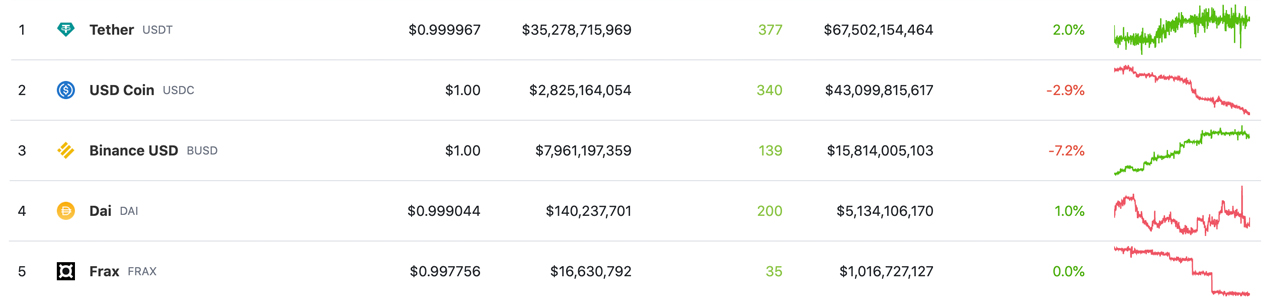

The stablecoin economic system continues to deplete as greater than $3 billion has been erased from the stablecoin market ecosystem during the last 44 days. Whereas statistics present that tether’s market valuation has risen by 2% during the last 30 days, usd coin’s market cap slid by 2.9%, BUSD valuation shed 7.2% during the last month and gemini greenback’s market capitalization slid by 1.5%.

$3 Billion in Greenback-Pegged Tokens Erased in 44 Days as Stablecoin Swaps Symbolize Almost 80% of International Crypto Commerce Quantity

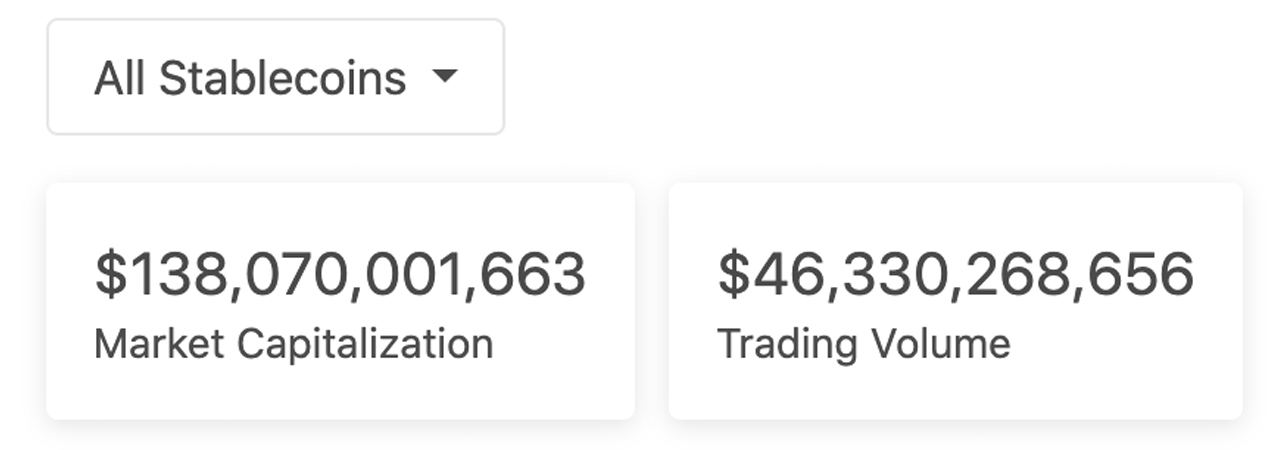

The general worth of the highest stablecoins by market capitalization has shed roughly $3 billion over the last 44 days or since Dec. 15, 2022. At the moment, the stablecoin economic system was price $141.07 billion. On that day, stablecoin swaps represented $44.55 billion of the $53.91 billion in international commerce quantity.

After shedding greater than $3 billion, the stablecoin economic system is valued at $138.07 billion, and stablecoin trades equate to $46.33 billion of the $58.76 billion in international trades on Jan. 28, 2023. Out of the highest ten stablecoin belongings, three market capitalizations have misplaced worth over the last 30 days.

Statistics present that usd coin (USDC) has shed 2.9% prior to now month, and BUSD misplaced probably the most with a 7.2% discount in 30 days. The Binance-affiliated and Paxos-managed dollar-pegged token BUSD has seen a big variety of redemptions over the previous couple of months. On the time of writing, BUSD’s total market cap in U.S. greenback worth is $15.8 billion.

USDC’s market capitalization on Saturday is round $43 billion. On Dec. 15, 2022, the valuation was round $45 billion. Equally, gemini dollar’s (GUSD) market cap was round $591 million 44 days in the past, and immediately it’s round $571 million. Whereas there have been a couple of stablecoin tasks that noticed market capitalizations slide, tether, DAI, trueusd (TUSD), and pax greenback (USDP) noticed will increase.

Tether (USDT) noticed a 2% enhance in cash in circulation during the last 30 days. Makerdao’s DAI elevated by 1%, and trueusd (TUSD) climbed 25.3% larger. Pax greenback (USDP) rose by 5.1% and Tron’s USDD noticed a small enhance of round 0.6% during the last 30 days. Liquity usd (LUSD) managed to rise by 24.4% over the previous month, and Abracadabra’s stablecoin MIM jumped 3.9%.

Whereas tens of billions in stablecoin belongings have been eliminated since final 12 months, they nonetheless characterize a dominant pressure within the crypto economic system. Since Might 2022, three stablecoin belongings have remained within the high ten market cap positions: USDT, USDC, and BUSD. Each USDT and USDC have been within the high ten positions for for much longer.

Moreover, the complete stablecoin economic system, valued at $138 billion, represents 12.71% of the complete crypto economic system’s worth of $1 trillion. In commerce quantity alone on Saturday, Jan. 28, stablecoins equated to 78.85% of all crypto asset trades worldwide on each centralized and decentralized change (dex) platforms. Meaning greater than seven out of ten crypto asset trades immediately, have been swapped with a stablecoin.

Tags on this story

What does the latest decline within the stablecoin economic system signify for the general cryptocurrency market? Share your ideas within the feedback.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an energetic member of the cryptocurrency neighborhood since 2011. He has a ardour for Bitcoin, open-source code, and decentralized purposes. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information concerning the disruptive protocols rising immediately.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.