The Bitcoin value took a significant hit yesterday regardless of a optimistic surprise within the US Client Worth Index (CPI), following a rumor that the US authorities bought 9,800 BTC associated to Silk Highway. Since then, the market has struggled to recuperate from the shock.

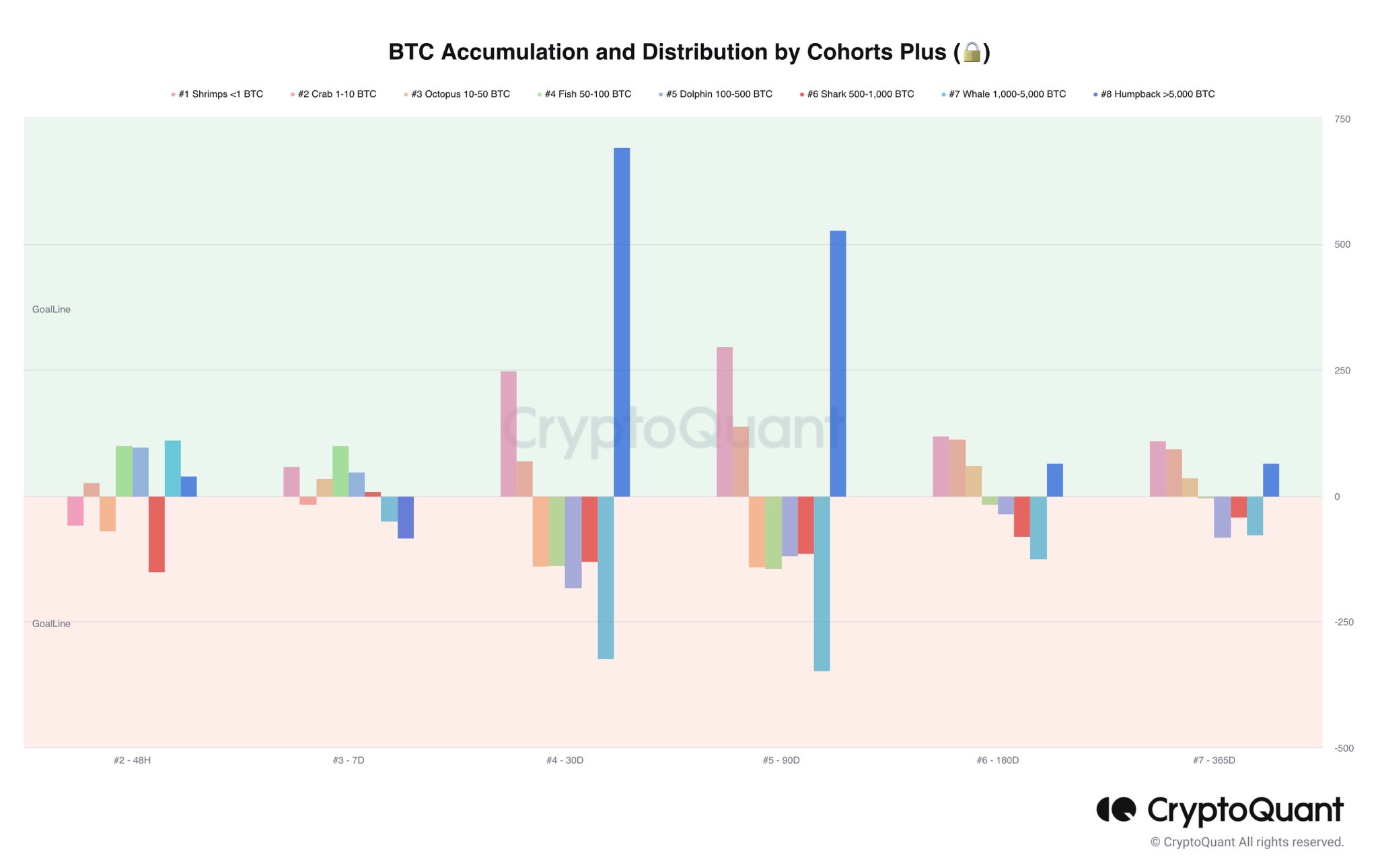

Nevertheless, one group of traders is displaying no worry: whales. The large traders with some huge cash are thought-about one of the crucial dependable indicators of when is an efficient time to purchase Bitcoin. On-Chain analyst Axel Adler acknowledged, “BTC Accumulation and Distribution – no modifications. Giant gamers proceed to purchase BTC from smaller gamers.”

The chart beneath exhibits that traders with greater than 5,000 BTC have been shopping for massive quantities (alongside smaller traders <10 BTC) during the last 30 and 90 days, whereas all different cohorts have been shedding BTC.

