For the reason that begin of 2022, the crypto markets have gone down from the $3 trillion mark — which was recorded in November 2021 — to $2.2 trillion in January final yr, to roughly $800 billion at the beginning of 2023.

These unfavorable circumstances have triggered a bearish environment surrounding all decentralized finance (DeFi)-related sectors, together with play-to-earn (P2E) video games and decentralized autonomous organizations (DAOs). The non-fungible token (NFT) trade was not spared within the onslaught, as a number of NFT initiatives initially price tens of millions of {dollars} declined to near-zero values.

Regardless of the damaging results of the previous fiascos, a number of market watchers have cause to imagine that these occasions have been essential to purge out weak initiatives, leaving the robust to thrive in an trade already suffering from assaults from regulatory companies and governments alike.

The Terra collapse

Some of the referenced debacles of final yr was the Terra Collapse that occurred in Might and precipitated a wave of insolvency crises into the crypto scene, resulting in the implosion of a crypto lender Celsius Community and hedge fund Three Arrows Capital.

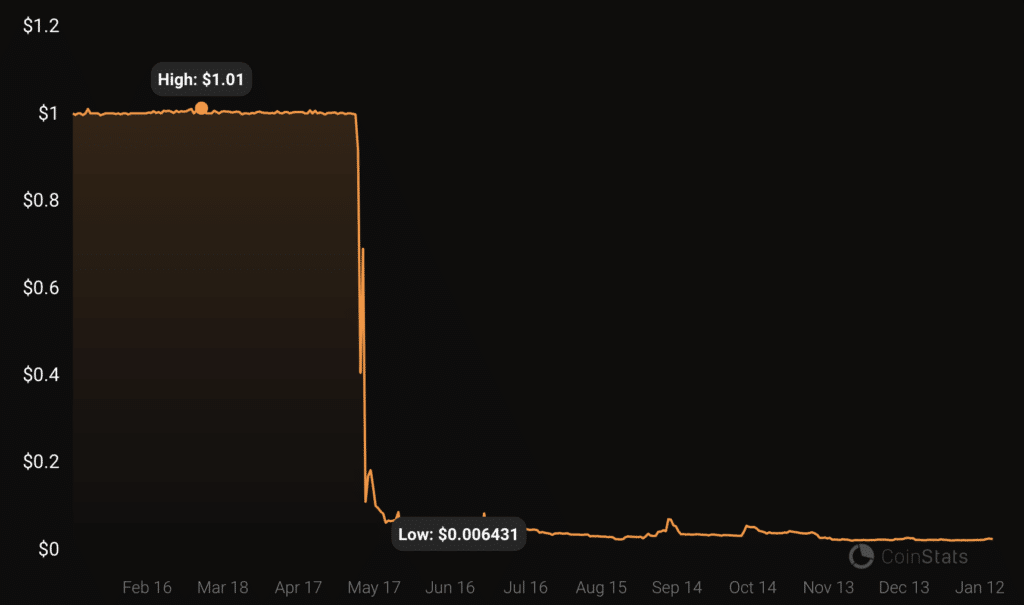

The autumn of the Terra ecosystem was majorly triggered by the depegging of TerraUSD (UST) in early Might.

Terraform Labs had taken out $150 million price of UST from a decentralized trade 3pool on Might 7, seeking to meet liquidity calls for on different exchanges. Nevertheless, two merchants, who appeared to take advantage of a vulnerability witnessed, swapped 185M UST for USDC on 3pool, destabilizing TerraUSD’s peg within the course of.

Terraform Labs needed to take out one other 100 million UST from 3pool in an try to stability UST’s ratio to different stablecoins on the trade, however the harm had already been achieved.

All subsequent strikes geared toward re-pegging the uncollateralized algorithmic stablecoin proved futile, resulting in a cascade of failures that finally impacted the whole ecosystem as market-wide selloffs ensued, triggered by buyers’ dread.

The aftereffects of the Terra implosion have been catastrophic at finest.

