Regardless of an ongoing bear market, crypto funds processors BitPay and Coingate recorded a notable uptick in crypto funds in 2022, with Bitcoin nonetheless essentially the most most well-liked crypto asset.

In its 2022 report, Coingate famous that funds at retailers rose 63%, with prospects spending Bitcoin in 48% of transactions, a determine down 7.6% from the earlier 12 months.

Extra Customers Used Altcoins in 2022

In response to Coingate, altcoins claimed 7.6% of Bitcoin’s 2021 market share in 2022, with prospects utilizing USDT, Ethereum, Litecoin, TRON, BNB, and ADA. Tether’s USDT was utilized in round 15% of transactions, whereas newcomers ADA and BNB broke into the highest 10, accounting for 1.1% and three.5% of funds, respectively.

BitPay’s CEO Stephen Pair noted that buyers had been much less involved concerning the worth of the cryptocurrency and extra concerning the transaction charges in 2022. Accordingly, prospects favored Litecoin over Bitcoin for smaller purchases due to LTC’s decrease transaction charges.

Customers used Litecoin in 27% of service provider transactions and Bitcoin in 41%. Prospects doubtless selected Bitcoin for bigger purchases due to its extra in depth community and appreciable “mining energy,” Pair added.

Coingate predicts that Bitcoin’s Lightning Network developments might see Bitcoin’s throughput and quantity enhance dramatically within the coming years.

In 2022, virtually 6.29% of Coingate’s Bitcoin funds had been finished on the Lightning Community, up from 4.5% the earlier 12 months.

BitPay and Coingate defend retailers from worth volatility via immediate crypto-to-fiat settlements.

What Are Individuals Utilizing Crypto Funds For?

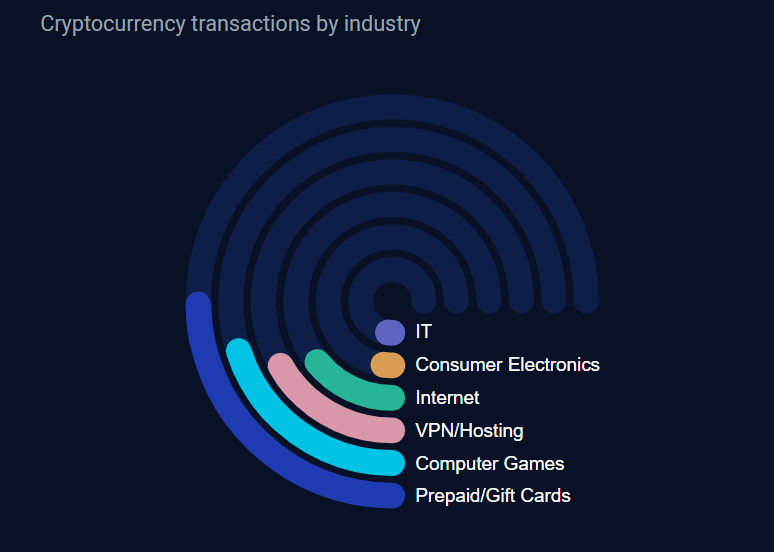

Knowledge from BitPay and Blockdata suggests that buyers spent crypto on VPN and internet hosting providers to bolster their on-line privateness. Customers additionally used crypto to pay for prepaid gift cards, electronics, and pc video games.

A 2022 report co-authored by PYMNTS and BitPay reveals that tech-driven customers, roughly 1 / 4 of faculty college students and people incomes $100,000 or extra yearly, account for many crypto purchases.

Thirty-five % of tech-driven customers favor a service provider providing crypto funds. Twenty-six % of that group mentioned they might be prepared to alter the place they store if the seller offered a crypto choice.

The report advised that retailers can goal crypto promotions for every class of linked gadget that tech-driven customers personal.

BitPay’s CEO identified that crypto funds don’t make sense for distributors catering to a lower-income demographic.

Professionals and Cons of Crypto Funds

According to blockchain analysis agency Blockdata, customers used crypto for funds in 2022 due to their security, velocity, and low charges.

Nonetheless, with out scalability enhancements just like the Lightning Community, a number of blockchains’ transaction throughputs are nonetheless properly under conventional fee networks.

Till builders implement sharding, Ethereum can solely course of about 20 transactions. Bitcoin processes seven transactions per second, whereas TRON claims a throughput of 6,000 transactions per second. To place these numbers into context, conventional fee networks like Visa provide transaction throughput within the tens of hundreds.

Moreover, counting on fee processors akin to BitPay introduces extra charges and a single level of failure.

For Be[In] Crypto’s newest Bitcoin (BTC) evaluation, click here.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned within the story to get an official assertion concerning the current developments, however it has but to listen to again.