Crypto.com researchers are optimistic about crypto initiatives in 2023 regardless of an unprecedented bear market. The basic evaluation has proven an imminent rise of cryptocurrencies and blockchain-powered applied sciences to highs by no means recorded in historical past.

Regardless of the continued turmoil within the blockchain-powered markets, crypto.com has made an thrilling discovery that brings a wave of hope for crypto-savvy traders. The report reads:

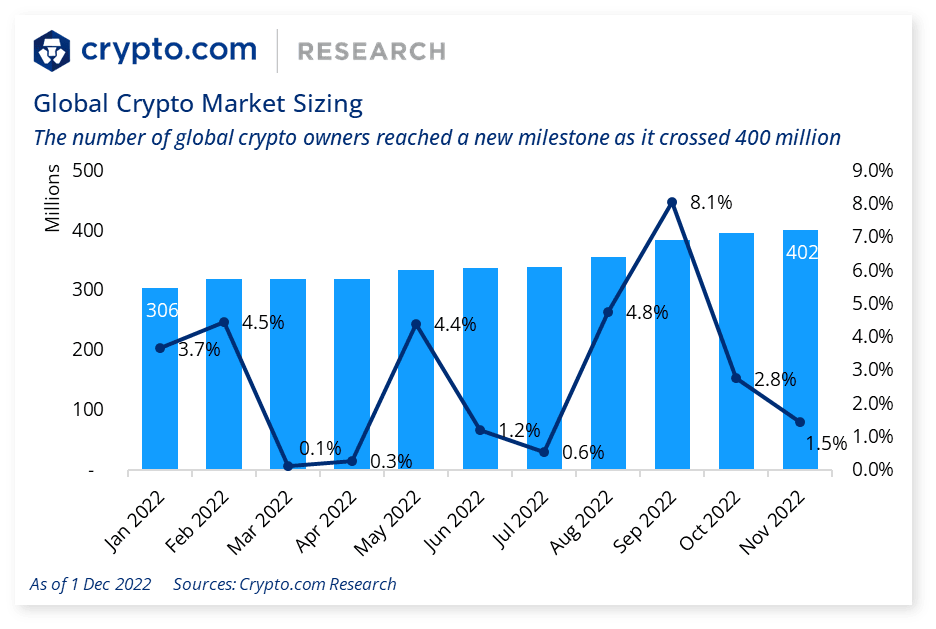

“As of November 2022, the variety of crypto house owners crossed the 400 million milestones, reaching 402 million.”

Crypto.com: 2022 Yr Assessment & 2023 Yr Forward

In response to stats published by the exchange, the projected variety of crypto house owners is ready to extend to 800 million in 2023, signaling bullish momentum.

Crypto.com additionally expects “to see a number of AAA video games within the subsequent yr or two, which can present gamers with new gaming experiences that combine high-performance gameplay with blockchain know-how.”

The yr 2022 has additionally seen the preliminary use of high-utility soulbound tokens (SBTs), that are anticipated to surge in 2023. The Japanese Government pioneered these NFTs by issuing SBTs on the ethereum community to seven mayors. They served as rewards for the mayors’ initiatives in the direction of enhancing the lives of residents utilizing up to date know-how.

How crypto hacks of 2022 could make crypto safer

In response to crypto.com, blockchain-powered applied sciences have gotten safer each day resulting from bankruptcies and scorching pockets hacks which have occurred in bulk in 2022. As an illustration, the proof-of-reserve (PoR) mannequin has mandated exchanges to publish their digital asset reserves held on behalf of shoppers. Though accompanied by many controversies, the PoR mechanism has initiated a step ahead for centralized exchanges (CEXes) to regain customers’ belief, which has been broadly affected by SBF’s unlawful practices with buyer funds.

“The important thing to constructing a profitable enterprise mannequin is establishing belief with finish customers,” Crypto.com wrote, citing enhancements within the crypto business set to safe traders from large monetary losses.