One among crypto’s largest hedge funds with $10B below asset administration, Three Arrows Capital (3AC) fell a month later, partly because of huge publicity to Terra. In accordance with founders Su Zhu and Kyle Davies, the hedge fund misplaced $500 million within the Terra collapse. The 3AC collapse led to liquidity points for a number of entities throughout the scene, together with Babel Finance, Voyager, and BlockFi. These entities have been revealed to have been considerably uncovered to 3AC.

The FTX implosion

Following a market-wide crash in Might, the crypto scene staged a minor comeback that recovered a number of the losses of the earlier months, however the sudden FTX implosion in November sealed the bear’s maintain over the markets.

Bitcoin (BTC), Ethereum (ETH), and different property plummeted to document lows amid a prevalent capitulation part. Buyers’ confidence in centralized exchanges declined.

The FTX saga started with a CoinDesk article in regards to the agency’s liquidity.

Binance founder and CEO Changpeng Zhao (CZ) announced on Nov. 6 that the trade can be liquidating all its FTT token holdings because of reviews suggesting insolvency points. This led to a pointy decline in FTT’s worth, resulting in selloffs and a mass withdrawal of funds from FTX, as buyers feared it was the following crypto entity to implode.

As a part of Binance’s exit from FTX fairness final yr, Binance acquired roughly $2.1 billion USD equal in money (BUSD and FTT). As a consequence of latest revelations which have got here to gentle, we’ve got determined to liquidate any remaining FTT on our books. 1/4

— CZ

Binance (@cz_binance) November 6, 2022

The financial institution run finally uncovered FTX’s liquidity disaster. FTX founder and CEO Sam Bankman-Fried (SBF) needed to attain out to CZ for a bailout from Binance. Binance had agreed to bail out FTX on Nov. 8, asserting it will buy the buying and selling platform, however CZ famous that the trade might pull out of the deal at any time. Binance finally did pull out following a due diligence course of on FTX’s sheets.

This raised better considerations about simply how dangerous the FTX scenario is.

Following a sequence of damning revelations, FTX finally filed for Chapter 11 chapter at a US Chapter Courtroom on Nov. 11, with SBF stepping down as CEO. Lawyer John J. Ray took cost to deal with the corporate’s chapter proceedings.

A number of entities have been affected by the FTX collapse because of vital exposures to the trade. A few of these embody BlockFi which paused withdrawals on Nov. 11, and Galois Capital with a $100 million publicity to FTX, Galaxy Digital, CoinShares, Nexo and several other others.

Extra just lately, crypto lender and Digital Foreign money Group subsidiary Genesis paused withdrawals on Nov. 16, citing the influence of the FTX collapse. Genesis’ transfer affected the crypto trade Gemini and its Earn program, because the trade revealed a $900 million publicity to Gemini.

Crypto hacks

Amid the debacles, liquidity crises, and the collapse of the crypto markets, the cryptocurrency trade additionally skilled quite a few hacks in 2022.

The highest 10 hacks within the trade resulted in losses to the tune of $2.1 billion. Notably, the biggest crypto hack in 2022 was the Ronin Bridge hack in March, which noticed a lack of $612 million.

Amid the FTX saga, the corporate suffered an exploit that noticed the hackers transfer $477 million from the platform. Reviews suggest the hack was an inside job. Moreover, the Wormhole Bridge and the Nomad token bridge have been individually hacked for $321 million and $190 million, respectively.

Moreover, market maker Wintermute was exploited final September and misplaced $160 million. A month later, a BNB Chain bridge was hacked for $100 million.

Crypto, DeFi, and NFTs in 2023

A number of market observers imagine the broader cryptocurrency scene will blossom in 2023 after going by means of one in all its hardest phases in historical past final yr. Others imagine the previous predicaments are essential for the sanitation of the crypto scene, and the purge is more likely to spill into 2023.

“2021 was a growth yr for crypto, DeFi, and NFTs. 2022 was a bummer yr. 2023 would be the yr that the market and regulators filter the riffraff,” mentioned David Lesperance, an legal professional with 30 years of expertise and managing director at Lesperance & Associates.

In accordance with him, the previous occasions, whereas unfavorable, have given the trade an eye-opener, resulting in calls for for accountability and better scrutiny. This could assist in exposing dangerous trade gamers this yr, he says.

