The Litecoin value remained in a consolidation part on Thursday as buyers targeted on the continued FTX contagion. It was buying and selling at $58.70, which is about 24% above the bottom degree this 12 months. LTC/USD and LTC/GBP are about 20% beneath the very best degree this month.

Litecoin hashrate slips

Litecoin value moved sideways on Thursday as buyers mirrored on the most recent contagion on FTX. For instance, crypto exchange Gemini briefly paused withdrawals on Wednesday because the variety of exits elevated.

Additional, Temasek, the enormous Singapore funding firm, stated that it had written off its $275 million funding in FTX. Lawsuits towards FTX have continued being filed in america and different jurisdictions.

The state of affairs was worsened by a collection of Twitter messages that Sam Bankman-Fried had with a Vox journalist. In it, he made a number of confessions, together with the truth that FTX’s accounting was a bit messy on the time.

Discover out how to buy Litecoin.

In the meantime, a lending firm owned by Digital Forex Group (DCG) introduced that it was pausing withdrawals and mortgage originations. That is notable since DCG owns main corporations like CoinDesk and GreyScale Investments, which runs the most important Bitcoin Futures ETF.

Litecoin value additionally consolidated as Bitcoin’s fear and greed index declined to the concern space. Traditionally, cryptocurrency costs have a tendency to say no when the index is within the concern space.

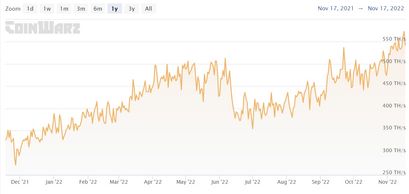

In the meantime, Litecoin’s hash charge has plunged to the bottom degree since November 13. It presently stands at 517 TH/s, which was a lot decrease than this month’s excessive of 580. Hashrate is a crucial metric in proof-of-work cryptocurrencies because it measures the computation energy on a blockchain.

It determines the variety of guesses made per second. A decrease determine implies that the community is much less safe. Nonetheless, Litecoin’s hashrate is sitting near its all-time excessive.

Litecoin value forecast

The chart above is named a renko. It differs from the standard candlestick in that it focuses on value actions reasonably than value and time intervals. Some merchants consider that renko is a greater chart to commerce because it removes the noise.

The chart reveals that Litecoin value has shaped a sample often called a widening wedge. In value motion evaluation, this sample is normally a bullish signal. The Superior Oscillator has been caught on the impartial degree.

Subsequently, whereas Litecoin and different cash are dangerous now, the wedge sample factors to a possible bullish breakout within the close to time period.