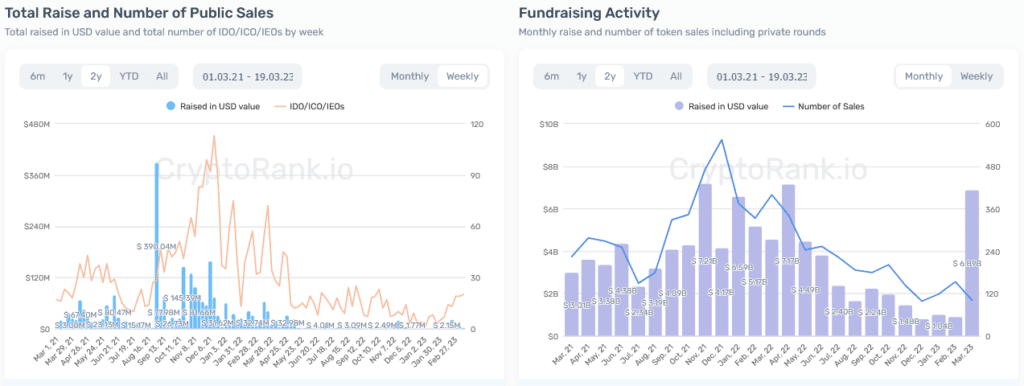

Regardless of rising considerations in the US banking business, the crypto business stands agency, elevating over $4m via token gross sales final week.

On Mar. 19, CryptoRank knowledge revealed that regardless of a contraction, the quantity raised had elevated considerably; showcasing the resilience and flexibility of the crypto business.

Collapse of main US banks impacts the crypto business

The data confirmed that the crypto business raised $4.11m via token gross sales, regardless of decreased token gross sales the earlier month.

The full raised within the final two months totaled a formidable $6.89b, up from final month’s $933.55m, together with non-public rounds.

That is in opposition to the backdrop of the collapse of main banks Silvergate, Silicon Valley Financial institution (SVB), and Signature Financial institution, which uncovered the vulnerability of the standard banking sector whereas briefly depriving the U.S. crypto market of its main fiat on-ramps.

Analysts have attributed the collapse of SVB and Silvergate to unfavorable market circumstances and poor danger administration. SVB’s downfall resulted from overexposure to long-term authorities bonds, which depreciated when rates of interest rose. This left the financial institution wanting property when many depositors withdrew their funds concurrently.

Silvergate’s collapse was fueled by FTX’s meltdown, damaging belief within the crypto sector, and quick sellers airing considerations on Twitter.

Signature Financial institution’s shutdown stirred controversy because it was reportedly not bancrupt and had already stabilized its capital outflow when U.S. regulators intervened. Many crypto fanatics noticed this as a politically-motivated transfer to push crypto out of the U.S.

With the collapse of Silvergate and Signature Financial institution, the 2 main monetary establishments offering banking providers to U.S. crypto firms, it was broadly believed that crypto firms would face main hurdles interacting with the dollar-based monetary system. Nonetheless, the latest fundraising success suggests in any other case.

Fundraising strategies: ICOs, IEOs, and IDOs

Preliminary Coin Choices (ICOs), Preliminary Change Choices (IEOs), and Preliminary Decentralized Choices (IDOs) are fundraising strategies that differ in construction and execution however share comparable objectives.

ICOs allow firms to boost funds by creating new cash, apps, or providers. IEOs contain on-line buying and selling change platforms conducting digital asset choices on behalf of firms, offering speedy buying and selling alternatives. IDOs, the newest fundraising mannequin, provide enhanced liquidity and are issued by decentralized exchanges.

Bitcoin (BTC), the biggest cryptocurrency on the planet, skilled a tumultuous journey, hitting an all-time excessive of almost $69,000 in November 2021 earlier than dropping to beneath $20,000 in March 2023.

Regardless of the banking disaster, bitcoin has climbed again up, buying and selling at round $27,740 on the time of writing. CryptoRank.io data signifies that Binance leads Bitcoin and Ethereum markets in every day futures volumes.