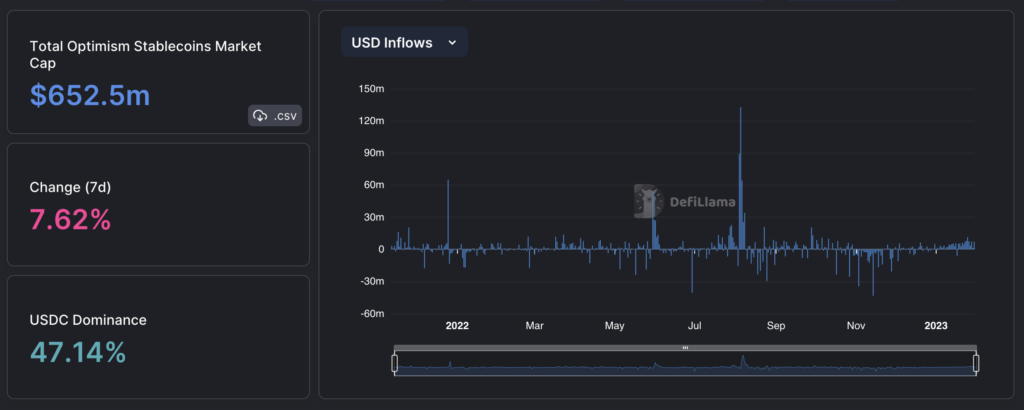

Knowledge from the decentralized finance (DeFi) complete worth locked (TVL) aggregator DefiLlama exhibits that the Optimism chain recorded constructive inflows in 27 out of the final 30 days.

In keeping with DefiLlama, this influx resulted in a $119 million enhance in Optimism’s TVL, representing about 18.3% of the chain’s whole stablecoin market capitalization.

Stablecoin inflows on @optimismFND have proven a gradual enhance over the previous month, with 27 out of the final 30 days recording constructive inflows. The overall influx quantity was $119.26 million, which represents 18.3% of the whole stablecoin market cap on Optimism pic.twitter.com/zX1n1PQMa2

— DefiLlama.com (@DefiLlama) January 31, 2023

The one days within the final month when Optimism didn’t have a constructive influx had been Jan. 1, Jan. 3, and Jan. 17, with the chain shedding about $7.43 million from its stablecoin valuation.

Firstly of the yr, Optimism’s stablecoin market cap stood at $539.19 million. However by Jan. 31, following the sustained constructive influx, the chain’s stablecoin holding was valued at $651.01 million, representing greater than 77% of its total value locked.

DefiLlama’s information additionally confirmed that 47.2% of Optimism’s stablecoin market cap was made up of USD Coin (USDC), which has confirmed to be essentially the most dominant stablecoin throughout different chains as effectively.

In keeping with one other crypto information aggregator, CoinMarketCap, the layer-2 solution’s TVL has recorded an general enhance of seven.56% within the final seven days and 38.17% within the earlier month.

Stablecoins play crucial position in DeFi liquidity

In DeFi-speak, influx is the overall quantity of stablecoins transferred right into a community, whereas outflow is the quantity moved from it. Such actions usually give crypto analysts insights into the overarching nature of the market. As an example, constructive inflows might signify a bullish market, and a rise in outflows could point out a bearish market.

Many of the liquidity in DeFi platforms like decentralized exchanges (DEXes) and lending protocols comes from stablecoins. As an example, within the second half of 2022, round 45% of the liquidity in decentralized exchanges was offered by stablecoins.

Ethereum maintains dominance within the stablecoin market cap

Ethereum (ETH) controls the lion’s share of the stablecoin market with a present TVL of $82.05 billion, virtually 60% dominance. Nevertheless, the determine represents a 3.5% drop from the beginning of the yr, when ETH’s stablecoin market cap was $85.56 billion.

Different networks with stablecoin TVLs of greater than a billion {dollars} embrace TRON, with a stablecoin market cap of $36.39 billion, and the Binance Sensible Chain (BSC), which holds about $9.12 billion price of stablecoins.