Amidst the present bearish market situation, Litecoin which is sometimes called the silver to Bitcoin’s gold didn’t fail to carry pleasure to its buyers. The altcoin registered large features over the past seven days.

Right here’s AMBCrypto’s Price Prediction for Litecoin for 2023-24

Extra excellent news got here in for LTC when the coin was listed among the many high cryptos when it comes to Galaxy Rating, which is a promising bullish sign.

Present high 10 cash by LunarCrush Galaxy Rating™:

1️⃣ $collie

2️⃣ $flux

3️⃣ #amplifi

4️⃣ $nebl

5️⃣ $clo

6️⃣ $ltc

7️⃣ $wtk

8️⃣ $okb

9️⃣ $snm

🔟 $ambhttps://t.co/BFkfJIFO20— JU’MetaAsset (@Jeedjameel) October 26, 2022

Moreover, Litecoin was additionally listed on Blockbank, a CeFi and DeFi platform. This new itemizing is not going to solely assist LTC enhance its attain, however can even permit new buyers to enter the Litecoin ecosystem.

NEW LISTING: @Blockbankapp crypto customers can now purchase and commerce #Litecoin⚡ https://t.co/dsD6LhP79d

— Litecoin (@litecoin) October 26, 2022

Now, you would possibly ask if LTC’s pump was due to its ecosystem-centric developments, or if it was only a consequence of Bitcoin’s worth surge. Properly, a have a look at its metrics will reveal the reply. However one level to be famous right here is {that a}t press time, LTC was buying and selling at $56.52, almost 10% greater than the final week, which was increased than that of Bitcoin’s 7-day worth.

Not all have been in favor

LTC’s on-chain metrics supplied some readability on the matter, as just a few of them have been backing the surge, whereas the others have been indicating a pattern reversal.

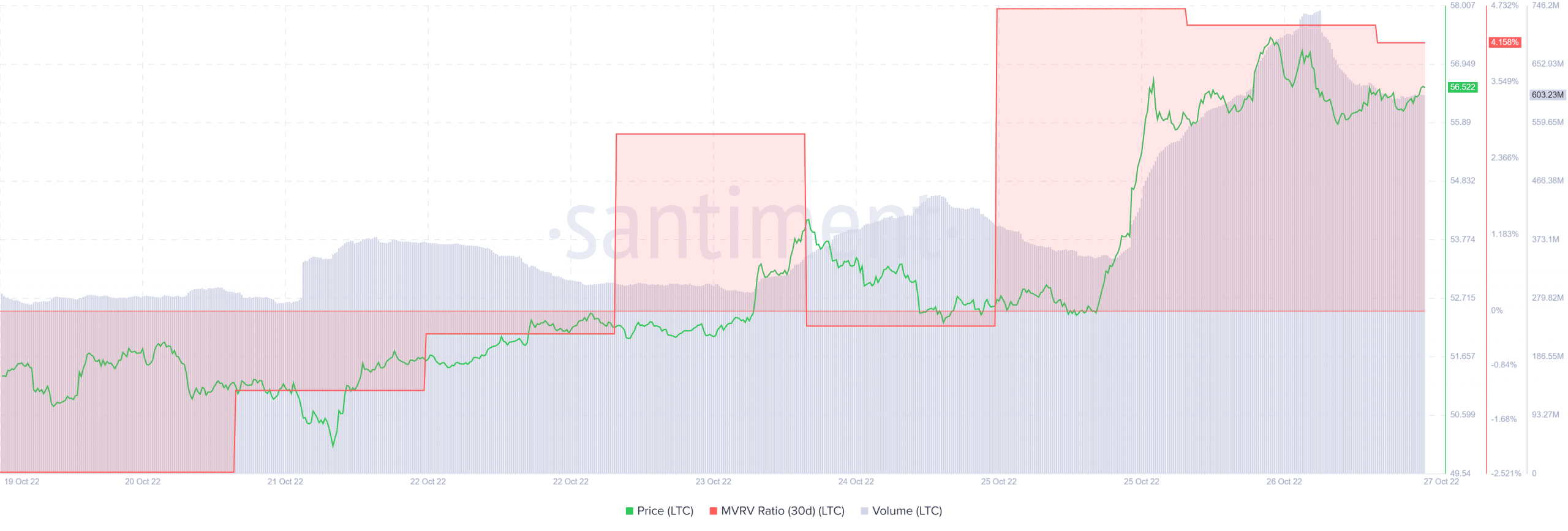

LTC’s MVRV Ratio went up significantly over the past week, which is a bullish signal. Furthermore, the coin’s quantity was additionally in its help because it elevated together with the MVRV Ratio.

