MakerDAO is contemplating investing $750 million in US Treasury bonds to make the most of the present yield surroundings, with the proposal anticipated to extend the ceiling to $1.25 billion.

If permitted, the proposal will enhance the ceiling to $1.25 billion, including to the $500 million permitted in October.

The DAO intends to make use of a ladder technique with a biweekly rollover to spend money on six-month US Treasury bonds. The notes can have maturities which are equally break up over the whole interval, with the pliability to maneuver to a extra advanced or totally different ladder scheme if wanted.

The motivation for the proposal is to generate further income on Maker’s PSM Property, with the flexibility to accommodate materials changes and upgrades as required below prevailing, related Maker RWA-related insurance policies. Given the present market turmoil, the transfer might assist Maker scale back counterparty and credit score danger.

MakerDAO advances within the DeFi area

Maker was within the information when it allotted $500 million in Treasury and company bonds, with detractors saying it didn’t conform to the spirit of decentralization. ShapeShift founder Erik Voorhees was amongst those that criticized the choice.

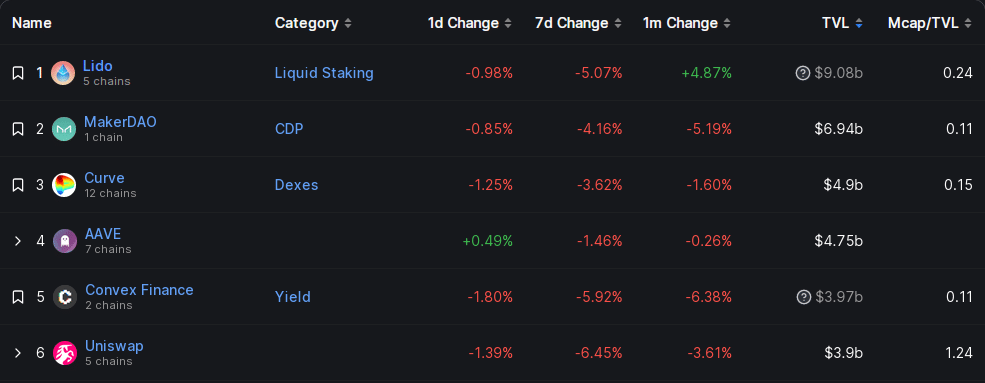

MakerDAO is a decentralized cash market and one of many first DeFi platforms, permitting token holders to lend out belongings for a yield and debtors to take loans by depositing collateral. Regardless of criticism, Maker stays one of the highly effective entities within the DeFi area, with a complete worth locked (TVL) of $6.94 billion as of Mar. 8, making it the second largest DeFi protocol by TVL after Lido Finance.

Final month, the MakerDAO group put aside 5 million DAI for a authorized protection fund to cowl facets of authorized protection that conventional insurance coverage wouldn’t cowl. It additionally announced an Aave competitor referred to as Spark Protocol, which can leverage DAI for liquidity and supply a lending product as its first providing. Just lately, it sparked discussions for a proposal permitting DAI to borrow from MKR tokens.