Knowledge reveals Ethereum’s 12 months of excessive correlation with Bitcoin is coming to an finish with the metric hitting ATH values.

Ethereum Ends 2022 With All-Time Excessive Correlation To Bitcoin

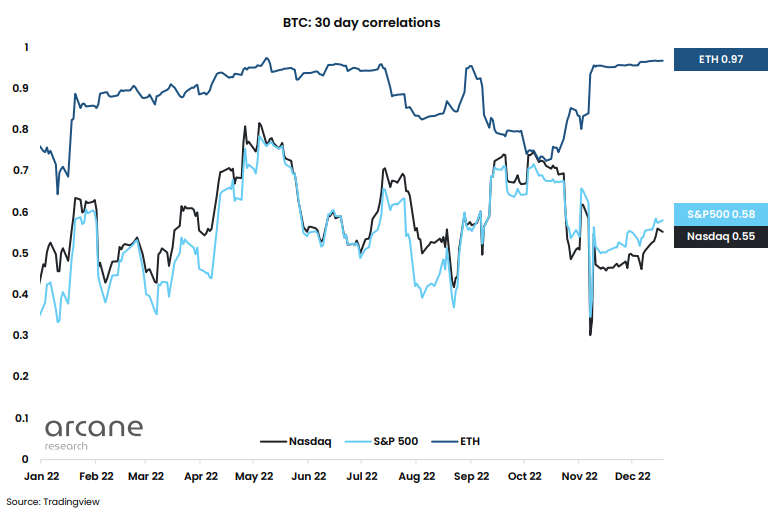

Based on the year-end report from Arcane Research, the worldwide markets have all fallen strongly correlated this 12 months. The “30-day correlations” is an indicator that measures how in-tune Bitcoin has been with one other asset when it comes to worth motion over a 30-day interval.

When the worth of this metric is bigger than zero, it means there was a optimistic correlation between BTC and the opposite asset previously month. Then again, detrimental values indicate that the worth of the crypto has been reacting to adjustments within the worth of the opposite asset by transferring in the other way.

Additionally, the upper the metric worth (in both path), the extra the diploma of the correlation. Naturally, the metric has a worth equal to zero suggesting the 2 costs aren’t tied to one another in the intervening time.

Now, here’s a chart that reveals the pattern in Bitcoin’s 30-day correlations with Ethereum, S&P 500, and Nasdaq over the previous 12 months:

Appears just like the metric's worth equivalent to ETH has been very excessive in latest weeks | Supply: Arcane Research's 2022 - Year in Review

Because the above graph shows, Bitcoin positively correlated with these three belongings throughout 2022. BTC’s correlation has been round or above 0.5 for many of the 12 months for the US equities, suggesting it has been decently tied with them.

The correlation with Ethereum, nonetheless, has been at values of round 0.9 or extra, implying Bitcoin has been extraordinarily correlated with it. Even now, because the 12 months’s finish, the correlation between these cryptos stands at 0.97, round ATH ranges.

Again in September of this 12 months, ETH efficiently completed its much-anticipated transition to a Proof-of-Stake consensus system, an occasion referred to as the Merge. Because the Merge introduced some developments distinctive to Ethereum, the correlation with BTC dropped, as is obvious within the chart.

Nevertheless, it wasn’t lengthy earlier than the 2 began transferring on the identical wavelength once more, so even the Merge wasn’t sufficient to trigger ample influence to separate the cash.

Additionally, since Bitcoin is extremely correlated with shares, so is Ethereum. Although, Arcane Analysis expects that this correlation between the cryptos and the US equities will soften within the subsequent 12 months attributable to buying and selling volumes within the crypto market declining considerably.

ETH Worth

On the time of writing, Ethereum’s price floats round $1,200, down 2% within the final week.

ETH appears to have gone down just lately | Supply: ETHUSD on TradingView

Featured picture from Pierre Borthiry – Peiobty on Unsplash.com, charts from TradingView.com, Arcane Analysis