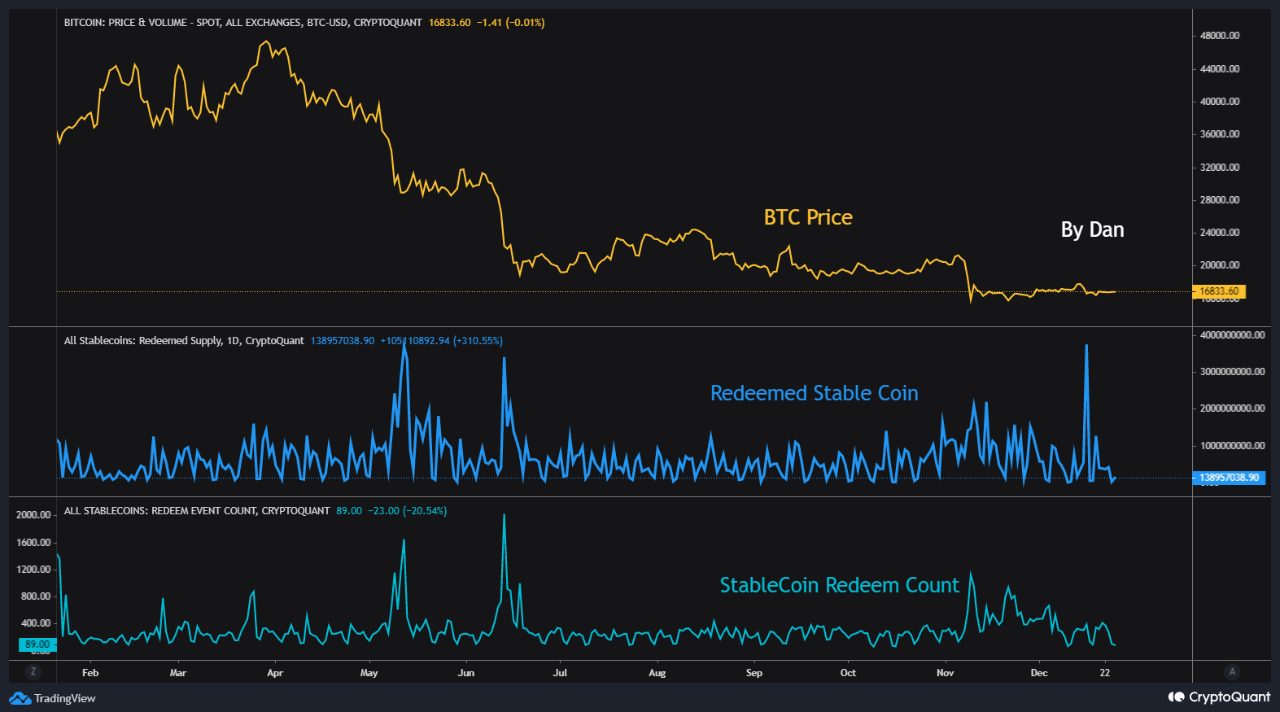

As identified by an analyst in a CryptoQuant post, massive stablecoin redemptions have often accompanied main declines within the Bitcoin value throughout this bear market. A stablecoin is claimed to be “redeemed” when an investor exchanges the token for fiat by means of the issuer of mentioned coin.

Traders often use stablecoins after they wish to escape the volatility related to tokens like Bitcoin. Thus, redemptions of them is usually a signal that buyers are exiting the market presently. The “stablecoins redeemed provide” is an indicator that measures the whole quantity of such redemptions occurring throughout the market of all varieties of stables.

One other metric that retains observe of those withdrawals is the “stablecoins redeem occasion rely,” which, as its title already implies, measures the whole variety of redemptions happening available in the market relatively than the whole sum of their worth.

Now, here’s a chart that reveals the pattern in each these stablecoin redemptions indicators over the previous yr:

Seems like solely certainly one of these metrics had its worth elevated in latest days | Supply: CryptoQuant

Because the above graph shows, throughout the massive declines within the value of Bitcoin on this bear market up to now, the stablecoins redeemed provide has often registered excessive values. This pattern is smart as buyers can be changing to stables to unload throughout the crash, after which redeeming them for fiat.

The stablecoin redeem rely additionally noticed spikes throughout such dumping occasions, apart from the latest one. This suggests that within the value plunges earlier than the most recent one, many buyers at all times took half in stablecoin redemptions, exhibiting that the market had a uniform and extra pure promoting urge for food.

In the latest decline the place Bitcoin went from above $18k to under $17k, nevertheless, the redeemed rely has stayed low whereas the redeemed provide has nonetheless noticed very excessive values. Which means that only some whales had been concerned on this dumping occasion, a attainable signal that largescale selling pressure could also be getting depleted available in the market.

BTC Value

On the time of writing, Bitcoin’s price floats round $16,800, up 1% within the final seven days. Over the previous month, the crypto has gained 2% in worth.

The worth of the coin appears to haven't proven any vital deviations in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, CryptoQuant.com