Hours after the US Securities and Alternate Fee (SEC) had issued a Wells discover to Paxos, the issuer of BUSD, the corporate was reportedly instructed to cease issuing the stablecoin.

New York regulator orders Paxos to cease new BUSD minting

Changpeng Zhao, the CEO of Binance, broke the information on Feb. 13 after being knowledgeable by Paxos.

#BUSD. A thread. 1/8

In abstract, BUSD is issued and redeemed by Paxos. And funds are #SAFU!

— CZ 🔶 Binance (@cz_binance) February 13, 2023

Paxos is regulated by the New York State Division of Monetary Providers (NYDFS) and claims to be compliant with US legal guidelines. It’s reportedly taking this step following an order from New York regulators.

It was revealed that Paxos obtained a Wells discover from the SEC earlier. The company claims BUSD is unregistered safety, compliant with the factors laid out underneath the Howey Check. The Howey Check lays down features that qualify an asset to be categorised as a safety and positioned underneath SEC’s rules.

By receiving the Wells discover, the stablecoin issuer was supposed to elucidate, in writing, why the company shouldn’t go on with an enforcement motion, on this case, a lawsuit.

The Wells discover has not been made public, however its content material is well-known to folks conscious of what’s taking place inside Paxos.

There was no official remark from Paxos on this growth. On the similar time, the NYDFS is but to difficulty the assertion.

What’s publicly recognized is that Paxos points BUSD underneath the Binance model. Binance is the world’s largest change by shopper depend however isn’t instantly related to Paxos. Paxos takes full management in minting BUSD.

BUSD market cap reducing

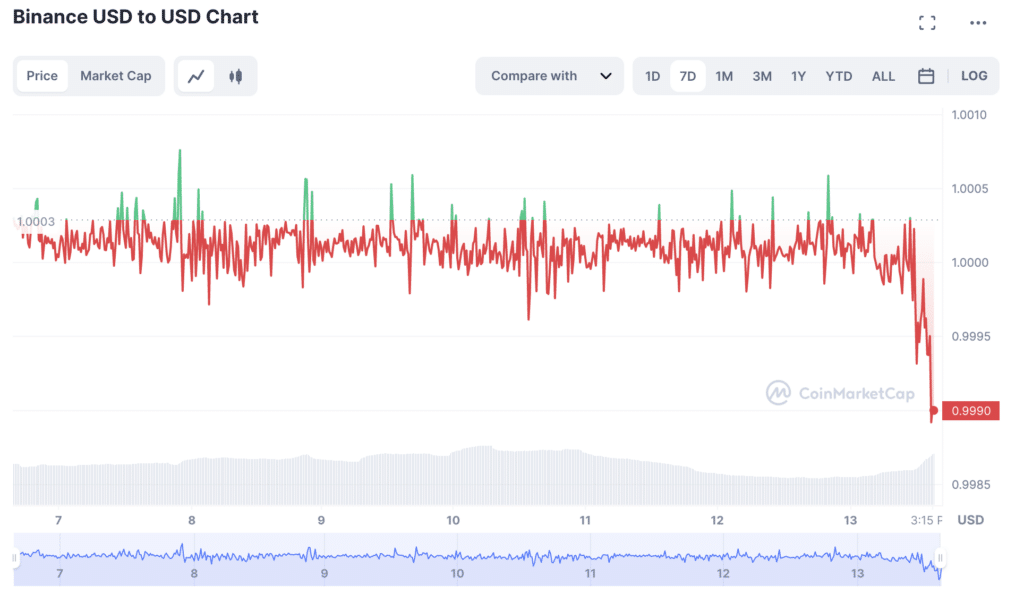

As of writing on Feb. 13, BUSD was the third largest stablecoin by market cap with a circulating provide of $16.1b. The stablecoin additionally trades beneath the $1 parity, with the USD at $0.9995.

The slight de-pegging may, following the announcement, be because of outflows to different stablecoins, together with USDT and USDC.

How this might affect the stablecoin dynamics throughout the board is but to be recognized.

Even so, Changpeng Zhao expects “BUSD’s market cap to proceed reducing,” and Paxos will proceed to service the product, managing redemptions.