The FTX saga examined buyers’ confidence in centralized exchanges. Reviews surfaced, suggesting {that a} blatant misappropriation of customers’ funds led to the trade’s collapse. This triggered calls for for accountability, as different platforms, together with Crypto.com and Binance, revealed proof-of-reserves reviews amid an exodus of consumers. A study final month revealed a rising variety of customers demanding proof-of-reserves reviews.

“The tide goes out and the crypto world is about to seek out out who was swimming bare and who’s sporting a showering swimsuit. These discovered to be swimming bare will discover themselves below shut examination by regulators and felony regulation enforcement in a number of jurisdictions to see if there have been any chargeable transgressions,”

Lesperance remarked.

Legislation enforcement and monetary regulators throughout a number of jurisdictions took a particular curiosity within the crypto scene following the FTX debacle. The better stage of scrutiny is more likely to contribute to the trade’s progress or downfall. Apart from the FTX collapse, the Terra fiasco attracted consideration from regulation enforcement, as South Korean prosecutors launched a manhunt for Terra founder Do Kwon. The nation has additionally put the native cryptocurrency scene below better scrutiny.

Notably, James Butterfill, head of analysis at digital asset funding agency CoinShares, claimed that the crypto scene should undergo years of fixed rebuilding to regain buyers’ confidence, particularly on the ranges witnessed in 2021 and early 2022.

Nevertheless, he believes the DeFi sector is more likely to get better sooner than the remainder of the crypto trade, particularly with proof that good contracts have been efficient in assembly the calls for for which they have been initially ready.

“Rehypothecated debt has declined considerably, however because of the nature of the good contracts, it has not had the snowball impact that some feared; this steered that investor confidence could get better extra shortly,”

Butterfill mentioned.

After the FTX collapse, how would regulators strategy the trade?

The FTX fiasco underlined the necessity for better oversight throughout the crypto scene for correct client safety measures.

The USA, which has seen an enormous focus of crypto buyers, just lately paid nearer consideration to the scene. The Department of Justice (DoJ) and the Securities and Exchange Commission (SEC) individually charged Sam Bankman-Fried with a number of crimes, together with fraud, conspiracy and cash laundering.

Senator Elizabeth Warren pushed a bipartisan invoice seeking to handle crypto-related cash laundering schemes shortly after the FTX fall.

Final month, crypto-friendly senator Pat Toomey introduced a invoice to manage stablecoin funds as one in all his final strikes earlier than finally retiring.

The US Senate Banking Committee Chair Sherrod Brown just lately reiterated his want to see the cryptocurrency trade cracked down following the FTX collapse. “There’s nothing ‘democratic’ or ‘clear’ a few shady, diffuse community of on-line humorous cash,” Brown had mentioned in June 2021. After the FTX debacle, he modified his stance.

Lesperance believes that regulators’ strategy to overseeing the trade after the FTX implosion will assist pave the way in which for additional improvement.

“The US is main the way in which, not solely on FTX, but additionally the longer term regulation of different exchanges who want to service US prospects. You will discover that regulators in different nations will comply with the US of their strategy to regulating those that cater to residents of their nations,”

“SEC chief Gary Gensler has already said that he believes that present US securities legal guidelines ought to be utilized to the crypto world. For exchanges, this implies not solely full audits of property and liabilities but additionally authorities examination to make sure correct KYC, AML, and so on. rules that are already utilized to non-crypto exchanges,” he added.

The lawyer famous that the SEC should deal with NFTs like each different safety so as to correctly regulate them. “This implies correctly submitting and disclosure earlier than being supplied to US prospects. Since nearly all NFTs are supplied to most people quite than solely accredited Buyers, you will notice a major variety of present choices disappear as they can’t meet the regulatory necessities….or can’t afford to conform,” Lesperance said.

James Butterfill believes Europe’s MiCa regulatory framework is the most effective throughout the world scene and can be adopted by different regulatory companies. “We count on a lot more durable regulation extra in step with the present banking to start to be formulated and partly carried out this yr, significantly for the on- and off-ramps for crypto,” Butterfill famous.

