- LTC registers promising beneficial properties because the date of halving approaches.

- Market indicators revealed that the bulls have been main.

David Burkett, MWEB developer, posted new updates associated to the Litecoin [LTC] community. Burkett talked about that he continued engaged on PSBT, and rapidly found some limitations within the preliminary design.

He was ready so as to add signing logic for inputs and outputs. Write the transaction finalization logic. Furthermore, Burkett additionally added that he shall be taking a while off, so there won’t be any January updates.

The newest replace from #MWEB developer @DavidBurkett38 is now accessible: Persevering with the engaged on PSBT format for {hardware} wallets together with:

✔Add signing logic for inputs and outputs

✔Write the transaction finalization logic

✔Implement part “merging”#Litecoin⚡ https://t.co/GkO4Qbushv— Litecoin (@litecoin) January 15, 2023

Learn Litecoin’s [LTC] Price Prediction 2023-24

A month stuffed with greens

Due to the bullish market, LTC traders had a good time final month as LTC’s value surged. CoinMarketCap’s information revealed that LTC registered over 6% weekly beneficial properties, and on the time of writing, it was trading at $87.96 with a market capitalization of greater than $6.33 billion.

Because the day of LTC’s halving is approaching, this new 12 months might need even higher days in retailer for Litecoin.

The Litecoin Halving Countdown.. Solely 200 days!!

⚡84,000,000 Max Provide

⚡2.5-minute block intervals

⚡Halving occasion each 4 years

⚡Change into scarcer over timeBe taught extra: https://t.co/u1l4qESPGS #LitecoinFACT #Litecoin $LTC #POW #Halving pic.twitter.com/LOdb53FZ70

— Litecoin Basis ⚡️ (@LTCFoundation) January 14, 2023

The token additionally remained fairly lively on its metrics entrance, which could have performed a key position in its value pump over the previous few weeks.

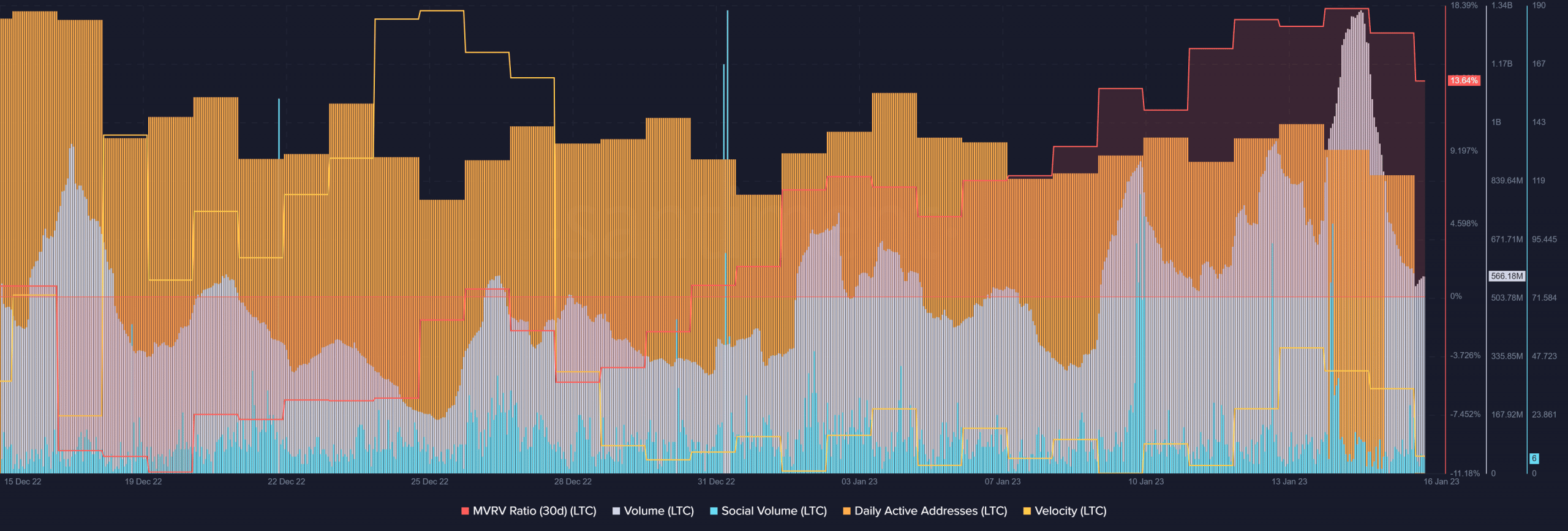

LTC’s MVRV Ratio elevated steadily, which was bullish. Litecoin’s quantity adopted an identical route and went up. The social quantity additionally spiked fairly a number of instances, reflecting LTC’s recognition.

