Bitcoin (BTC) data the best weekly influx within the newest CoinShares report, as XRP and ADA path behind with zero.

Being the firstborn crypto, Bitcoin (BTC) has persistently maintained its dominance within the cryptocurrency area. Whereas the bear market has not proven any respect for the asset’s lofty standing, Bitcoin has persistently put up an honest combat towards the bears.

Regardless of BTC’s optimistic sentiments, the asset has seen inflows into funding funds prior to now week regardless of worrisome market circumstances when most digital property are trailing behind.

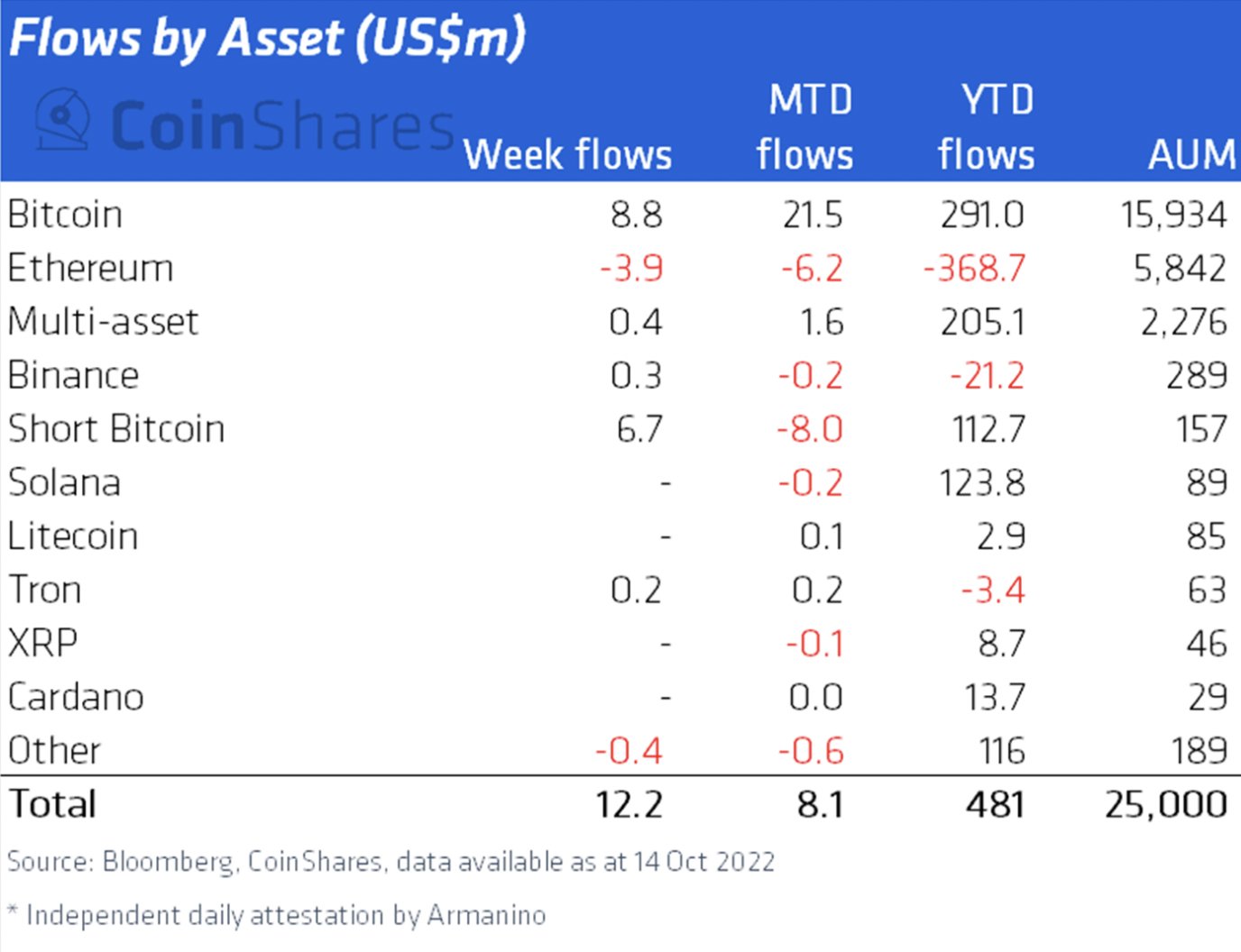

CoinShares just lately shared its Digital Asset Fund Flows Weekly Report for final week. The report revealed a cumulative influx of $12M into digital asset funds prior to now week. Whereas this degree of influx is quite low in comparison with earlier weeks, it beats different weeks that witnessed outflows from these funds.

Bitcoin reiterated its dominance within the digital asset area by taking the biggest chunk of the overall inflows, reaching $8.8M – 73% of the cumulative worth of $12M. The latest influx of $8.8M marked the fifth consecutive week of inflows BTC funds are seeing.

Then again, traders appeared to have been much less inclined in the direction of pumping funds into XRP and Cardano (ADA), as each property noticed zero flows. XRP’s good run hit a roadblock in October, because the asset noticed outflows for the primary time on OCT third, earlier than that, XRP was recording inflows for seven consecutive weeks. Cardano additionally met the identical destiny after eight consecutive weeks of optimistic flows.

Month-to-date (MTD) flows of Cardano stay flat at a price of $0, whereas XRP has seen a slight MTD outflow of $0.1M. Bitcoin, nonetheless, remains to be trying good, with MTD inflows totaling $21.5M. The king altcoin, Ethereum, seems to be seeing much more bearish sentiments than XRP and ADA, because it recorded outflows of $3.9M prior to now week, with MTD outflows of $6.2M.

– Commercial –