On-chain information reveals that Ethereum realized volatility has now declined to uncommon ranges noticed solely thrice earlier than in historical past.

Ethereum 1-Month Realized Volatility Has Plummeted To Simply 39.8%

As per information from the on-chain analytics agency Glassnode, the month of December 2022 was traditionally quiet for each Ethereum and Bitcoin. The “realized volatility” is an indicator that measures the usual deviation of each day returns from the imply for the market in query.

The indicator is normally taken over a rolling window, with the one-week and one-month variations being typically essentially the most helpful timespans for it. Within the context of the present dialogue, the related metric is the one-month realized volatility.

When the worth of the metric is excessive, it means the asset’s value has been exhibiting better fluctuations from the common not too long ago. Such a pattern implies that the market is offering a excessive buying and selling threat presently. Alternatively, low values recommend returns haven’t deviated a lot from the imply, and therefore that the worth has been caught in stale consolidation.

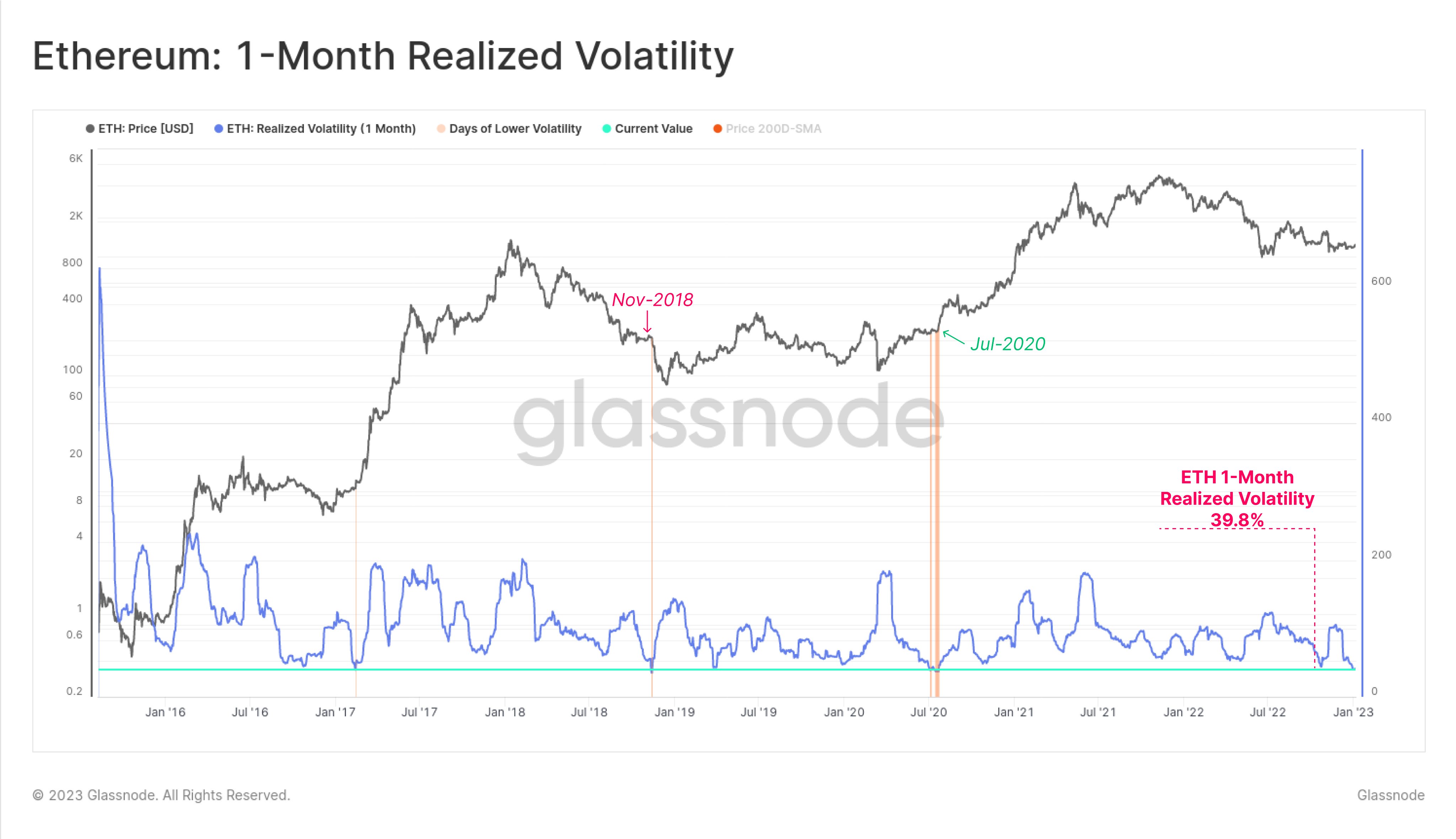

Now, here’s a chart that reveals the pattern within the one-month Ethereum realized volatility over the previous few years:

Appears like the worth of the metric has declined in current days | Supply: Glassnode on Twitter

As displayed within the above graph, the Ethereum one-month realized volatility has plunged to simply 39.8% not too long ago, suggesting that the previous month has had little or no range in day-to-day returns. This present stage of the indicator is definitely a traditionally low worth, and as is obvious from the chart, there have solely been three cases within the historical past of the crypto the place the worth has been this secure.