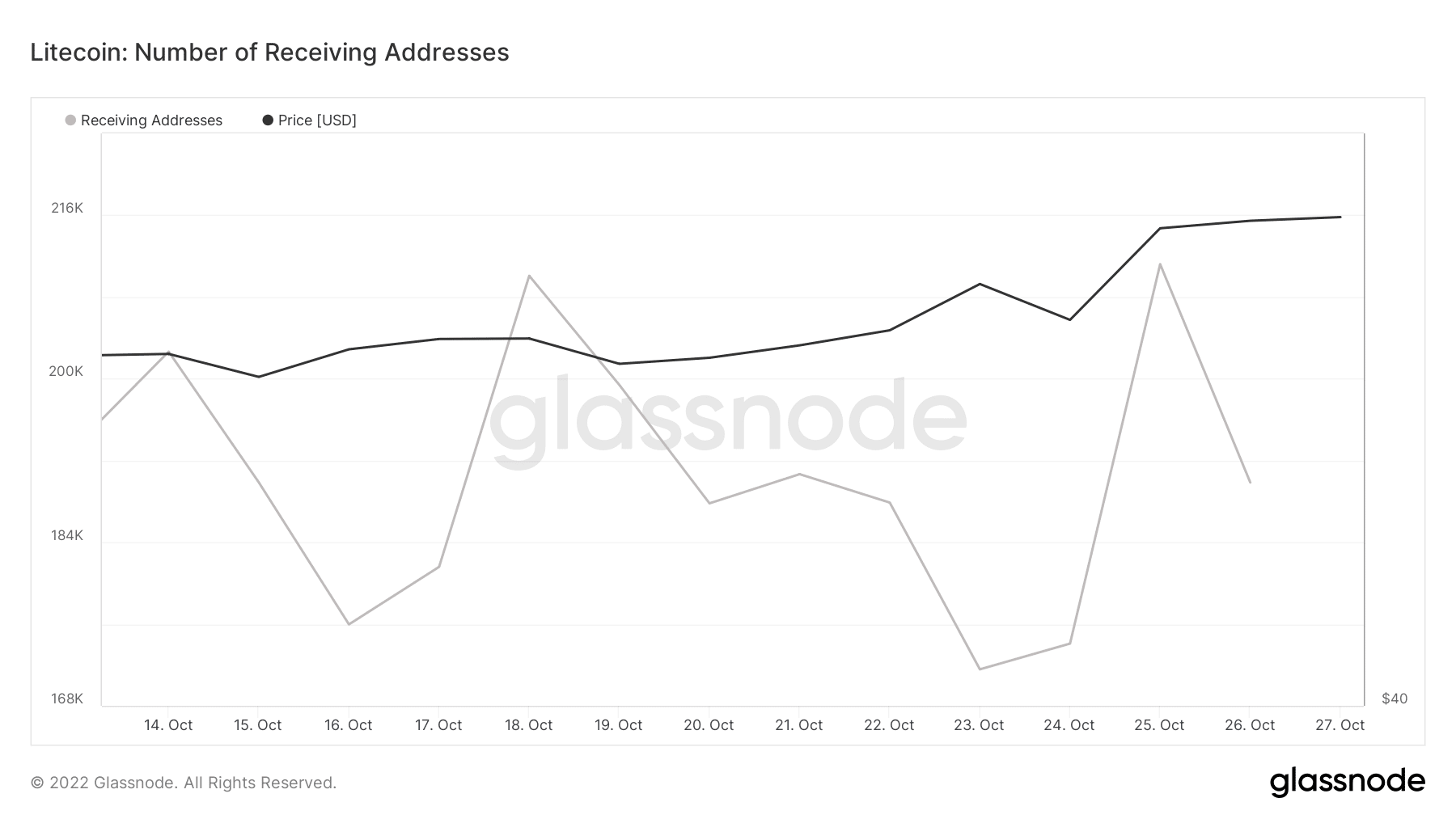

Nonetheless, Glassnode’s knowledge revealed a unique story for Litecoin. LTC’s variety of receiving addresses registered a decline over the previous couple of days, which is a destructive sign.

Not solely this, however Litecoin’s reserve danger spiked currently, indicating buyers’ low confidence.

