Share

In response to a collection of transaction points that raised considerations concerning the Multichain (MULTI) protocol, main crypto trade Binance has quickly suspended deposits for 10 bridged tokens as of Might 25.

Affected token pairs embody polkastarter (POLS), alpacatoken (ALPACA), travala.com (AVA), spell (SPELL), fantom (FTM), alchemy (ACH), beefy (BIFI), superverse (SUPER), harvest finance (FARM), and dexe (DEXE).

A short lived suspension

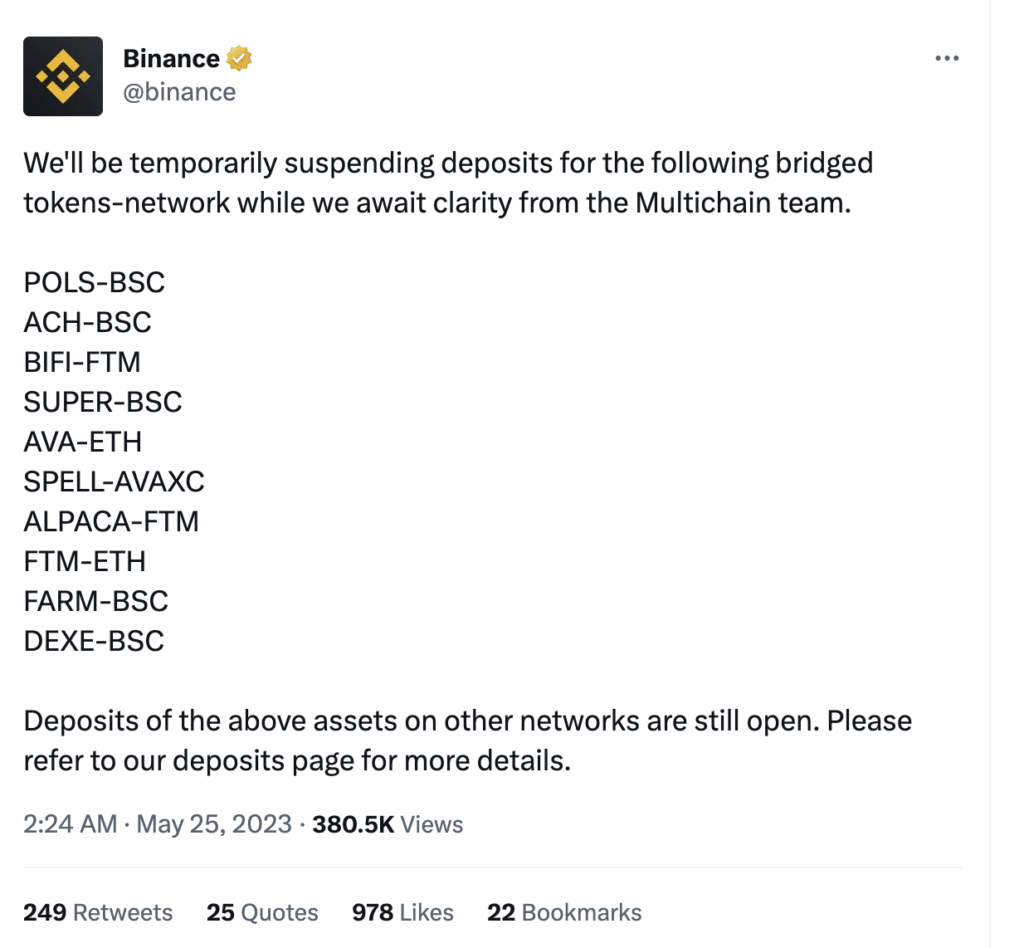

In a tweet that went out on Might 25, Binance shared that they are going to quickly be suspending deposits for bridged tokens-network whereas they await readability.

The announcement impacts the next pairings, POLS-BSC, ACH-BSC, BIFI-FTM, SUPER-BSC, AVA-ETH, SPELL-AVAXC, ALPACA-FTM, FTM-ETH, FARM-BSC, DEXE-BSC on the BNB Sensible Chain, Fantom, Ethereum, and Avalanche blockchain networks.

As said on Binance’s deposit web page, though deposits for these particular tokens are quickly halted, withdrawals of those tokens and deposits on different supported networks stay unaffected and proceed to be obtainable for customers.

The gas for uncertainty

Regardless of Binance attributing the suspension to Multichain, the corporate has been comparatively silent. The final tweet from Multichain went out on Might 24.

Nevertheless, on Twitter, rumours additionally circulated across the Multichain staff being arrested in Shanghai and inflicting the initiation of the switch of funds.

In response to @ArkhamIntel on Twitter, staff wallets related to the undertaking have reportedly shifted roughly $3 million value of $MULTI to the cryptocurrency trade Gate.io. These developments have additional contributed to investor apprehension, leading to a major 26.5% drop within the value of $MULTI inside a 24-hour interval.

This incident highlights the vulnerability of the cryptocurrency market to technical points, regulatory uncertainties, and unverified info, reiterating simply how vital transparency, communication, and immediate decision of points are to the continuing growth and adoption of cryptocurrencies.