Share

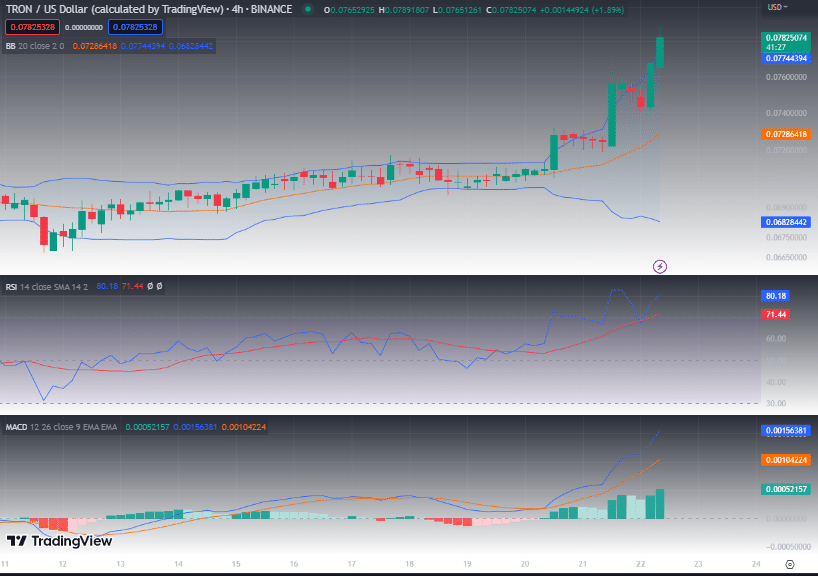

Tron (TRX) is performing effectively for the bulls, and the asset is exhibiting bull flags in response to technical indicators supplied by TradingView.

Buying and selling at $0.07826 as of press time, TRX was sitting on a day by day achieve of 8.2% because the asset recorded a 100% enhance in buying and selling quantity throughout the identical interval.

Regardless of the rising valuation, TRX’s volatility ranges appear to be growing because the Bollinger bands utilized in estimating volatility diverge away from one another, displaying elevated volatility ranges.

The relative power index indicator can also be shifting in above its common line, a optimistic indication of a bullish development on TRX, because the MACD indicator additionally now strikes excessive above within the optimistic area, technically indicating a bullish development on the asset.

Tron is sitting at 11% for the week as the entire cap for the asset stood at $412,092,598 as of press time, with a circulating provide of 90,342,261,289 TRX.

Tron’s Q1 report

The transfer comes forward of the discharge of Tron’s Q1 report. In line with latest analysis printed by market intelligence firm Messari, the primary three months of 2023 noticed an increase within the variety of transactions on the Tron blockchain.

The overall market capitalization of its native token, TRX, elevated by roughly 20% quarter over quarter.

The USA Securities and Alternate Fee (SEC) has introduced a number of lawsuits towards tron tokens.

Nonetheless, the community exercise has largely remained unaffected by these developments. The crypto’s general quarterly income elevated to $90.04 million in Q1 2023, representing a rise of 88% when in comparison with the $47.96 million it introduced in throughout This autumn 2022.