A quant has damaged down how the Bitcoin MVRV MACD oscillator could possibly be used to verify for alerts within the value.

Bitcoin MVRV MACD Oscillator As Value indicator

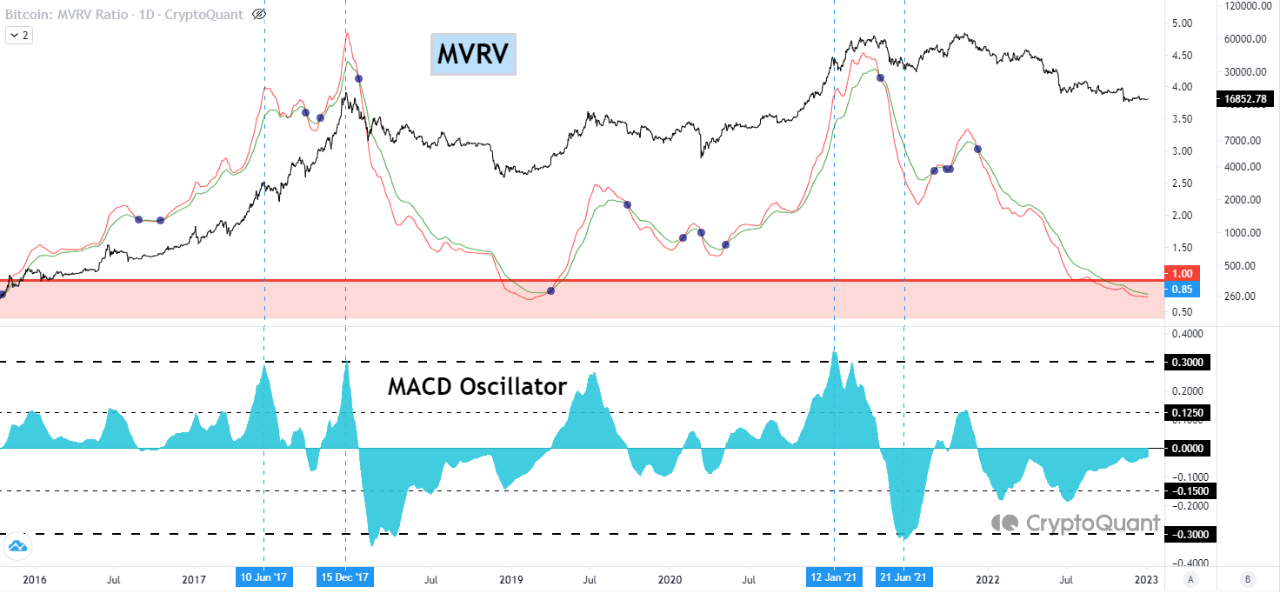

As defined by an analyst in a CryptoQuant post, this metric might help detect each the lows and the highs within the value, in addition to the higher developments. The “Bitcoin MVRV” is an indicator that measures the ratio between the market cap and the realized cap.

Right here, the “realized cap” is a capitalization mannequin for BTC that values every coin in circulation on the value at which it was final moved, somewhat than taking the identical present BTC value as the worth of all of the cash, as the conventional market cap does.

For the reason that realized cap is form of a “true” worth mannequin for the coin, its comparability with the market cap (within the MVRV) can inform us whether or not the coin is undervalued or overvalued in the mean time. When the MVRV is larger than 1, it means BTC is overpriced proper now, whereas having values beneath the edge suggests it’s underpriced.

Now, to make use of MVRV as a buying and selling instrument, the quant has taken the MACD oscillator of the indicator. A MACD oscillator is simply the distinction between the short-term and long-term exponential shifting averages (EMA) of the metric in query. Right here, these EMAs are the 50-day and the 100-day variations.

The beneath chart reveals how the Bitcoin MVRV MACD can be utilized for locating tops and bottoms within the value:

The metric appears to have approached a price of 0 not too long ago | Supply: CryptoQuant

Based on the quant, at any time when the MVRV MACD has been greater than 0.3, it has been a sign that BTC is overbought at present. Then again, values lower than -0.3 have signaled underbought situations.

From the chart, it’s obvious that whereas these alerts haven’t coincided with the cycle tops and bottoms, they’ve nonetheless accurately indicated some native tops and bottoms.

Now, right here is one other graph the place the analyst has highlighted how divergences between the worth and the MVRV MACD can sign future developments:

Varied divergences between BTC and the MVRV MACD | Supply: CryptoQuant

“A divergence happens when the path of a technical indicator and the path of the worth pattern are shifting in reverse instructions,” explains the analyst. Within the graph, it’s seen that at any time when the MVRV MACD has moved up contained in the detrimental area whereas the worth consolidates sideways or declines, a bullish divergence has fashioned for Bitcoin.

Equally, a bearish divergence has taken form when the worth of the crypto has been rising, however the indicator has been happening within the zone above zero. At current, none of those alerts have fashioned within the present bear market to date.

BTC Value

On the time of writing, Bitcoin is buying and selling round $16,800, up 1% within the final week.

Appears like BTC has stagnated after the rise yesterday | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com