Liquidity expectations for 2023

Final yr witnessed a sequence of liquidity crises that finally led to the chapter of a number of companies. FTX’s implosion, specifically, was triggered by a liquidity crunch attributable to an enormous financial institution run. Genesis just lately paused withdrawals because of a liquidity disaster they’re at the moment experiencing. Celsius additionally needed to pause withdrawals because of dried-up liquidity.

.@CelsiusNetwork is pausing all withdrawals, Swap, and transfers between accounts. Appearing within the curiosity of our group is our high precedence. Our operations proceed and we’ll proceed to share data with the group. Extra right here: https://t.co/CvjORUICs2

— Celsius (@CelsiusNetwork) June 13, 2022

Some proponents imagine this subject is a essential evil that may spill into 2023. “The correlation and intertwining of the crypto market have been uncovered in 2022. It will proceed to unravel in 2023 as numerous exchanges, hedge funds, and different gamers within the crypto house set off margin calls. The dominoes haven’t but all fallen,” Lesperance commented.

Conversely, Butterfill believes that the crypto scene has solely witnessed a shift in liquidity between property and exchanges quite than a dry-up. He highlighted the sustenance of liquidity throughout the bitcoin market amongst its buying and selling pairs, staying regular at $10 billion a day. “It merely shifted to different exchanges, with centralized trade dominance being steadily eroded by decentralized ones and bilateral over-the-counter (OTC) preparations the place custody is way safer,” Butterfill remarked.

