MakerDAO is insulating itself from the vulnerability to threat related to stablecoins in response to the agency’s new proposal.

It’s a response to the current depegging of USDC, which has rekindled worries over stablecoins in poor market circumstances. This proposal has seen MKR achieve over 5% within the final 24 hours, trackers on Mar. 11 present.

The pressing proposal goals to unravel the issue related to unstable cryptocurrencies. The latter will emphasize minimizing publicity to unstable stablecoins whereas concurrently working to extend the DAI peg’s resilience. DAI is an algorithmic stablecoin issued by MakerDAO.

How MakerDAO goals to realize this

The DeFi platform intends to perform these aims by elevating the prices related to USDC-DAI swaps. As well as, if the plan is accepted, a most of 250m DAI could also be minted each day.

To handle the uncertainty surrounding the centralized stablecoin market, the Danger Core Unit has submitted an emergency proposal for Govt Vote to restrict Maker’s publicity to impaired stablecoins and reinforce the DAI peg.

— Maker (@MakerDAO) March 11, 2023

The logic for rising swap prices is that doing so will cut back the variety of USDC-DAI swaps whereas additionally offering an incentive for utilizing different strategies of promoting USDC. If such measures aren’t made, there’s a chance that extra publicity to the liquidity issues related to stablecoin runs would consequence.

The plan has a number of incentives, together with an elevated debt restrict of 1b DAI. The USDP to DAI trade cost is greater than the DeFi platform desires to get right down to zero %.

MKR is trending

Although March has been a dismal month to this point, MKR merchants ought to discover that the token has maintained an excellent portion.

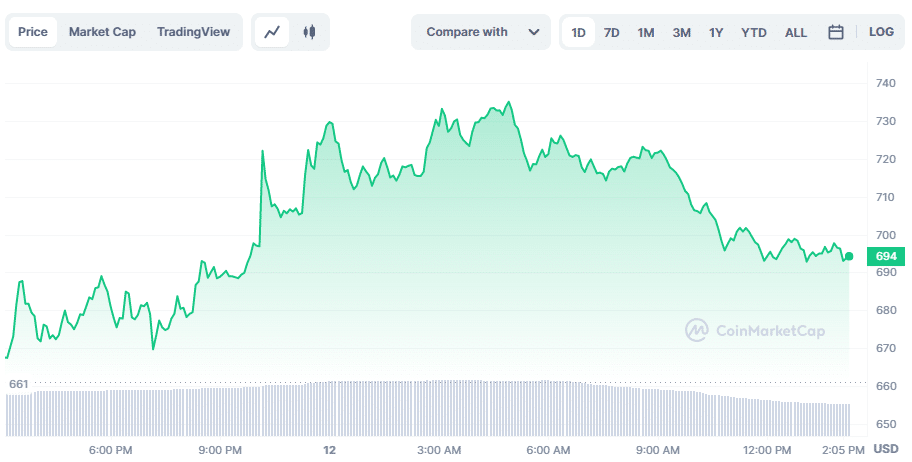

As of CoinMarketCap on Mar. 12, the asset elevated from its earlier 24-hour value by 5.2% to $695.21. The altcoin, which has recorded a 24% lower regardless of the rise, recorded a 5% improve in its market cap throughout the similar interval.

The asset had a circulating provide of 977,631 MKR on the time of writing.