Apparently, after every incidence of the volatility hitting these lows, the worth has made a pointy transfer and the indicator has jumped again up. An necessary instance of this was again in November 2018, when the worth of ETH collapsed towards the underside of the bear market in a sudden transfer, after the metric had reached these uncommon ranges.

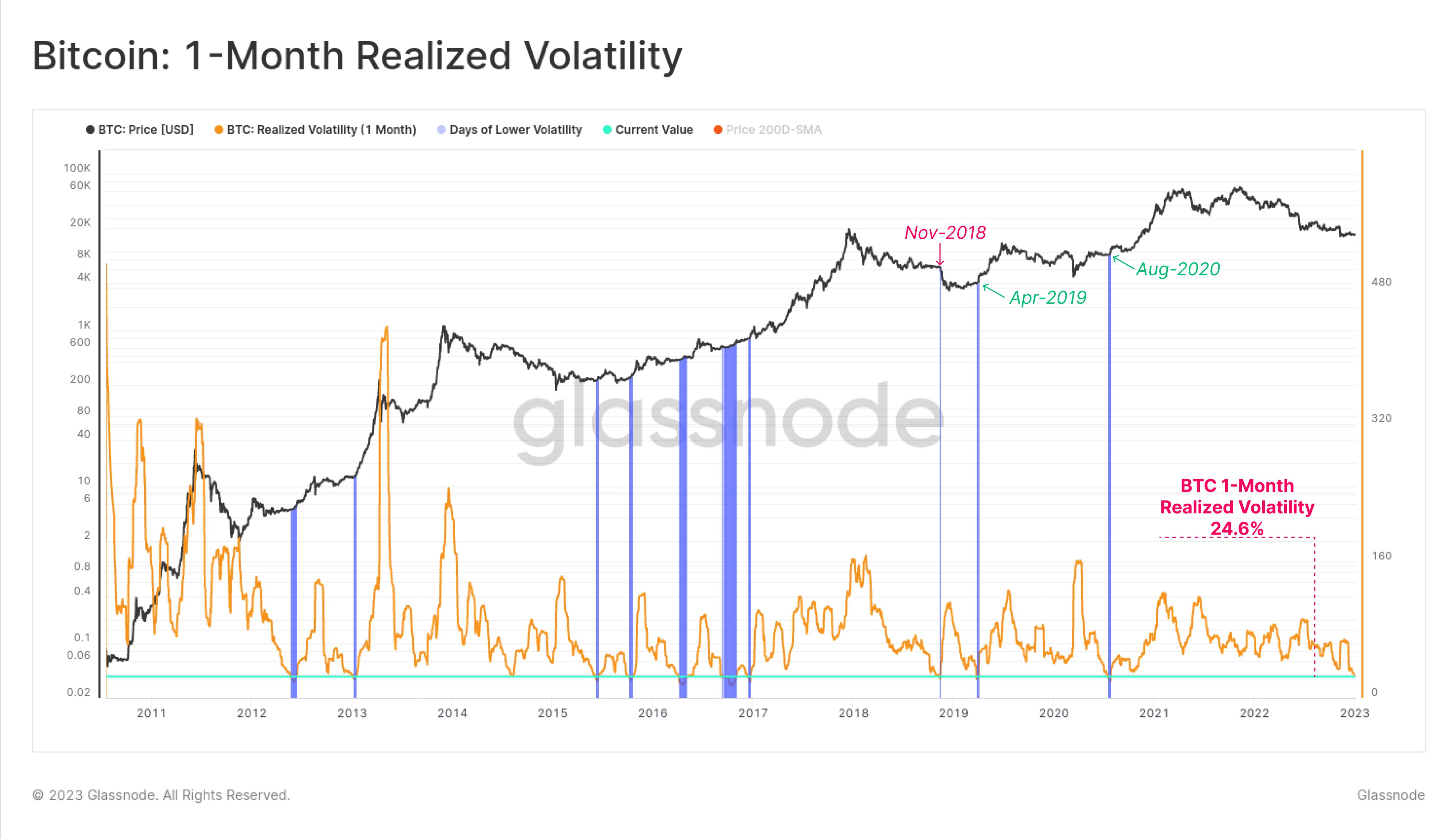

Glassnode additionally factors out that, identical to for Ethereum, the one-month realized volatility for Bitcoin has additionally plunged to historic lows not too long ago, because the under chart highlights.

The worth of the metric appears to have hit very low values not too long ago | Supply: Glassnode on Twitter

As you possibly can see above, the Bitcoin one-month realized volatility has solely been decrease than the present worth (24.6%) a couple of instances in all the historical past of the crypto. A notable occasion right here was additionally in November 2018, the place, identical to ETH, BTC crashed right down to type its backside.

If these historic developments are something to contemplate, then the present extraordinarily low values within the one-month volatility for Ethereum and Bitcoin might imply each the cryptos could quickly see a major spike within the metric quickly, however the accompanying value transfer may very well be towards both path.

ETH Worth

On the time of writing, Ethereum’s price floats round $1,300, up 8% within the final week.

ETH has shot up throughout the previous day | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com