Share

Curve Finance’s newly launched algorithmic stablecoin, crvUSD, noticed a 0.25% worth enhance within the final 24 hours, with the DeFi protocol minting greater than $22 million price of the dollar-pegged token.

Information from blockchain explorer Etherscan exhibits {that a} contract deployed by Curve Finance on the Ethereum mainnet produced greater than $22 million price of crvUSD in the previous few hours, with $20 million of that quantity minted in simply 5 minutes.

Following issuing the primary tokens, a pockets labeled “Curve.Fi Crew” by blockchain knowledge evaluation agency Arkham Intelligence leveraged about $1.8 million in frxETH, issued by Frax Finance, to create a $1 million crvUSD mortgage, which Curve later confirmed.

As many figured – deployment of crvUSD good contracts has occurred!

This isn’t finalized but as a result of UI additionally must be deployed. Keep tuned!

— Curve Finance (@CurveFinance) May 3, 2023

Curve has cautioned that there’s nonetheless some work to be achieved earlier than crvUSD deployment might be finalized, particularly relating to its integration into the DeFi’s person interface.

In response to an admin on Curve Finance’s official Telegram channel, crvUSD remains to be “ready on the entrance finish” earlier than it may be absolutely launched.

Nonetheless, minting $22 million price of the algorithmic stablecoin is a major step in direction of bringing it to the general public.

As soon as absolutely deployed, Curve’s stablecoin will face stiff competitors as a spate of different DeFi protocols have additionally issued their very own native stablecoins to rope in additional customers and increase declining crypto buying and selling and lending exercise.

Curve stablecoin positive factors 7%

After the $22 million crvUSD mint, the stablecoin’s worth reportedly elevated by 7.16%.

Curve Finance’s new #stablecoin, #crvUSD, noticed a surge of seven.16% previously 24 hours after the profitable deployment of its good contracts

— Coinpedia – Fintech Information (@CoinpediaNews) May 4, 2023

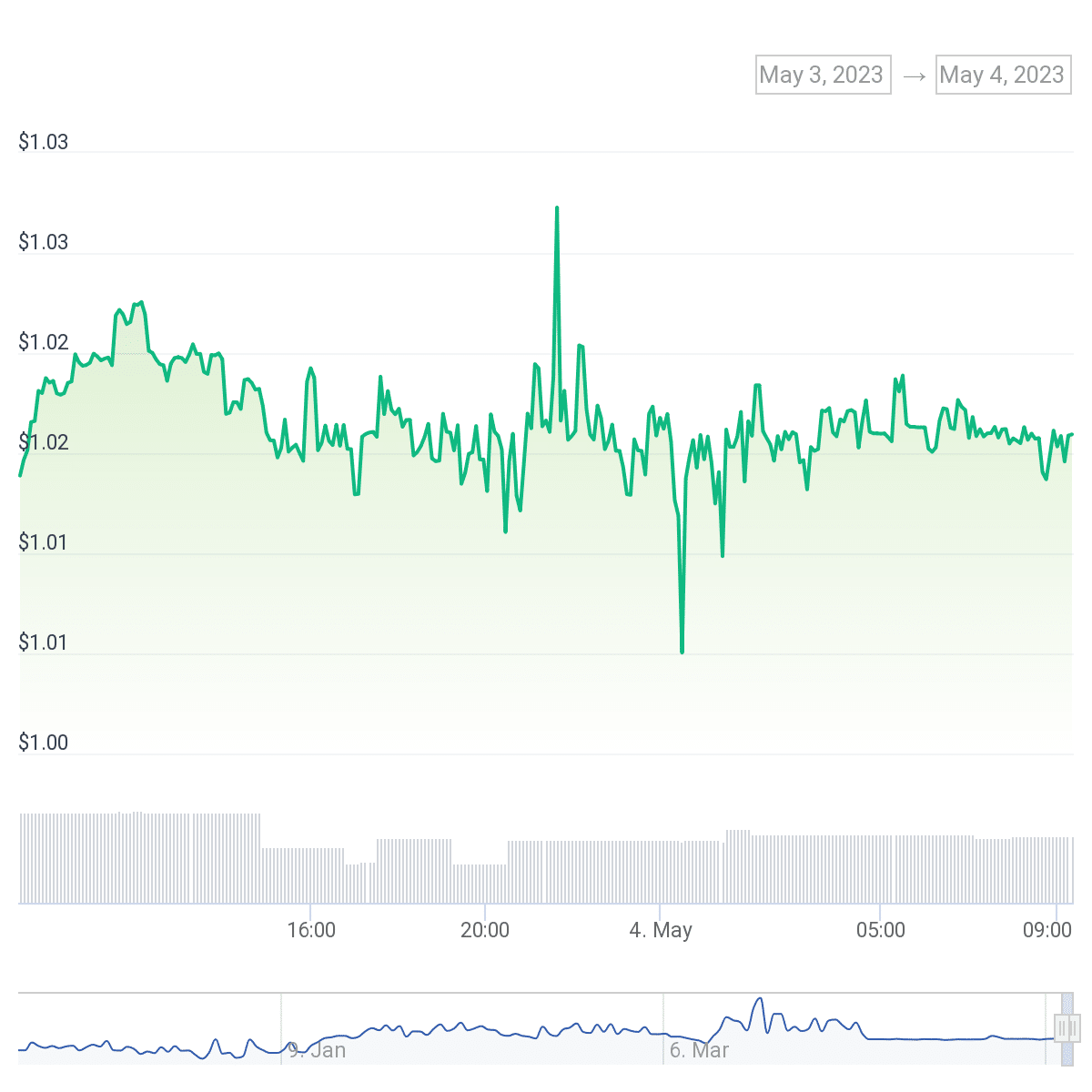

Whereas initially buying and selling at about $0.96, knowledge from CoinGecko exhibits that crvUSD’s worth shot as much as $1.03 because the market reacted to the minting. Nonetheless, a few hours later, it dropped to $1.01 earlier than pushing again as much as $1.02, the place it hovered mainly till going to press.

Whereas there are some jitters relating to algorithmic stablecoins because the collapse of Do Kwon’s Terra USD (UST), Curve Finance maintains that its new providing is distinct from UST in that it employs a design just like MakerDAO’s DAI stablecoin.

Curve claims that crvUSD will operate as a “collateralized-debt-position” stablecoin, that means that customers should deposit collateral to take out a mortgage in crvUSD.

Nonetheless, the DeFi protocol, whose whole worth locked (TVL) is at the moment pegged at about $4.4 billion by DeFiLlama, has but to determine the popular asset customers can leverage as collateral.