Regardless of regulatory stress and worsening macroeconomic situations, Bitcoin (BTC) demonstrated bullishness holding close to $28,000 for the previous week. Moreover, skilled merchants have maintained leveraged lengthy positions on margin and in futures markets, indicating energy.

On the regulatory entrance, on April 4, the Texas Senate Committee on Enterprise and Commerce agreed to maneuver ahead and remove incentives for miners working inside the state’s regulatory surroundings. If handed, Senate Invoice 1751 would set a cap on compensation for load reductions on Texas’ energy grid throughout emergencies.

Threat of recession grows in opposition to price hikes

The chance of a recession grew after functions for U.S. unemployment advantages for the week ending March 25 had been revised to 246,000, up 48,000 from the preliminary report.

Moreover, Kristalina Georgieva, Managing Director of the Worldwide Financial Fund (IMF), stated on April 6 that economies within the U.S. and Europe ought to proceed to battle as larger rates of interest weigh on demand.

Relating to the banking disaster, Georgieva suggested central banks to maintain elevating rates of interest, including, “issues stay about vulnerabilities which may be hidden, not simply at banks but additionally non-banks — now just isn’t the time for complacency.”

However, on April 6, St. Louis Federal Reserve President James Bullard downplayed issues concerning the affect of monetary stress on the economic system. Bullard acknowledged that the Fed’s response to the banking sector’s weak spot was “swift and applicable,” and that “financial coverage can proceed to place downward stress on inflation.”

Let’s take a look at derivatives’ metrics to raised perceive how skilled merchants are positioned within the present market situations.

BTC worth derivatives replicate merchants’ impartial sentiment

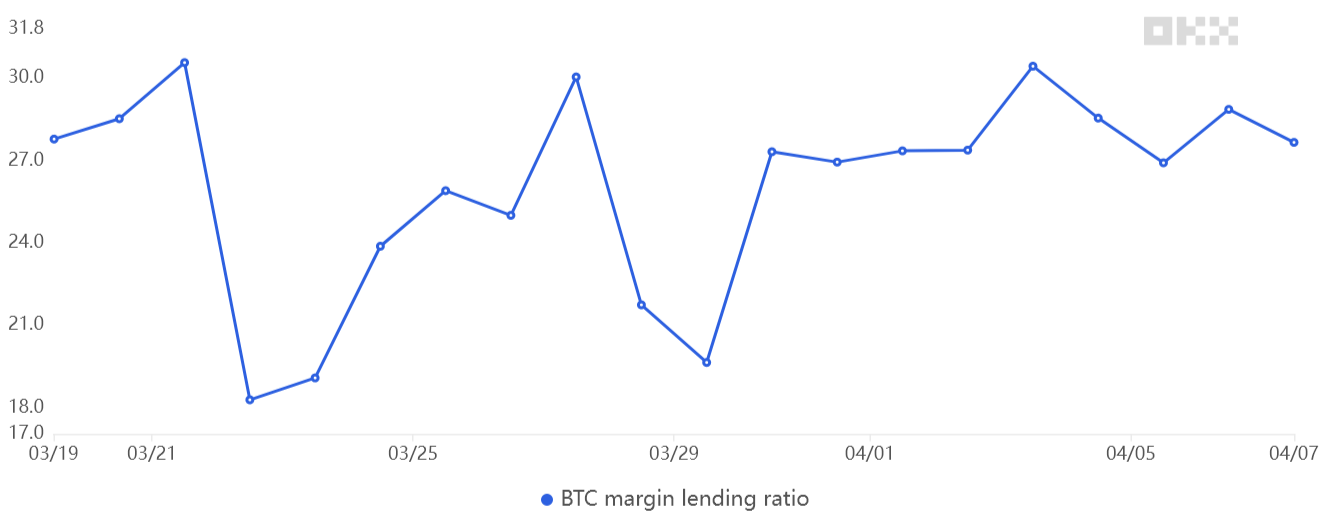

Margin markets present perception into how skilled merchants are positioned as a result of they permit traders to borrow cryptocurrency to leverage their positions.

For instance, one can improve publicity by borrowing stablecoins and shopping for Bitcoin. However, debtors of Bitcoin can solely take quick bets in opposition to BTC/USD.

The chart above exhibits that OKX merchants’ margin lending ratio has remained close to 28x in favor of BTC longs over the past week. If these whales and market makers had perceived elevated dangers of a worth correction, they might have borrowed Bitcoin for shorting, inflicting the indicator to fall beneath 20x.

