On-chain analytics agency Glassnode’s information reveals that bitcoin traders have just lately been aggressively accumulating the cryptocurrency, a development that will assist delay the continued rally.

The “accumulation development rating” is the important thing indicator being analyzed, because it displays whether or not bitcoin traders have been accumulating or distributing the digital asset over the previous month.

The buildup development rating not solely signifies the quantity of cash being purchased or offered by holders, but additionally the pockets sizes of the individuals concerned within the accumulation or distribution course of.

A rating near 1 signifies that enormous entities or a big variety of smaller traders are presently accumulating the asset. Conversely, scores approaching 0 recommend that holders are distributing or not accumulating a lot for the time being.

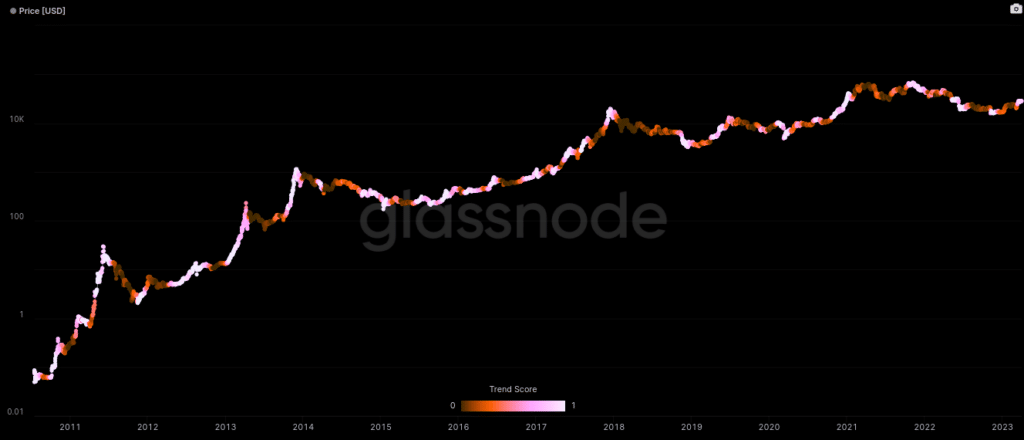

A chart displaying the development within the bitcoin accumulation development rating over the previous few years reveals that in the course of the preliminary months of the most recent rally, the metric was nearer to 0, implying that substantial distribution happened amongst giant entities. This might point out that traders weren’t assured the rally would final and had been wanting to safe their income.

Nonetheless, the current development has shifted as the value has neared $30,000. Apparently, the current rally appears to be following a sample just like the April 2019 rally, which started within the wake of bear market lows and confronted substantial distribution in its early phases.

When that rally neared its “cycle baseline,” investor conduct shifted towards heavy accumulation, and the indicator turned darkish purple (values very near 1). The April 2019 rally skilled a pointy upward momentum after this accumulation started.

With the value of bitcoin now approaching the $30,000 mark, the buildup development rating has additionally shifted towards accumulation. This stage represents the baseline of the present cycle, which bears a structural resemblance to the 2018-2019 cycle.

If the continued rally continues to observe the sample of the April 2019 rally, the current shift towards accumulation could possibly be a optimistic improvement for the value surge. On the time of writing, bitcoin is buying and selling round $28,200, marking a 4% improve over the previous week.