Cross-chain decentralized finance (DeFi) protocol Rubic was compromised, leading to funds saved in its person’s addresses being siphoned out and transferred to the hackers.

On Dec. 25, Rubic protocol introduced that one in every of its routing contracts was compromised and all contracts could be stopped till the scenario is absolutely understood. The announcement learn:

The protocol’s creators additionally suggested their customers to revoke contract authorization by the revoke.money software. A Twitter thread by blockchain cybersecurity agency PeckShield explains {that a} vulnerability within the Rubic protocol led to a lack of $1.41 million price of funds straight from the wallets that approved its good contracts.

The exploiter deal with obtained the funds from the Uniswap decentralized alternate (DEX) in transactions involving the USD Coin (USDC) stablecoin. PeckShied defined that the hack was made doable attributable to mistakenly including USDC into supported routers. Moreover, “a scarcity of validation in ruterCallNative” additionally allowed malicious contract use.

A fast good contract evaluation with the assistance of chatGPT means that the ruterCallNative operate accommodates quite a few potential vulnerabilities, together with invalidated enter for the “_params” and “_data” parameters. These might enable an attacker to go malicious enter that might lead to incorrect or unintended behaviour.

Moreover, the “_gateway” parameter handed to the operate is unrestricted, probably permitting an attacker to create a contract and have it executed by the RubicProxy contract.

Certainly, the attacker deployed a customized good contract that was used within the assault. The decoded bytecode exhibits the 337 strains of code that allowed the attacker to carry out the assault as effectively as doable.

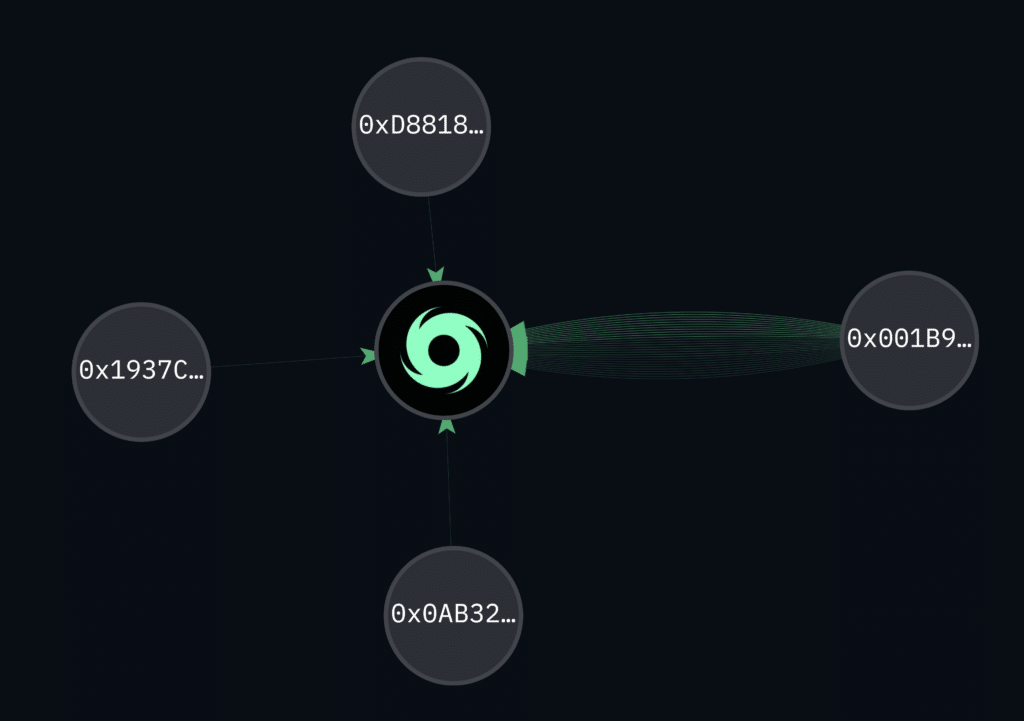

The hacker’s deal with obtained first a 1,161.55 ethereum (ETH) switch and one other 26.88 ETH switch, each from the Uniswap protocol siphoning out completely USDC and exchanging it for wrapped ethereum (WETH). All of this WETH was later despatched to an on-chain mixer and sanctioned entity Tornado Cash to anonymize the ill-gotten funds.

On-chain evaluation exhibits that $1.45 million price of incoming transactions despatched to the coin anonymization service originated from the hacker’s deal with — on a complete incoming worth for the service of about $2.9 million. In different phrases, about half of the belongings despatched to the mixer right now had been despatched by the exploiter.

Regardless of the hacker’s funds being such a good portion of the service’s incoming transaction quantity, their anonymity remains to be substantial. The deposit could also be among the many $2 million withdrawals from Twister Money processed right now or among the many $174 million price of belongings nonetheless deposited within the good contract.

Twister Money is a now-illegal DeFi protocol that enables customers to carry out nameless transfers on the Ethereum blockchain. The protocol makes use of zero-knowledge proofs (ZK-proofs) to cover transactions’ enter and output addresses. It’s troublesome for third events to find out the id of the events concerned within the transaction or the particular function of the switch.

Twister Money is an open-source venture constructed on prime of the Ethereum blockchain and accessible to anybody with an Ethereum pockets. Customers can work together with the Twister Money contract utilizing their Ethereum pockets or an internet interface nonetheless obtainable by the decentralized internet hosting service InterPlanetary File System (IPFS). They’ll carry out nameless transfers of ETH or tokens compliant with the ERC-20 customary by sending their funds to the Twister Money contract and withdrawing them to a brand new deal with.

The information follows latest reports that North Korean hackers have stolen round $1.2 billion in cryptocurrency and different digital belongings over the previous 5 years. Most of these hacks occurred in 2021 alone.