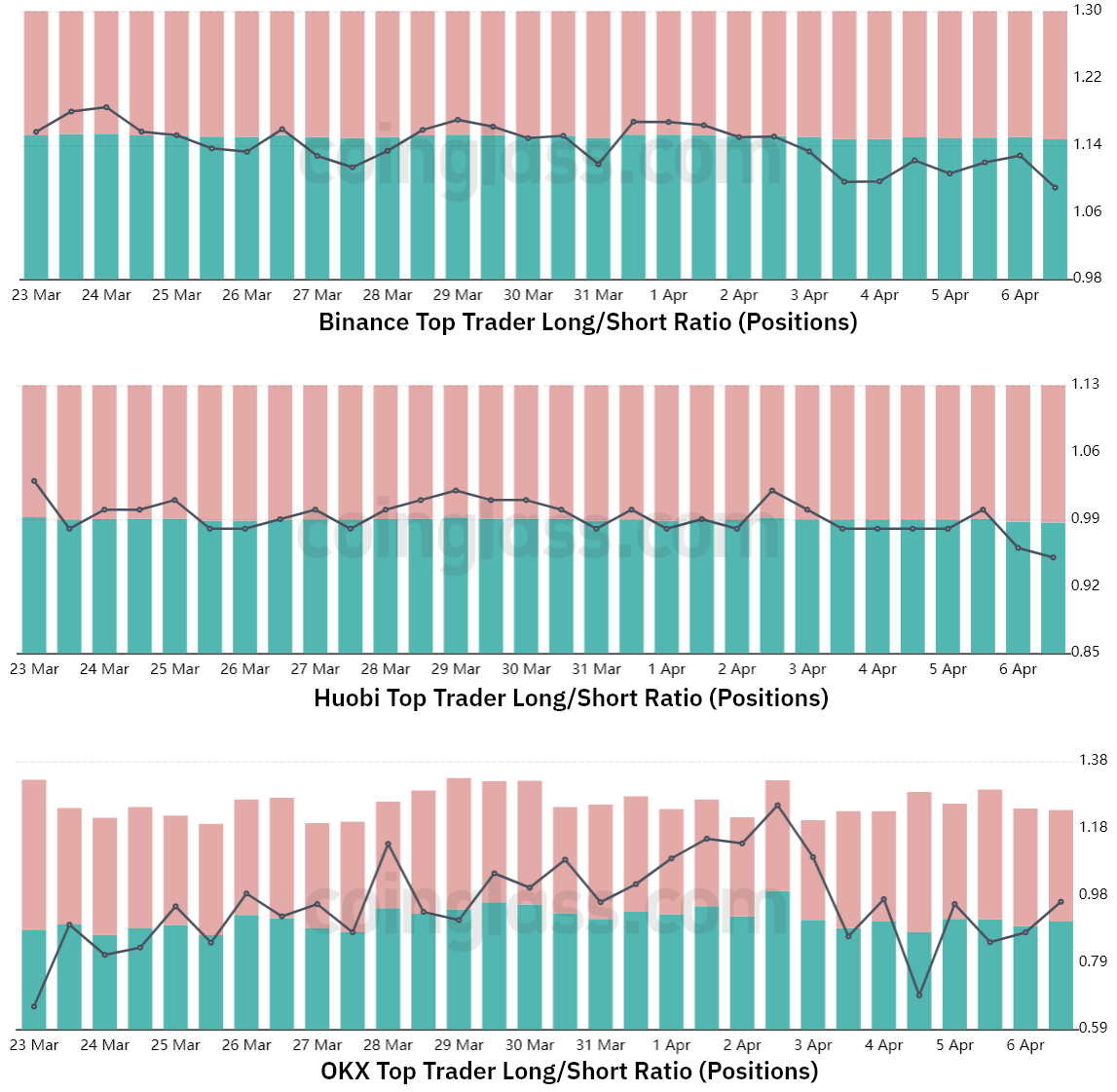

The highest merchants’ long-to-short web ratio excludes externalities that may have solely impacted the margin markets. Analysts can higher perceive whether or not skilled merchants are leaning bullish or bearish by aggregating the positions on the spot, perpetual and quarterly futures contracts.

As a result of there are some methodological variations between completely different exchanges, viewers ought to give attention to modifications somewhat than absolute figures.

Between April 1 and April 7, the highest merchants’ long-to-short ratio at Binance barely declined from 1.17 to 1.09. In the meantime, on the Huobi trade, the highest merchants’ long-to-short ratio has stood close to 1.0 since March 18. Extra exactly, the ratio slid from 1.00 on April 1 to 0.95 on April 7, thus comparatively balanced between longs and shorts.

Lastly, OKX whales introduced a really completely different sample because the indicator declined from 1.25 on April 3 to a 0.69 low on April 5, closely favoring web shorts. These merchants reverted the development, aggressively shopping for Bitcoin utilizing leverage for the previous two days because the long-to-short ratio returned to 0.97.

Absence of Bitcoin shorts is a bullish indicator

In essence, each the Bitcoin margin and futures markets are at present impartial, which needs to be interpreted positively provided that the Bitcoin worth rose 41.5% between March 10 and March 20 and was capable of maintain the $28,000 degree.

Given the big regulatory uncertainty attributable to the SEC’s Wells notice against Coinbase on March 22, the absence of shorts utilizing margin and futures markets at present favors additional worth appreciation.

Until the financial disaster unfolds sooner than anticipated, inflation will stay a high concern for traders, and Bitcoin inflows needs to be sufficient to maintain $28,000 as a resistance degree.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t essentially replicate or signify the views and opinions of Cointelegraph.