The EURUSD made a powerful bullish bounce on the 61.8% Fibonacci retracement degree, which might take worth as much as the -27.2% goal close to 1.025.

Bitcoin (BTCUSD) is in a short-term bullish uptrend after breaking above the resistance development traces (dotted orange)

The bullish bounce signifies a double backside reversal chart sample. It didn’t break under the earlier backside, which signifies that the wave 1-2 sample is just not invalid.

EURUSD bullish bounce at 61.8% Fibonacci

The EUR/USD made a powerful bullish bounce on the 61.8% Fibonacci retracement degree:

The EUR/USD bullish bounce on the golden ratio (61.8% Fib) will increase the chances of a bigger bullish retracement.

The bullish correction might happen by way of a WXY (pink) correction.

There was an ABC zigzag (inexperienced) throughout the wave W and X (pink) waves.

There may very well be one other ABC (inexperienced) inside wave Y (pink) of wave 4 (grey).

After the wave A (inexperienced) is completed, we count on a bearish ABC (purple arrows) again to the help development line (inexperienced) throughout the wave B (inexperienced).

A bullish bounce (blue arrow) might take worth as much as the -27.2% goal close to 1.025.

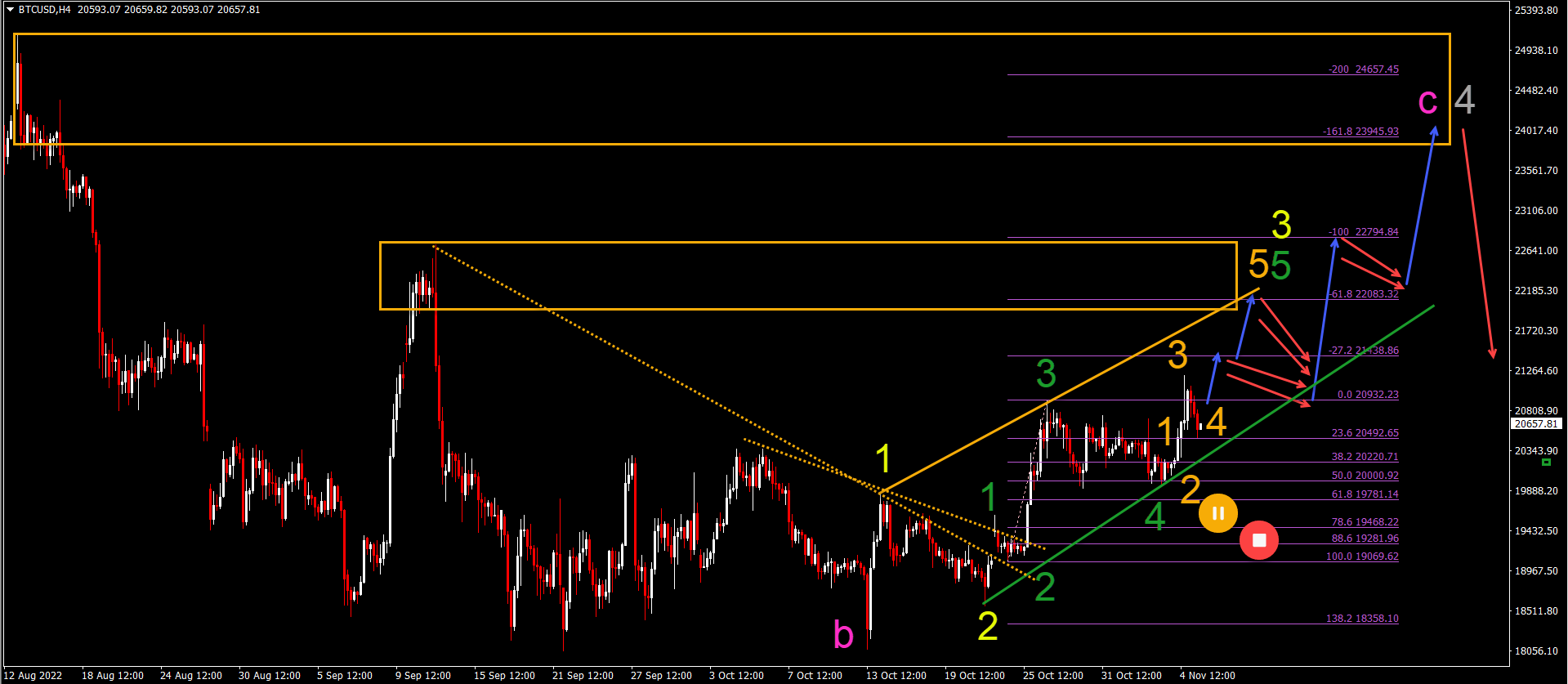

Bitcoin uptrend after bullish breakout

Bitcoin (BTCUSD) is in a short-term bullish uptrend after breaking above the resistance development traces (dotted orange):

BTCUSD is in an uptrend channel with larger highs and better lows.

Bitcoin appears to have accomplished a wave 4 (inexperienced) not too long ago.

A transfer up inside wave 5 (inexperienced) of wave 3 (yellow) is now anticipated.

This stays legitimate so long as worth motion doesn’t break under the help line (inexperienced) of the uptrend channel.

There appears to be a 5 wave (orange) sample inside wave 3 (yellow) that would take worth motion as much as the -27.2% and -61.8% Fibonacci targets.

A retracement is then anticipated, adopted by one other push up.

Finally worth motion ought to full a wave C (pink) inside wave 4 (grey).

Gold creates double backside sample

Gold (XAU/USD) has bounced on the earlier backside with out breaking it:

The bullish bounce signifies a double backside reversal chart sample.

The bounce nonetheless didn’t break under the earlier backside, which signifies that the wave 1-2 (pink) sample is just not invalid.

A break under the underside would invalid it.

The breakout above the resistance development traces (dotted orange) signifies a bullish swing.

This bullish swing might both be a part of 1) a wave 3 (pink) or 2) a bigger WXY (yellow) inside an prolonged wave 2’ (pink).

The wave sample will depend upon the value response on the earlier high.

The evaluation has been achieved with the symptoms and template from the SWAT method easy wave evaluation and buying and selling. For extra day by day technical and wave evaluation and updates, sign-up to our newsletter