On-chain knowledge reveals Bitcoin’s open curiosity has sharply gone up lately, an indication that the crypto’s value could also be heading towards extra volatility.

Bitcoin Open Curiosity Has Made A Large Leap Of 8.3% Over Previous Day

As identified by an analyst in a CryptoQuant post, this improve in open curiosity is the biggest noticed through the previous three months. The “open interest” is an indicator that measures the overall quantity of Bitcoin futures contracts which are presently open on by-product exchanges. The metric accounts for each quick and lengthy contracts.

When the worth of this metric goes up, it means customers are opening new positions on the futures market proper now. As leverage normally goes up with buyers opening new contracts, this sort of development can result in the worth of the crypto changing into extra unstable.

However, reducing values of the indicator suggest buyers are closing up their positions for the time being. Particularly sharp drawdowns recommend mass liquidations have simply taken place out there.

Naturally, when the open curiosity comes all the way down to low sufficient values, the worth tends to change into extra steady as there isn’t a lot leverage current anymore.

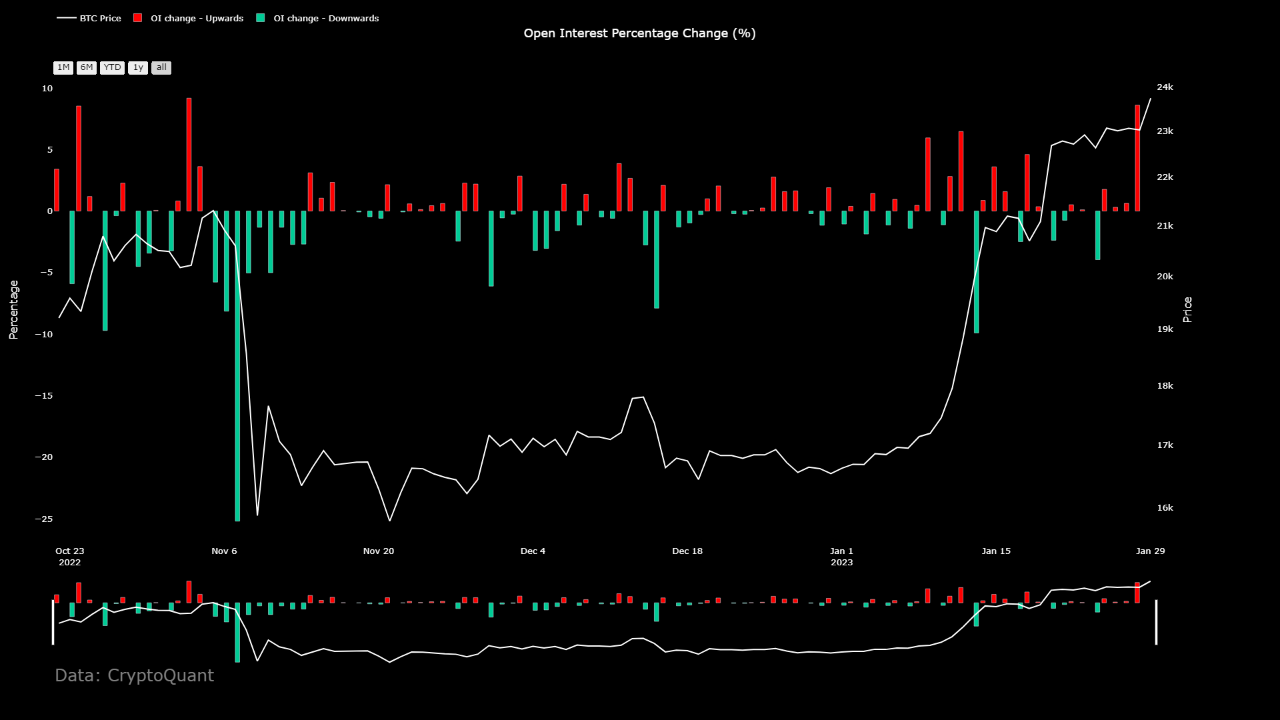

Now, here’s a chart that reveals the development within the each day share change of the Bitcoin open curiosity over the previous few months:

Appears to be like like the worth of the metric has been fairly excessive over the previous day | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin open curiosity appears to have gone by means of a really massive optimistic change lately. On this spike, the indicator’s worth elevated by $700 million, which represented a share change of 8.3%, the best noticed over the past three months.

This might sign that volatility could also be coming quickly for the crypto. Nonetheless, it’s presently unclear wherein course this new volatility would possibly find yourself taking the worth in.

From the chart, it’s obvious that earlier through the present Bitcoin rally, the open curiosity noticed a big spike (clearly smaller than the present one), and solely a day later, a pointy detrimental spike was seen as Bitcoin’s value quickly climbed.

Which means that the worth improve then was fueled by a short squeeze. A “squeeze” takes place when mass liquidations happen directly as a consequence of a pointy transfer within the value.

Such liquidations solely amplify the worth transfer additional, resulting in much more positions being liquidated. On this approach, liquidations can cascade collectively throughout a squeeze occasion. Squeezes are the explanation why excessive open curiosity durations usually introduce extra volatility to the worth.

It might seem that when the rally began, a lot of buyers opened quick positions, believing that the worth improve wouldn’t final too lengthy. However as their guess failed, their positions being liquidated solely fueled the rally additional.

It now stays to be seen whether or not an analogous occasion will even observe this open curiosity improve, or if an extended squeeze will happen this time as an alternative.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $23,100, up 1% within the final week.

BTC continues to consolidate | Supply: BTCUSD on TradingView

Featured picture from Aleksi Räisä on Unsplash.com, charts from TradingView.com, CryptoQuant.com