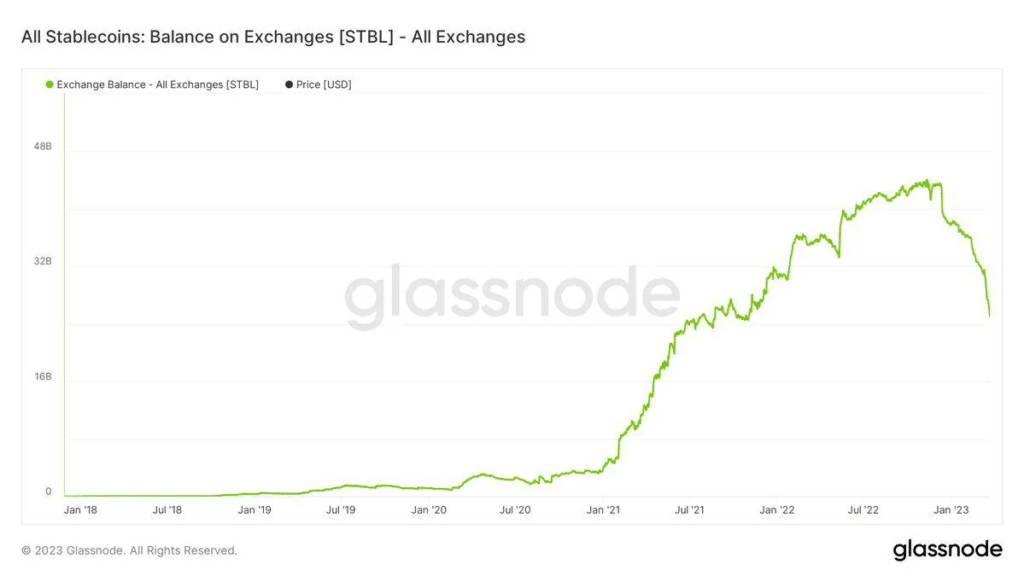

Glassnode knowledge on Mar. 26 shows that the stablecoin provide on exchanges has greater than halved to lower than $24b in 4 months.

Stablecoin provide on exchanges dropping

In November, stablecoin provide on exchanges stood at over $44b. Nonetheless, this determine, triggered by a number of basic elements, together with regulatory actions, has been contracting over the months.

As of writing, solely about $24b is held in varied cryptocurrency exchanges. Some analysts imagine {that a} large chunk may need been transformed to different liquid crypto belongings or currencies, together with bitcoin (BTC) and ethereum (ETH), or stable money just like the USD.

In crypto, stablecoins observe the worth of different belongings perceived to be secure. Stablecoins monitoring fiat currencies just like the USD are well-liked.

The widespread ones embody USDT, a token current in a number of blockchains like Tron and Ethereum, issued by Tether Holdings. It’s pegged to the USD. Its issuers declare the token is sufficiently backed by money and money equivalents, together with United States short-term securities like Treasuries. Different alternate options embody USDC by Circle, BUSD by Paxos, and DAI, an algorithmic stablecoin by MakerDAO minted solely on Ethereum.

Traditionally, stablecoins have served as conduits, permitting customers to channel funds from conventional finance to the cryptocurrency market.

Since stablecoins are theoretically “secure” and divergent from crypto belongings like bitcoin, that are unstable, tokens like DAI, USDT, and USDC can act as shields when crypto costs are below liquidation stress.

Regulatory modifications and stablecoins de-pegging

There may very well be a number of explanations behind the sharp contraction of stablecoin provide on exchanges.

Final month, the New York Division of Monetary Companies (NYDFS) ordered Paxos, the issuer of BUSD, a stablecoin, to halt the minting of recent tokens. It comes hours after the US Securities and Trade Fee (SEC) issued a Wells Discover to Paxos, claiming that BUSD was a safety. This pressured BUSD holders to transform to different stablecoins and belongings, principally USDT and USDC.

Days later, the financial institution run at Silicon Valley Financial institution (SVB) impacted Circle, the issuer of USDC. Circle had $3.3b caught in SVB. This triggered panic within the markets, forcing USDC to de-peg as customers rushed to exit for USDT, which at the moment was buying and selling at a premium. The exit from USDC additionally impacted DAI, which de-pegged.

Analysts level out that the destabilization of stablecoins and rising regulatory stress could also be why token holders may very well be exiting to currencies of legacy networks, together with bitcoin. When writing on Mar. 26, bitcoin is trading at $27,831, up 15% within the final month.