Bitcoin has plunged over the last 24 hours and now finds itself on the $26,200 degree. Right here’s why this degree is essential for the asset.

Bitcoin 200 WMA & 111 DMA Are Each At $26,200 Proper Now

In a brand new tweet, the analytics agency Glassnode has talked about how the totally different technical pricing fashions for Bitcoin could also be interacting with the asset’s value presently.

There are 4 related technical pricing fashions right here, and every of them relies on totally different moving averages (MAs) for the cryptocurrency.

An MA is a instrument that finds the typical of any given amount over a specified area, and as its identify implies, it strikes with time and adjustments its worth in accordance with adjustments in mentioned amount.

MAs, when taken over lengthy ranges, can easy out the curve of the amount and take away short-term fluctuations from the info. This has made them helpful analytical instruments since they’ll make finding out long-term developments simpler.

Within the context of the present subject, the related MAs for Bitcoin are 111-day MA, 200-week MA, 365-day MA, and 200-day MA. The primary of those, the 111-day MA, is named the Pi Cycle indicator, and it typically finds helpful in figuring out quick to mid-term momentum within the asset’s worth.

The 200-week MA is used for locating the baseline momentum of a BTC cycle as 200 weeks are equal to nearly 4 years, which is about what the size of BTC cycles within the well-liked sense is.

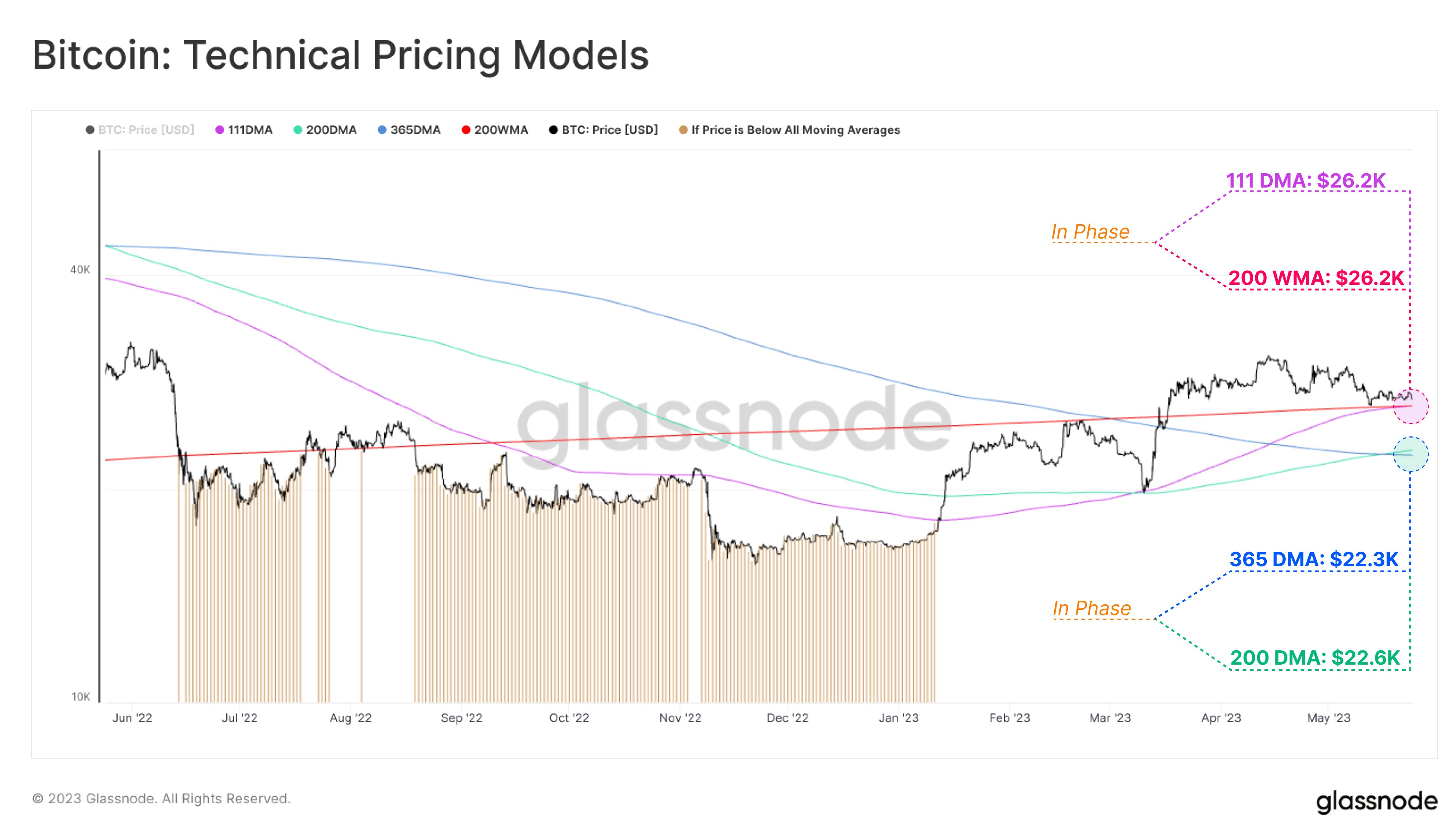

Here’s a chart that exhibits the pattern in these totally different Bitcoin technical pricing fashions over the previous yr:

Seems like pairs of fashions have come collectively in part in current weeks | Supply: Glassnode on Twitter

As proven within the above graph, these totally different Bitcoin pricing fashions have taken turns in offering assist and resistance to the value throughout totally different intervals of the cycle.

For instance, the 111-day MA changed into assist lately, as the value rebounded off this degree again throughout the plunge in March of this year, as could be seen within the chart.

The 111-day and 200-week MAs have lately come into part, as each their values stand at $26,200 proper now. That is the extent that Bitcoin has been discovering assist at in current days, so it will seem that the bottom shaped by these strains could also be serving to the value presently.

Glassnode notes that if a break beneath this area of assist takes place, the subsequent ranges of curiosity could be the 365-day and 200-day MAs. The previous of those merely signify the yearly common value, whereas the latter metric is named the Mayer Multiple (MM).

The MM has traditionally been related to the transition level between bullish and bearish developments for the cryptocurrency. When the 111-day MA supplied assist to the value again in March, the metric had been in part with the MM.

From the graph, it’s seen that the 365-day and 200-day MAs have additionally curiously discovered confluence lately, as their present values are $22,300 and $22,600, respectively. This could indicate that between $22,300 and $22,600 could be the subsequent main assist space for the asset.

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,200, down 4% within the final week.

BTC has plunged throughout the previous day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com