Furthermore, the each day lively addresses on the LTC community remained constant, which indicated a steady variety of customers on the community. The regarding issue was the community progress, which went sharply down.

Life like or not, right here’s LTCs market cap in BTC’s phrases

The bulls are exhausting to beat

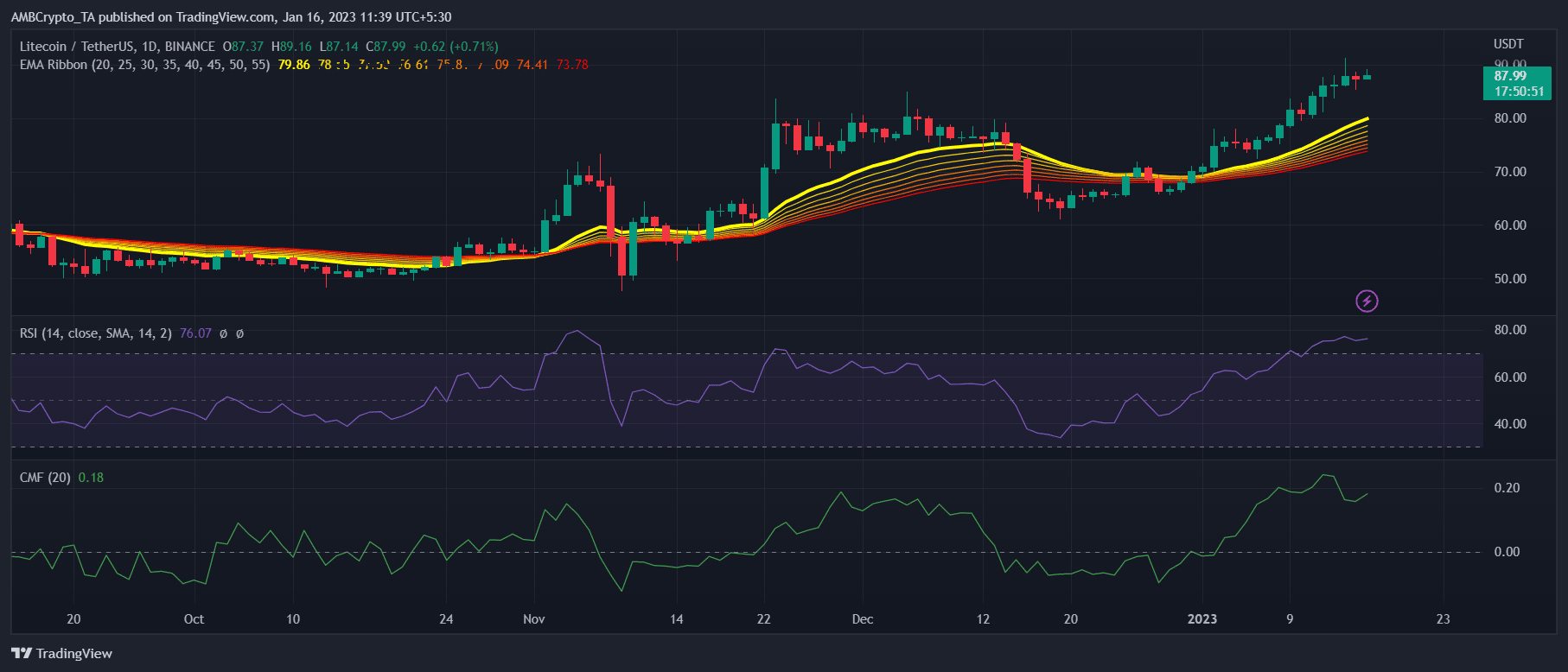

LTC’s each day chart revealed a large bullish benefit available in the market as a lot of the indicators have been in patrons’ favor. As per the Exponential Shifting Common (EMA) ribbon, the 20-day EMA was properly above the 55-day EMA, suggesting a continued uptrend.

The Chaikin Cash Circulate (CMF) was additionally resting above the impartial mark, which regarded bullish. Nonetheless, the Relative Energy Index (RSI) was within the overbought zone, which could result in a rise in promoting strain.