No! LTC’s pump is for actual

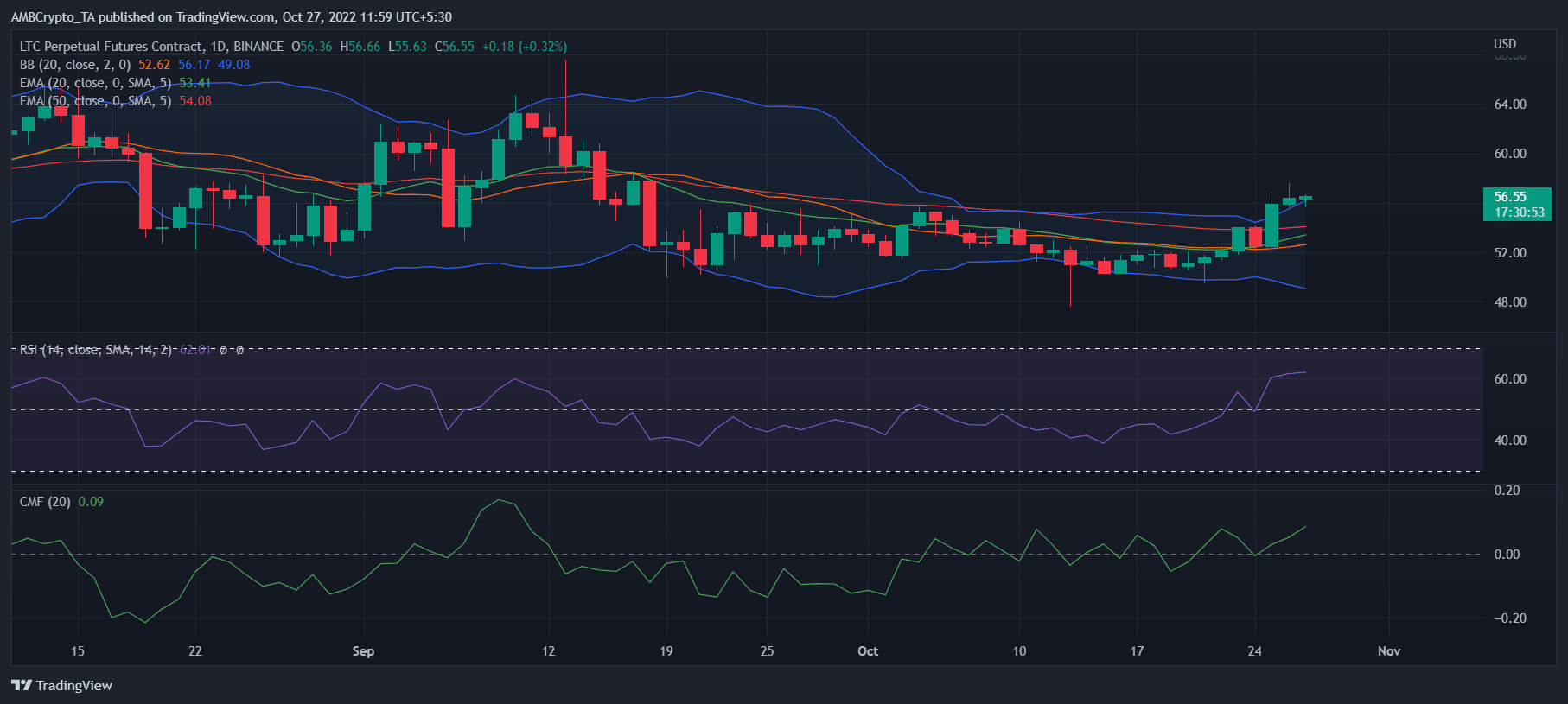

Traders would possibly get comfortable as LTC’s every day chart urged that the pump was not only a mere consequence of the bullish market as a number of market indicators have been sporting an additional northbound motion.

Each the Relative Power Index (RSI) and Chaikin Cash Circulation (FLOW) have been hovering above the impartial place, which is a bullish sign.

Along with that, the 20-day Exponential Transferring Common (EMA) (Inexperienced) was quick approaching the 50-day EMA (Purple), growing the probabilities of a bullish crossover within the coming days.

The Bollinger Band revealed that LTC’s worth was about to enter a excessive volatility zone. Combining all of the market indicators, a continued worth surge was probably, which ought to elate buyers.