Stablecoins equivalent to USD Coin (USDC) and Binance USD (BUSD) see their market capitalization fall following growing regulatory scrutiny.

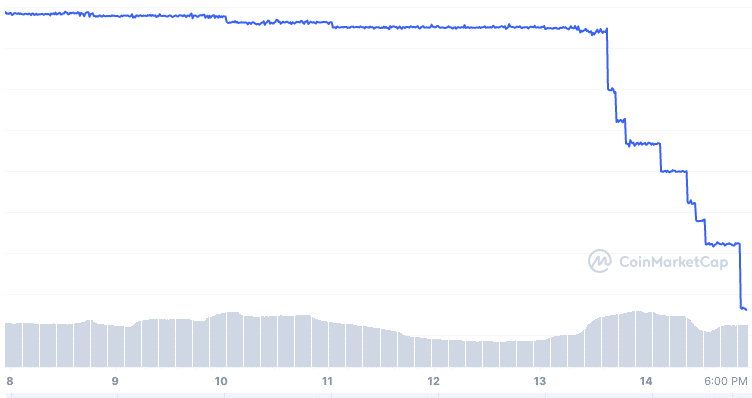

Market knowledge reveals that BUSD’s market cap has fallen by 4.56% from $16.2 billion reported on Feb. 7 right down to its present worth of $15.46 billion — a low not seen since late January.

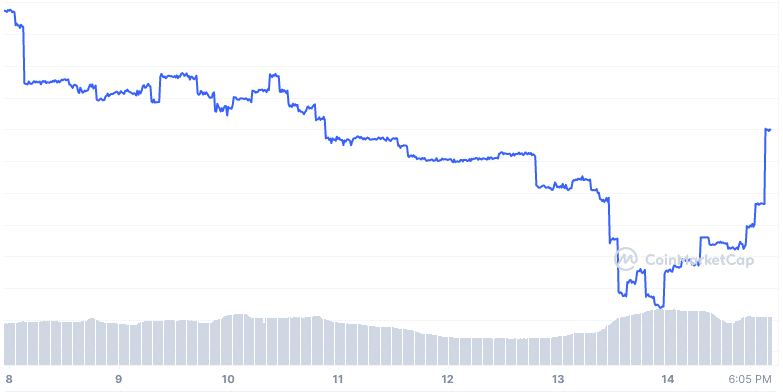

Equally, USDC has seen its market cap fall from $41.85 down on Feb. 7 to its present worth of $40.8 billion — a descent of two.4%. This occurred after ethereum (ETH) blockchain knowledge showed that on Feb. 10 $4,286 billion of USDC had been burned and $4.434 billion had been minted.

BUSD specifically has seen a gentle lower in its market cap during the last 24 hours after experiences began circulating that america Securities and Change Fee (SEC) issued a Wells discover to BUSD issuer Paxos — intimating the corporate to cease issuing the stablecoin.

The information was quickly adopted by an increased Binance USD inflow to centralized exchanges as the corporate’s battle with the SEC grew to become extra broadly identified amongst market contributors.

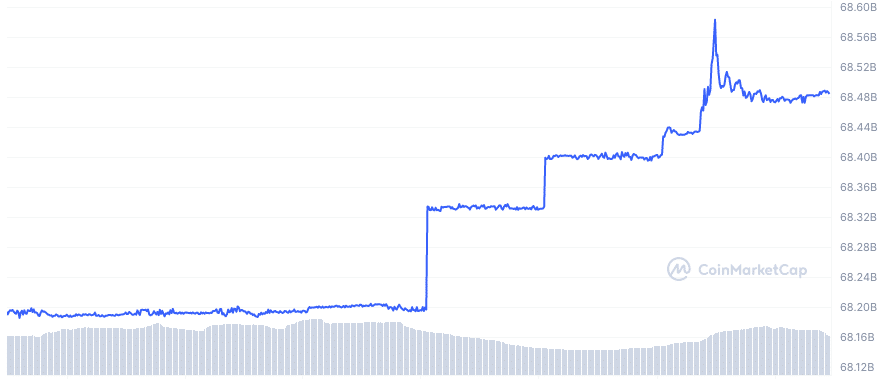

Whereas each USDC and BUSD have seen their market capitalizations shrink following the growing regulatory scrutiny on stablecoins and their staking, USDT’s market cap elevated as an alternative.

USDT’s market cap elevated from $68.2 billion every week in the past to $68.5 billion as of press time — not a big enhance by any depend, however positively not a lower.

5/ Regulation by enforcement doesn’t work. It encourages firms to function offshore, which is what occurred with FTX.

— Brian Armstrong (@brian_armstrong) February 8, 2023

The way forward for stablecoin staking in america is unsure following the unfold of rumors that the SEC could be trying to crack down on crypto staking.