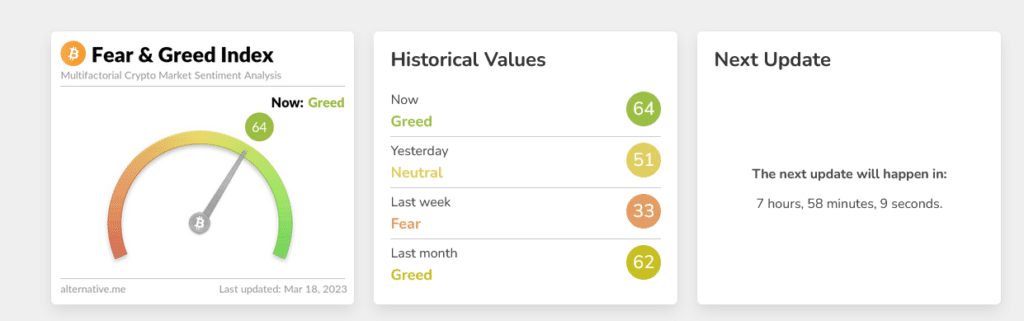

The Bitcoin Concern and Greed Index is at a 16-month excessive, rising to 64, as merchants seem like optimistic of the coin’s prospects.

Bitcoin merchants are grasping

In keeping with the index’s reading on Mar. 18, it seems that merchants are “grasping” and seeking to purchase extra cash and trip the march larger. The shift in sentiment follows the exemplary efficiency of bitcoin (BTC) up to now few buying and selling days.

The Concern and Greed Index is a crypto sentiment indicator that merchants and traders intently comply with. In contrast to different asset lessons, crypto and bitcoin might be influenced by hype.

Relying on market circumstances, there might be concern of lacking out (FOMO) when the merchants count on bitcoin to outperform. In the meantime, in depressed circumstances characterised by tanking asset costs, there may be concern, uncertainty, and doubt (FUD). This may set off a sell-off, forcing costs decrease.

When writing on Mar. 18, BTC is altering fingers above the $27,000 mark, agency on the final buying and selling day, surging over 35% in lower than every week. The fast enlargement of bitcoin follows a collection of elementary occasions that spooked the standard finance markets, forcing capital to censorship-resistant and trustless property, principally bitcoin, and different crypto property, together with ethereum (ETH).

Banking disaster Within the US compelled crypto costs larger

Following information of a financial institution run on Silicon Valley Financial institution (SVB) and the closure of Signature Bank, crypto sentiment shortly shifted from FUD to FOMO as bitcoin rocketed from as little as $19,700 to over $27,000 when writing.

The concern of a market-wide collapse and the Federal Reserve, the central financial institution of america, offering a security internet for struggling banks is rising speak that they’re again to easing, fueling the crypto and bitcoin bull run.

This preview is anticipated to drive the studying of the Concern and Greed index even larger. Over the past bull cycle in November 2021, when bitcoin peaked at over $69,000, the studying stood at 72. Whether or not this studying shall be surpassed even with the coin buying and selling at over half of 2021 excessive is but to be decided.

Within the every day charts, bitcoin has already bottomed and is buying and selling above February 2023 and August 2023 highs, rising 74% from November 2022 lows.