Lido Finance, a well-liked DeFi protocol, has paused the staking and withdrawal performance of MATIC, the native token of Polygon, an Ethereum sidechain.

In a tweet on Mar. 6, Lido Finance mentioned the choice was reached resulting from a bug affecting stMATIC withdrawals. This resolution was taken out of prudence to guard consumer funds.

Lido on Polygon staking + withdrawal performance has been briefly paused for troubleshooting because of the discovery of a bug affecting stMATIC withdrawals.

TLDR: All funds are protected and deposits and withdrawals will resume within the subsequent few days.

— Lido (@LidoFinance) March 6, 2023

Nevertheless, to assuage fears from the broader DeFi and crypto group, the protocol assured customers that each one funds had been protected.

The bug was identified earlier as we speak and impacted massive stMATIC holders who needed to withdraw. Particularly, the error affected a consumer requesting a big withdrawal quantity cut up between completely different nodes. Requesting stMATIC withdrawal from a single node is easily executed, and the consumer receives the right amount of MATIC tokens.

The flaw shall be corrected throughout the subsequent few days. Throughout this time, rewards accrued throughout downtime gained’t accumulate. When common operation resumes, the protocol will robotically begin distributing rewards retroactively.

Lido Finance is a decentralized liquid staking platform that helps 5 chains, together with Ethereum and Polygon. Staking is a vital characteristic in public chains. It permits customers to take part in community safety. Particular node operators referred to as validators should stake a specific amount of cash for an opportunity to validate networks and earn community rewards.

As a result of generally the quantity of cash the community stipulates the validator to lock could be out of attain from most retailers, Lido Finance is among the many many protocols permitting extraordinary customers to stake cash by their nodes for a share of community rewards.

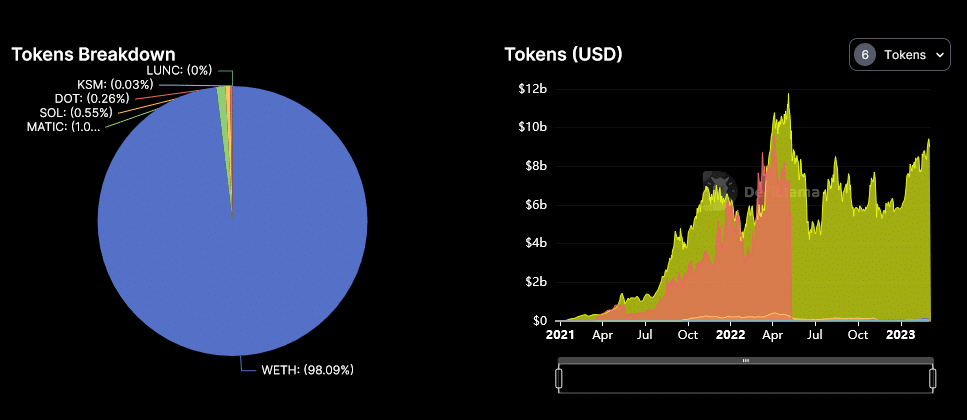

TLV at $9.18b, ETH stake dominates

Of the 5 blockchain cash supported, Lido Finance helps the staking of MATIC. The equal quantity the staker holds, representing coin staked, is a spinoff model, on this case, stMATIC.

As of March 6, Lido Finance managed $98.16 nillion of MATIC, representing roughly one % of the full worth locked (TVL) within the protocol, at $9.18b. This makes the platform the most important in DeFi by TVL.

Even so, most customers use Lido Finance to lock ETH, whose share of the protocol’s TVL is $9.11 billion. The spike of ETH staked is forward of the extremely anticipated Shanghai-Capella improve scheduled within the subsequent few weeks.

Polygon ID builders lately released 4 instruments in a bid to allow the constructing of a extra equitable web the place privateness shall be paramount.