Prospects for P2E video games this yr

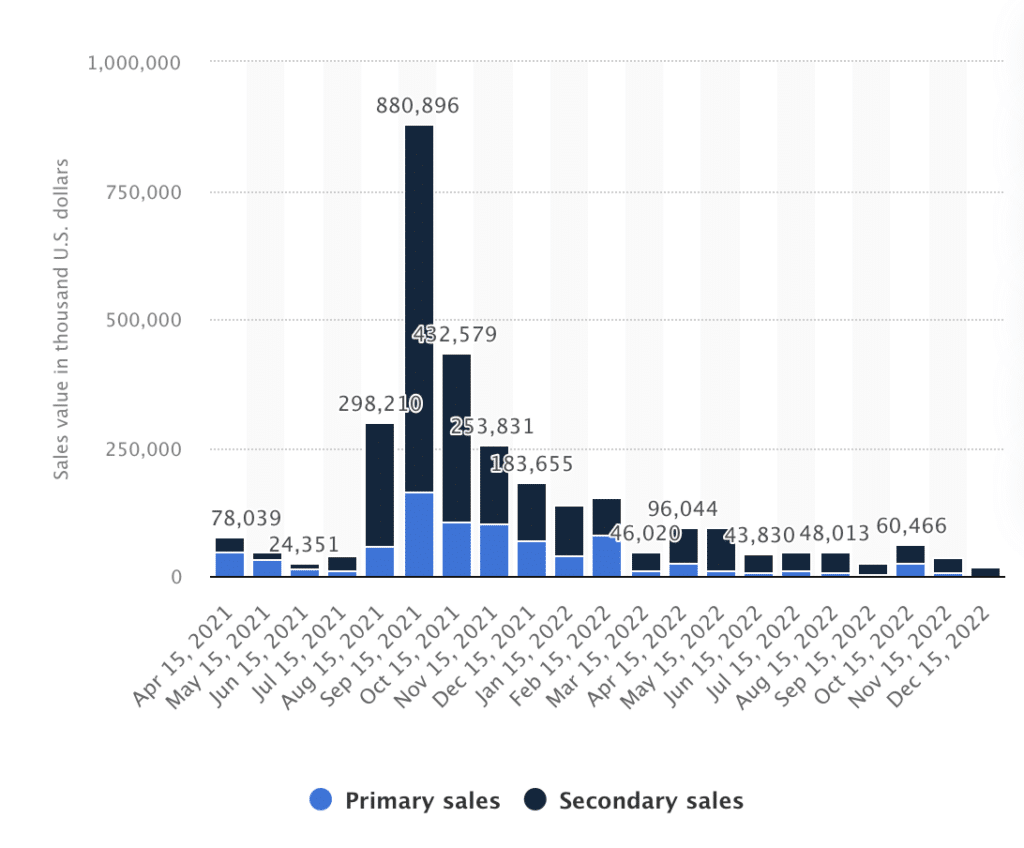

Play-to-earn games attracted mass adoption in 2021 because of the bull run that resulted in exponentially larger values for digital property and a corresponding huge espousal fee for the cryptocurrency trade. The bear market of 2022 flushed out a number of P2E fans, resulting in a dearth of gamers. However, the trade stays one of many quickest rising throughout the crypto scene.

The P2E gaming trade reached a peak valuation of $116 billion in 2021. This was because of the mass adoption fee. Round 34% of the people that took a worldwide survey revealed that that they had performed P2E video games, with 29% being in Hong Kong, 27% in Spain, and 27% within the United Arab Emirates. Moreover, information means that 13.3% of males within the US had patronized P2E video games.

A number of P2E platforms that rose to prominence embody Axie Infinity, Decentraland, STEPN, and CryptoKitties. Axie Infinity, specifically, sooner or later, was capable of accommodate over 2 million lively gamers on a month-to-month foundation. However buyers have additionally skilled points with P2E platforms, together with the collapsed CryptoZoo NFT challenge promoted by skilled wrestler Logan Paul.

Lesperance believes these P2E platforms should show that they’re extra helpful than detrimental to buyers so as to rack in gamers in 2023 because of the warning with which buyers are getting into the crypto scene proper now.

Notably, Marc Arjoon, Analysis Affiliate at CoinShares, doesn’t imagine P2E platforms will entice huge adoption in Q1 2023.

“Both means, Axie Infinity and to a lesser extent immutable X have been the principle gaming platforms and noticed their valuations rise in step with the bubble so, no, I don’t count on this.”

Arjoon remarked.

He believes these video games require extra time to be correctly developed, and builders ought to leverage extra scalable blockchains comparable to layer-2 or hybrid networks.

What about DAOs?

DAOs represent the purest type of decentralization and are essential in sustaining the idea, however because of inherent flaws observed inside their buildings, mass adoption has declined.

Nonetheless, the worldwide scene has had a gradual improve to this point. As of August of final yr, the variety of lively DAOs stands at a whopping 5,000 in quantity, having a cumulative treasury of $9.7 billion. DAOs have additionally been acknowledged by some jurisdictions, together with three US states – Vermont in 2018, Wyoming in 2021, and Tennessee final yr. However simply how a lot development will these organizations expertise in 2023?

“DAOs are available in two types: included or unincorporated. The issue with the latter is that in regulation, they’re handled as common partnerships. In a common partnership, every member is chargeable for the DAOs actions and the actions of different members. If there’s fraud or a hack or an accident, different members or third events can sue a member with the deepest pockets,”

Lesperance disclosed, talking on the way forward for DAOs.

He additionally highlighted a second downside that these organizations might need to beat, which is within the type of taxation, “since a given DAO could have members from a number of jurisdictions, every requiring completely different tax and monetary disclosure obligations,” he added. Lesperance additionally famous that American taxpayers are more likely to dump their DAOs as soon as they weigh the tax complexities and their submitting obligations with the guarantees of the organizations.

Arjoon, however, believes some DAOs will carry out higher than others in 2023, noting that those which have a greater imaginative and prescient and a extra sturdy governance system are more likely to succeed over others.

“DAOs that extra intently combine with real-world property and rules/legal guidelines will seemingly see simpler acceptance.”

“There’s additionally additional experimentation to be achieved with twin governance buildings like Optimism for instance, however the infrastructure for these organizations (voting, multisig, administration, payroll, and so on.) will turn into much more essential in 2023,” he concluded.

Whereas it’s troublesome to precisely predict the trajectory of the crypto trade in 2023, there’s hope for a greater yr than the earlier one. Buyers might be getting into the scene with a extra cautious outlook, and vital progress in correctly regulating the trade will contribute to larger confidence.