Ethereum transaction charges are as soon as once more hitting highs final seen since Could 2022. This growth has raised considerations in regards to the impression on the Ethereum community utilization and its native cryptocurrency, ETH.

Ethereum, the second-largest crypto by market capitalization, is likely one of the main decentralized finance (DeFi) and non-fungible tokens (NFTs) platforms. The community has been experiencing a surge in exercise as a result of growing reputation of memecoins akin to PEPE, which has induced charges to spike.

Rising Transaction Charges: A Trigger For Concern

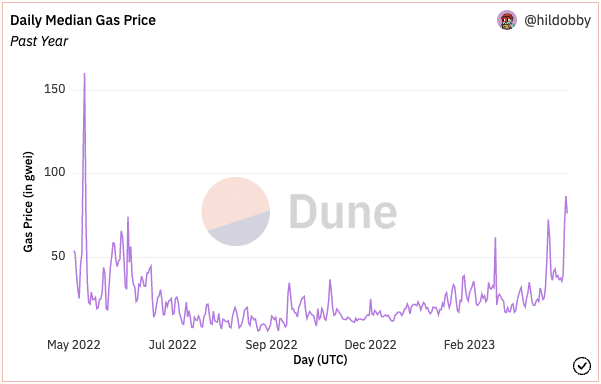

On Could 2, the median common transaction charge on the Ethereum community soared to round 87 gwei, based on Dune Analytics. This spike was primarily attributed to the elevated on-chain exercise surrounding memecoin buying and selling, based on Hildobby, a pseudonymous information researcher at VC agency Dragonfly.

Memecoins akin to Pepe the Frog-themed token have been having fun with a renaissance lately, with the token value hovering over 266 occasions in simply 4 days in April. The memecoin’s market cap rose to over $500 million this week earlier than crashing under $400 million once more.

Whereas this surge in activity might point out growing curiosity within the crypto market, it additionally highlights considerations in regards to the community’s scalability and the impression of rising charges on customers. Excessive transaction charges can deter customers from interacting with decentralized functions on the Ethereum community; because the charges enhance, smaller customers are priced out of the platform and its functions.

Notably, the rise in memecoin buying and selling exercise, which elevated the variety of transactions on the Ethereum community, resulting in a surge in charges, has additionally made decentralized exchanges (DEXs) on Ethereum expertise the best stage of customers since 2021.

Dune Analytics data reveals that Ethereum-based DEXs noticed a surge in quantity, with the full buying and selling quantity on these platforms surpassing $63 billion in April alone. This represents a big enhance from March, when the full buying and selling quantity was round $31 billion.

What This Means For ETH

It’s value noting that the rising transaction charges on the Ethereum community are seen as a drawback to the worth of ETH, as customers might search alternative blockchains with decrease transaction prices. An occasion of that is the growing curiosity in different L1 blockchains akin to Solana (SOL), Cardano (ADA), Fantom (FTM), and so forth.

Nonetheless, Ethereum co-founder Vitalik Buterin lately recommended that the community might quickly scale up to 100,000 transactions per second. This might assist alleviate community scalability considerations and scale back transaction charges.

Regardless, the elevated exercise could also be a optimistic signal of rising curiosity within the crypto market; but it surely has an costly value tagged. The rise in charges might discourage smaller transactions and result in a decline in demand for ETH.

Wwith Ethereum’s scalability enhancements within the pipeline, it stays to be seen how the community will evolve within the coming months. In the meantime, ETH price has declined 0.4% after a possible surge to commerce above $2,000, final month.

ETH presently trades for $1.872 on the time of writing. ETH has a 24-low of $1,855 and a 24-high of $1,919, based on information from CoinMarketCap. Whatever the market decline, the asset’s buying and selling quantity has solely ranged between $8 billion and $9 billion previously two weeks.

Featured picture from Shutterstock, Chart from TradingView