Crypto.com’s 2022 overview

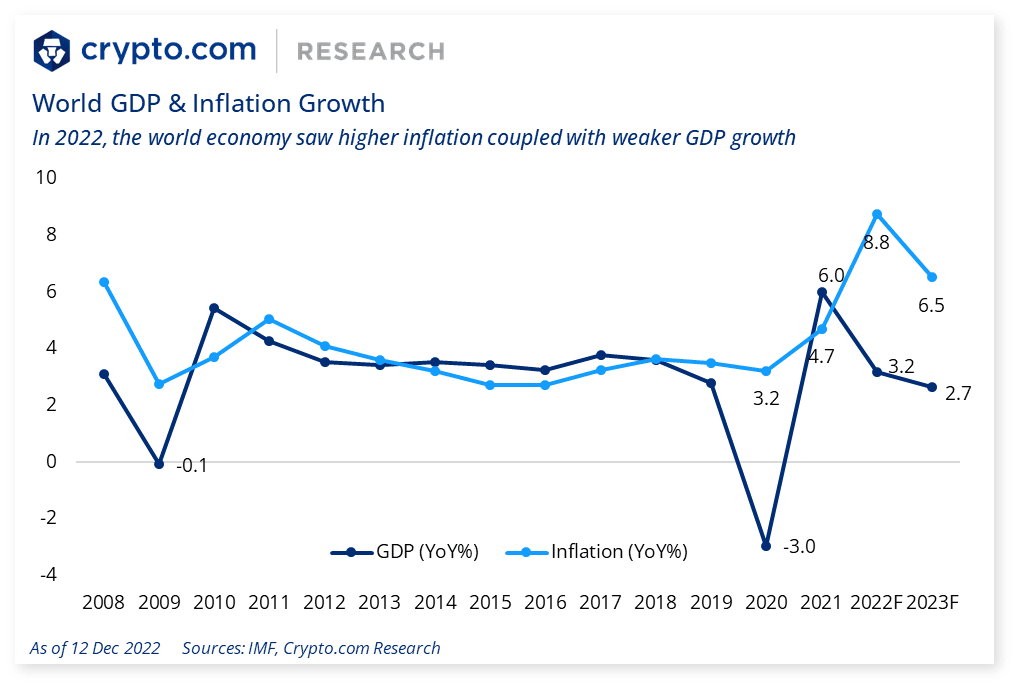

This yr has left an indelible mark on the minds of enterprising people, hedge funds, asset managers, and basic finance lovers. Within the wake of a monetary recession predicted by analysts and specialists corresponding to Robert Kiyosaki, the Federal Reserve has constantly fought inflation utilizing the simplest monetary weapons, the rates of interest. In March, the Fed raised interest rates to the best stage ever witnessed in 15 years, in line with CNBC.

The battle in Europe additionally wound monetary sectors, together with cryptocurrencies. Graphical knowledge from crypto.com exhibits a decline in Gross Home Product figures this yr from highs recorded in 2021. Inflation has been rising to highs of 8.8percentas macroeconomic components elevate the price of items and providers.

Along with the elevated inflation and curiosity hikes, the crypto group acquired numerous further occurrences. First was the collapse of the Terra-Luna ecosystem in Could, which worn out $45 billion in days because the founder, Do Kwon, went lacking. Only a month later, two incidents occurred. Celsius, a widespread crypto borrowing and lending platform, introduced going below receivership for defense in opposition to collectors.

Equally, Three Arrows Capital (3AC) filed for insolvency, and founders Kyle Davies and Su Zhu once more went lacking. July noticed Voyager Digital plummet to chapter resulting from heavy publicity on the already collapsed TAC, with FTX profitable its liquidation by providing the best bid.

October was nicknamed HackOctober by netizens upon experiencing a record-breaking variety of cyber-attacks. In mid-October alone, Chainalysis recorded $718 million stolen by hackers in safety breaches as hackers compromised DeFi protocols. Or the latest FTX collapse that worn out $32 billion and ended up within the books of historical past as essentially the most well-known crypto rip-off of all time.