The governance token of MakerDAO, MKR, topped good points final week, trackers on Mar. 5 present.

MakerDAO leads weekly good points

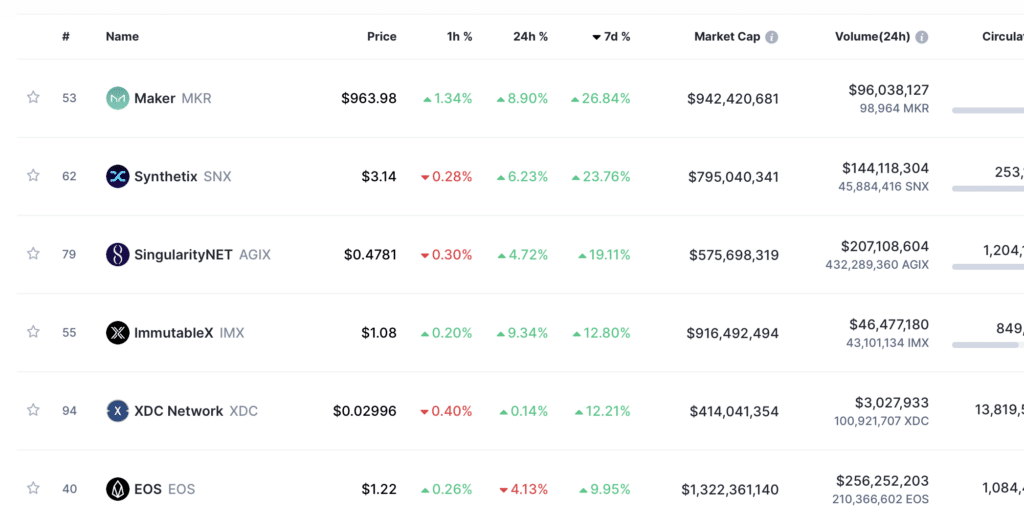

MKR roared roughly 27% in seven days ending Mar. 5, pushing its market cap to over $942m. At this stage, MKR outperforms the broader crypto market, together with bitcoin (BTC) and ethereum (ETH).

As an illustration, BTC and ETH are down 4.5% and three.5%, respectively, previously week of buying and selling.

As of writing, MKR is altering fingers at $963, up about 9 % previously 24 hours and secure within the final hour.

There are a number of components behind the MKR surge. Amongst them is information that the protocol would possibly quickly enable customers to borrow DAI, their algorithmic stablecoin monitoring the USD, utilizing MKR.

MakerDAO additionally lowered charges to as little as 0.5% on its staking product that’s anchored on Rocket Pool ETH (rETH). The 0.5% annual price is without doubt one of the lowest amongst opponents.

• Annual charges as little as 0.5%.

• Maker Protocol.

• @Rocket_Pool staked ETH.

• DAI stablecoin.

The most affordable $rETH borrowing product via the biggest DeFi lending protocol with essentially the most liquid decentralized stablecoin. pic.twitter.com/xDsApOt7an

— Maker (@MakerDAO) March 1, 2023

In addition to the price change, the protocol additionally elevated its debt ceiling from 5m to 10m DAI. Stress-free the debt ceiling means the liquidation ratio for the rETH vault is extra enticing, a web optimistic for MKR.

MakerDAO is a decentralized cash market and one of many first DeFi platforms. It permits token holders to lend out belongings in return for a yield. In the meantime, debtors can take loans by depositing collateral. The protocol stays one of many largest DeFi options.

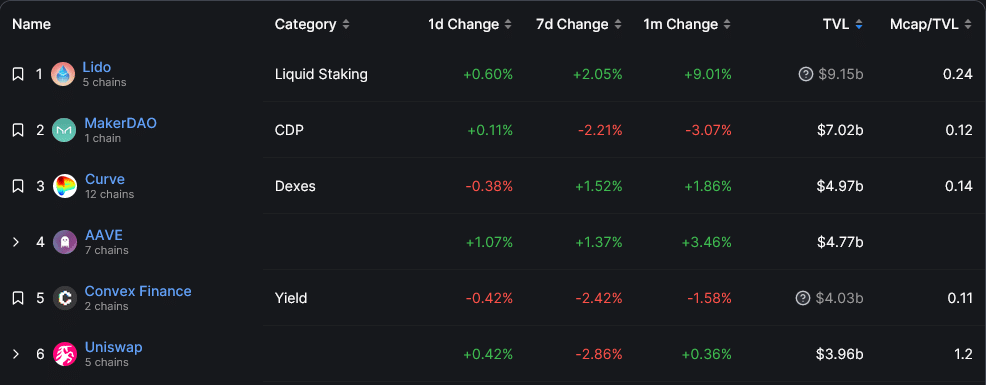

As of Mar. 5, DeFiLlama shows that it had a complete worth locked (TVL) of $7.02b, down two % within the final week.

Even so, it stays the second largest DeFi protocol by TVL solely after Lido Finance, a decentralized liquidity supplier permitting customers to stake on, amongst different proof of stake blockchains, Ethereum.

Synthetix amongst different high performers

In addition to MakerDAO, Synthetix’s native token, SNX, is available in second, including 23%.

After a profitable safety audit, the decentralized derivatives DEX just lately deployed their v3 on the Ethereum mainnet. Synthetix v3 on Ethereum is extra environment friendly and permits builders to create much more advanced derivatives.

In the meantime, SingularityNet coin, AGIX; ImmutableX, IMX; and the XDC Community, XDC, posted double-digit good points, capping the highest 5 by including 19%, 12.8%, and 12.2%, respectively.