What Do Bitcoin Whales Know?

In fact, it could actually solely be speculated what the Bitcoin whales know that others don’t. However the reality is that Bitcoin noticed an upward development yesterday after the CPI launch, till the pretend information (manipulation?) concerning the US authorities promoting Bitcoin broke.

However, yesterday’s CPI print may have considerably extra implications than are obvious at first look. For a while now, the market has been betting on an early pivot by the U.S. central financial institution (Fed). The market is at present betting on three rate of interest cuts by the tip of the yr (3x 25 bps to 4.25-4.50%).

Whereas the U.S. banking disaster reinforces this wager, whales could have been calling the Fed’s bluff for a while. As NewsBTC editorial director and technical analyst Tony Spilotro not too long ago identified through Twitter, the Fed (and the plenty) are counting on lagging indicators.

Keep in mind: CPI is a lagging indicator. The inventory market is a number one indicator.

— Tony “The Bull” (@tonythebullBTC) May 10, 2023

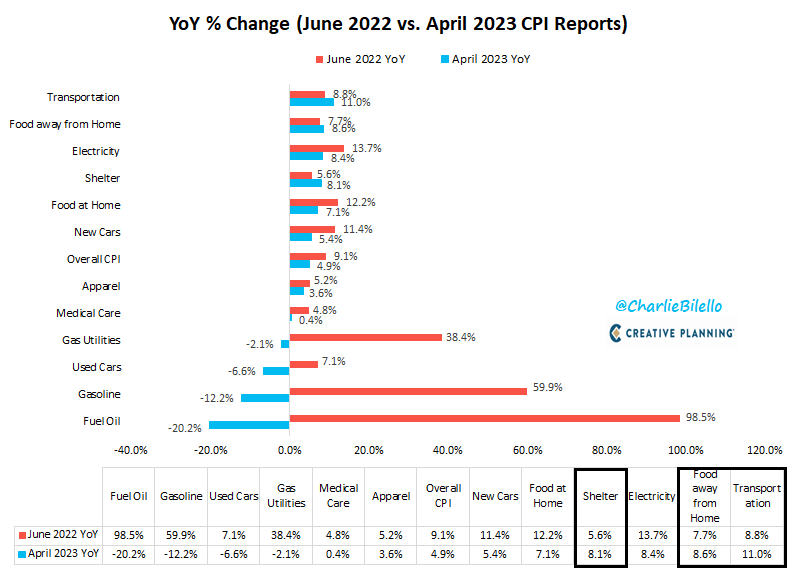

Charlie Bilello, chief market strategist at Inventive Planning, burdened on Twitter that the patron value index within the U.S. has declined from a excessive of 9.1% in June final yr to 4.9% in April. Based on the famend analyst, the rationale for this lower is the decrease inflation charges in heating oil, gasoline, used vehicles, fuel provide, medical care, clothes, new vehicles, meals at residence and electrical energy.

Inflation charges in transportation, out-of-home meals and lodging have elevated since final June, however declines within the different main elements have offset these will increase. The truth that the U.S. core inflation index (excluding meals/power) nonetheless stands at 5.5% year-over-year is primarily on account of shelter CPI (+8.1% year-over-year), in response to Bilello:

Why was Shelter CPI nonetheless shifting greater whereas precise lease inflation has been shifting decrease for a while? Shelter CPI is a lagging indicator that wildly understated true housing inflation in 2021 & first half of 2022.

As Biello added, after 25 consecutive will increase (on an annual foundation), the shelter CPI confirmed its first decline in April, from 8.2% in March (the best stage since 1982) to eight.1% in April. If shelter inflation lastly peaks, it can have a big effect on the general CPI, as shelter accounts for greater than one-third of the index.

Deflation Coming Quick?

This opinion is echoed by Fundstrat’s head of analysis, Thomas Lee. In an interview, Lee mentioned that inflation will come down quicker than most individuals suppose and that can make the Fed’s pause extra comfy for traders as a result of it can result in a gentle touchdown.

For Lee, this is likely one of the key implications of yesterday’s April CPI report. Carl Quintanilla of Fundstrat added:

40% of the CPI basket (by weight) is in outright deflation. It is a large improvement. Housing and Meals will not be ‘deflating’ regardless that real-time measures present this. That might add one other 50% or so after they do.

For Bitcoin, a fast drop in inflation charges and a gentle touchdown as predicted by Lee might be extraordinarily bullish. Whales may use this part to build up whereas retail traders are promoting out of worry of a looming recession with excessive inflation.

At press time, the Bitcoin value traded at 27,550, again within the decrease vary.

Featured picture from iStock, chart from TradingView.com